Most credit cards charge a 3% international transaction fee for purchases made overseas or in a foreign currency. But did you know that this surcharge is also often charged for online purchases made in Australian Dollars, simply because the business is based overseas or the transaction was processed offshore?

This catches a lot of people by surprise as there’s often no way to determine at the time of making the online purchase whether the transaction will be processed overseas. It can even happen when buying from an Australian website with a “.com.au” domain name.

As one example, an AFF member discovered last year that they had been charged a 3% surcharge by their card issuer when purchasing a Norton product online. The amount was charged in Australian Dollars, and even included Australian GST, yet the credit card issuer added a 3% international transaction fee because the payment – unbeknownst to the customer – was processed outside of Australia.

In that particular case, the customer complained to their bank and was issued a one-off refund of the fee only “as a gesture of goodwill”.

But this problem is not unique to one particular bank. For example, CommBank says on its website that a 3% international transaction fee will apply to both “transactions converted by Mastercard® or Visa” and “transactions in Australian dollars but with an overseas connection”. The website goes on to say:

In some cases, overseas merchants may allow you to pay in Australian dollars, e.g. when you’re shopping online or over the phone. This is still considered an international transaction because your transaction is processed overseas.

Note: Even though a merchant has a website address ending in ‘.com.au’ and displays prices in Australian dollars, they may still be located overseas or otherwise choose to process their credit card payments outside of Australia. It’s best to check with the merchant before you pay if you are unsure.

Similarly, NAB says:

Do you love online shopping or frequently book holidays or hotels online? If you do, be aware that any transaction processed outside of Australia or in any foreign currency (e.g. USD or GBP) will attract the fee.

It may not always be obvious that your purchase is being processed overseas. For example, you could be on a ‘.com.au’ website and paying for the purchase in Australian dollars (AUD). However, the transaction is actually being processed by the merchant outside of Australia and the fee will apply.

Westpac says a 3% fee will apply when paying in another currency, or in Australian dollars for a purchase “with a Merchant located outside Australia” or “that is processed by an entity located outside Australia”. ANZ, Australia’s other major bank, has the same policy – as do most other banks.

ACCC guidance not always followed

The Australian Competition & Consumer Commission (ACCC) identified the (lack of) disclosure of international transaction fees as a key issue in its 2019 Foreign currency conversion services inquiry.

The ACCC report found that Australian consumers “may reasonably expect that the transaction will take place in Australia” if the business had an Australian website, a physical presence in Australia and was charging for online purchases in Australian Dollars.

“In these circumstances, a consumer is likely to have no basis to suspect the transaction will be processed overseas,” the ACCC report said.

“However, the consumer’s card issuer will consider the transaction to be an international transaction if the merchant’s payment facility is located overseas. Unless disclosed by the merchant, the consumer is unlikely to be aware that they will incur an international transaction fee until the payment is processed and charged to them.”

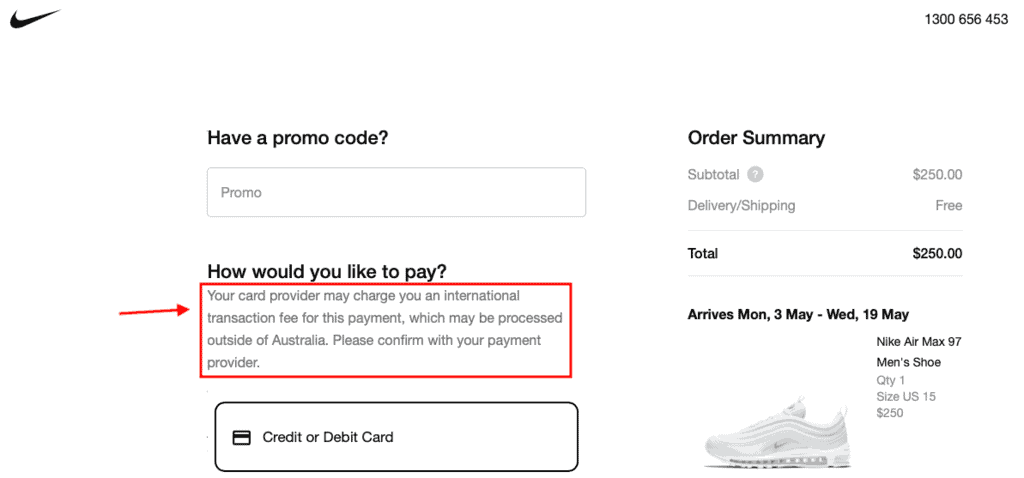

In 2019, the ACCC sought to solve this issue by issuing “best practice guidance” advising that businesses processing transactions overseas should alert customers to this before collecting payment. This could be as simple as a warning on the checkout page, such as this one that Nike added to its website after engagement with the ACCC last year:

Last year, the ACCC went on to say that retailers may now be engaging in misleading and deceptive conduct if Australian consumers are given the overall impression that the transaction is processed here, when it is actually processed outside of Australia.

How to avoid paying international transaction fees when shopping online

Sadly, not all websites offer this warning so it can still be difficult to know when a transaction is being processed overseas.

In general, purchases made from local Australian businesses in Australian dollars should be fine. But if you’re purchasing from a large multinational company, it can be difficult to know where the payment is being processed. You may be able to find out by contacting the merchant, but this isn’t always easy to do.

ACCC Chair Rod Sims advises that “consumers who have been charged an unexpected international transaction fee for a purchase in Australian dollars from a website that appears Australian-based or has an Australian domain name should query the fee with their bank and report it to the ACCC.”

But if in doubt, the best option is to simply use a credit card without international transaction fees. There are quite a few of these cards available in Australia from various different banks and they’re handy when shopping online – not just when travelling overseas! Some forex fee-free credit cards like the 28 Degrees Mastercard or Bankwest Zero Platinum card even have no annual fees.

Community Comments

Loading new replies...

Join the full discussion at the Australian Frequent Flyer →