Qantas Frequent Flyer members could earn 50 status credits and more than 6,000 Qantas points starting from as little as $63.63, thanks to a lucrative Qantas Health Insurance promotion.

Originally running between 9-13 July 2021, this promotion is now back and available to new Qantas Health Insurance customers who sign up between 8-12 October 2021.

With this offer, anyone who takes out a new hospital and/or extras cover policy between 8-12 October 2021 and keeps the cover for at least 60 days will earn 50 Qantas status credits.

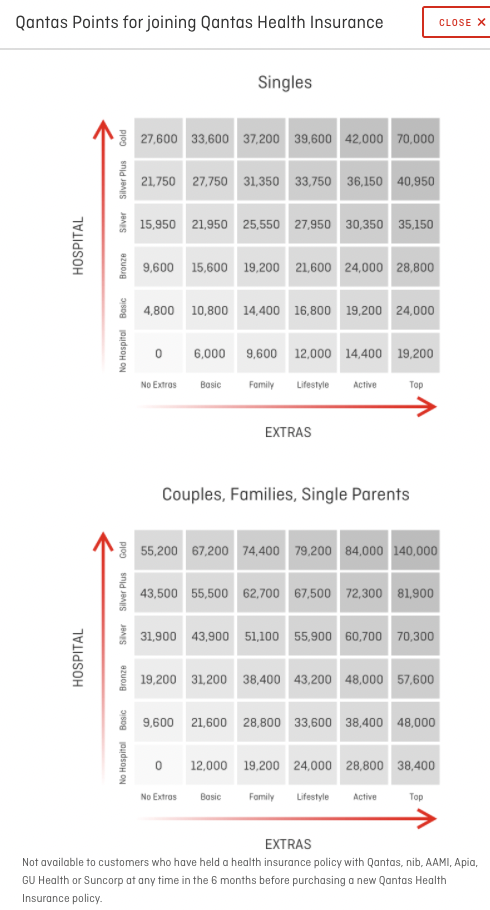

That’s in addition to up to a sign-on bonus of up to 140,000 Qantas points, which varies according to the type and level of cover. These charts from the Qantas website show the number of points you would earn for hospital and/or extras cover for singles, couples, families or single parents:

The exact number of bonus points earned depends on the type of cover (and will be based on the level of cover held after 60 days). But the 50 Qantas status credits will be awarded with any new policy.

Status credits count towards earning status in the Qantas Frequent Flyer program. You would need to earn 300 status credits to reach Silver status, 600 status credits for Gold or 1,400 status credits to attain Platinum. Lower thresholds apply when renewing your existing Qantas status.

The cheapest policy available is the Basic Extras cover for singles. This costs between $7.07-$10.12 per week for most adults under 65 years old, depending on your income and which state you live in. (Residents of WA & NT pay the lowest premiums while those in NSW, ACT or SA pay the most.) Individual quotes may vary – to check how much you would need to pay, you can get a quote on the Qantas Insurance website.

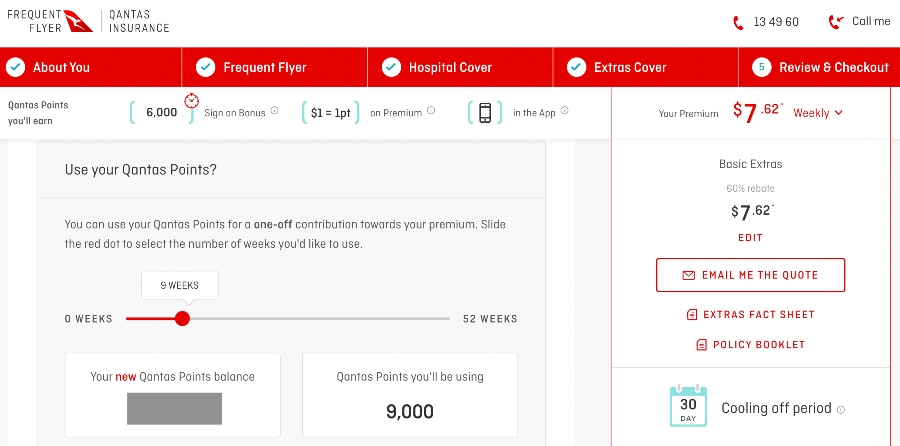

To receive the sign-on bonus points and 50 status credits, you would need to keep your cover for at least 60 continuous days. Payments are made on a weekly basis, so at an absolute minimum, you would need to pay for at least 9 weeks (63 days) worth of cover to get the bonuses. That represents a cost of between $63.63 and $91.08, depending on your premium.

You can also choose to pay with Qantas points using the Points+Pay feature. With a Basic Extras policy, you could expect to pay around 9,000 Qantas points for 9 weeks of cover. If you were to pay with Qantas points and cancel after the 60 days had passed, that could mean paying a net cost of around 3,000 Qantas points to earn 50 status credits (since you’d get back 6,000 points). Not bad, if you need some status credits!

In addition to any bonus points, you’ll earn 1 Qantas point per dollar on all Qantas Health Insurance premiums paid. And if you use the Qantas Wellbeing App to earn points for meeting your step or sleep goals, you’ll earn Qantas points at a much higher rate while you’re a Qantas Insurance customer.

While Qantas regularly offers bonus points as an incentive to sign up for a Qantas Insurance policy, status credits are generally only thrown in during short, limited-time promotions such as this one.

What are the catches?

Firstly, you’ll only be eligible for the bonus points & status credits from this Qantas Insurance offer if you have not held a health insurance policy issued by NIB in the past six months. NIB issues health insurance for NIB, Qantas, AAMI, Apia, GU Health and Suncorp. So if you already took advantage of this offer in July, you can’t get a second round of bonus points & status credits now.

According to the Qantas Insurance Policy Booklet, you also cannot have the same type of health cover (i.e. hospital and/or extras) with more than one health fund. If you already have private hospital and extras insurance with another provider, you can’t also take out Qantas Health Insurance cover at the same time. But you may be able to switch funds, if that’s of interest.

The bonus status credits will count towards your lifetime status credit tally and can be rolled over, if you’re eligible for this. We also assume the status credits would count towards the Qantas Status Fast Track offer. But they will not contribute towards any Loyalty Bonus, Platinum or Platinum One Bonus Rewards or a Qantas Status Accelerator challenge.

Based on AFF members’ experiences with past offers from Qantas Health Insurance, the bonus points from these offers will typically land in your Qantas Frequent Flyer account on your 61st day of holding the policy. But the status credits may take around a week longer to arrive.

If you choose to cancel your insurance after receiving your bonus points & status credits, beware that it is not possible to do this online. You will need to call Qantas to cancel your insurance, and some AFF members have reported that they were questioned about why they wanted to cancel and given a “hard sell” to try to persuade them not to. You’ll still be able to cancel, but be prepared!

Join the discussion on the Australian Frequent Flyer forum: 50 SC for signing up to Qantas Health Insurance