With the trans-Tasman bubble launching next week, many Australians are booking trips to New Zealand. But Australians heading overseas are now paying much more than before for the privilege.

Airfares from Australia to New Zealand are now considerably more expensive than they were before the pandemic, when return Qantas flights to Christchurch were available for as low as $225. Now, the taxes & charges alone are higher than that.

While most airlines have increased their lowest-available airfares on trans-Tasman routes, compared to pre-COVID prices, the government and airport-imposed taxes & charges on many international tickets out of Australia have also recently increased by almost $50 per return ticket. In fact, the taxes & charges on a return ticket from Australia to New Zealand, for example from Sydney to Wellington, are now as high as $243.60 per passenger. That’s almost $1,000 for a family of four in taxes alone.

What’s behind the increase in Australian international flight taxes & charges?

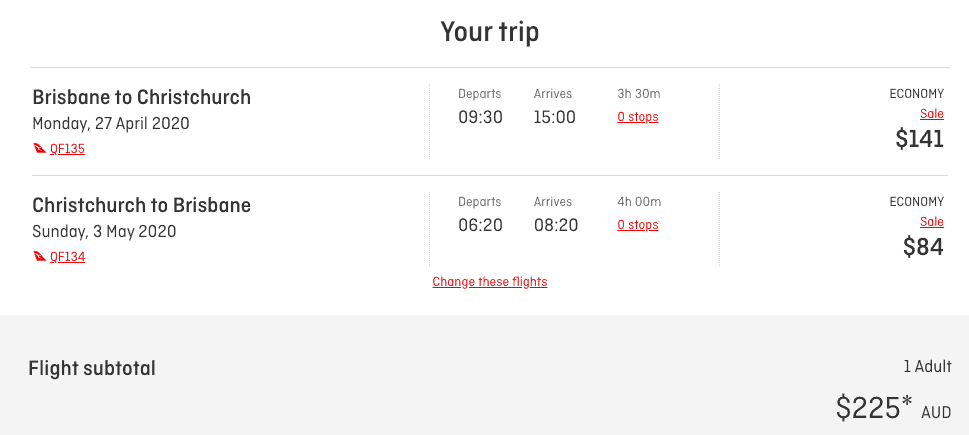

As an example, let’s compare the fare breakdown on a return Qantas Brisbane-Christchurch flight in April/May 2020 to the same flights in April/May 2021.

In this example from last year, the flights were on sale for $224.10 return.

If we have a look at this fare breakdown from last year, this comprised of a $40 return fare (admittedly, this was unusually cheap) and $184.10 worth of “taxes, fees and charges” which are not pocketed by Qantas. (As this was a paid airfare, it does not include any of the Qantas carrier charges found on Classic Flight Reward tickets.)

By comparison, a return Qantas ticket from Brisbane to Christchurch would now cost $608.86 return in 2021.

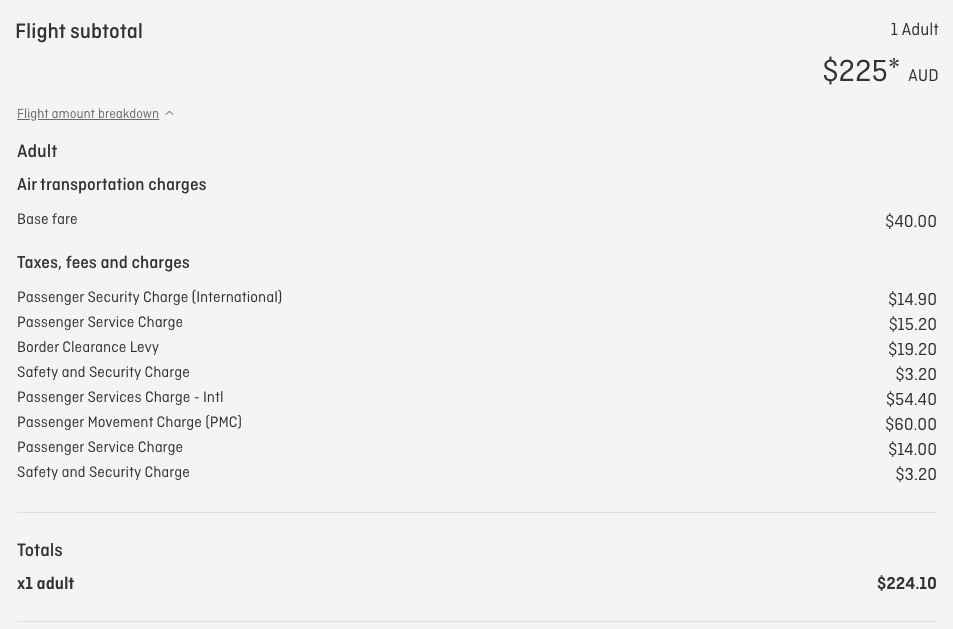

Here’s the fare breakdown:

There are 8 separate taxes, fees and charges itemised here (some are listed twice as the same type of charge is applied on both the outbound and return journey). But if we break this down into Australian and New Zealand charges, here’s what’s changed:

Australian charges

- Australia Passenger Movement Charge PMC (AU) – no change at $60

- Australia Passenger Services Charge Departure International (WY) – increased from $54.40 to $56.80

- Australia Safety And Security Charge Departure (WG) – increased from $6.40 to $49.86

So, the Australian taxes & charges have increased by $45.86 per passenger.

New Zealand charges

- New Zealand Border Clearance Levy International Arrival (F1) – decreased from $19.20 to $18.70

- New Zealand Passenger Service Charge International Arrivals (KK) – decreased from $29.20 to $28.40

- New Zealand Passenger Security Charge International (IA) – increased from $14.90 to $15.10

So, the New Zealand taxes & charges have actually decreased by $1.10, likely due to exchange rate fluctuations.

Australia’s international flight charges have increased

As you can see, the main change is in the Australian airport charges. For international departures from Brisbane, the main increase is in the airport-specific “WG” surcharge.

International departures and arrivals to/from Sydney don’t attract a “WG” charge, but the “WY” charge has increased by $46.76 per ticket. This “Passenger Services Charge” was $64.44 in 2020, and is now $111.20 in 2021. With the “Passenger Movement Charge” added on, this brings the total Australian component of the taxes & charges on return international flights from Sydney to $171.20.

Australian taxes & charges on return international tickets from Melbourne, meanwhile, have increased by $26.62 from $107.82 to $134.44.

These taxes & charges are applied to both paid airfares (included in the cost of the ticket), and to award bookings. When redeeming Qantas points for an international flight to New Zealand, you’ll need to pay all of these taxes & charges in addition to Qantas’ $14 carrier charge in each direction.

So, if you think airfares to New Zealand are higher now than they were before COVID-19, you’re right. And it’s not entirely the fault of the airlines.

Slight reduction in domestic charges

Meanwhile, there has actually been a slight reduction in the taxes & charges payable on Qantas domestic Classic Flight Rewards. From yesterday, Qantas started including the domestic “safety and security charge” as part of the base fare. This means it’s no longer payable on award bookings, saving around $6.50 per passenger in taxes on a Sydney-Melbourne reward booking.