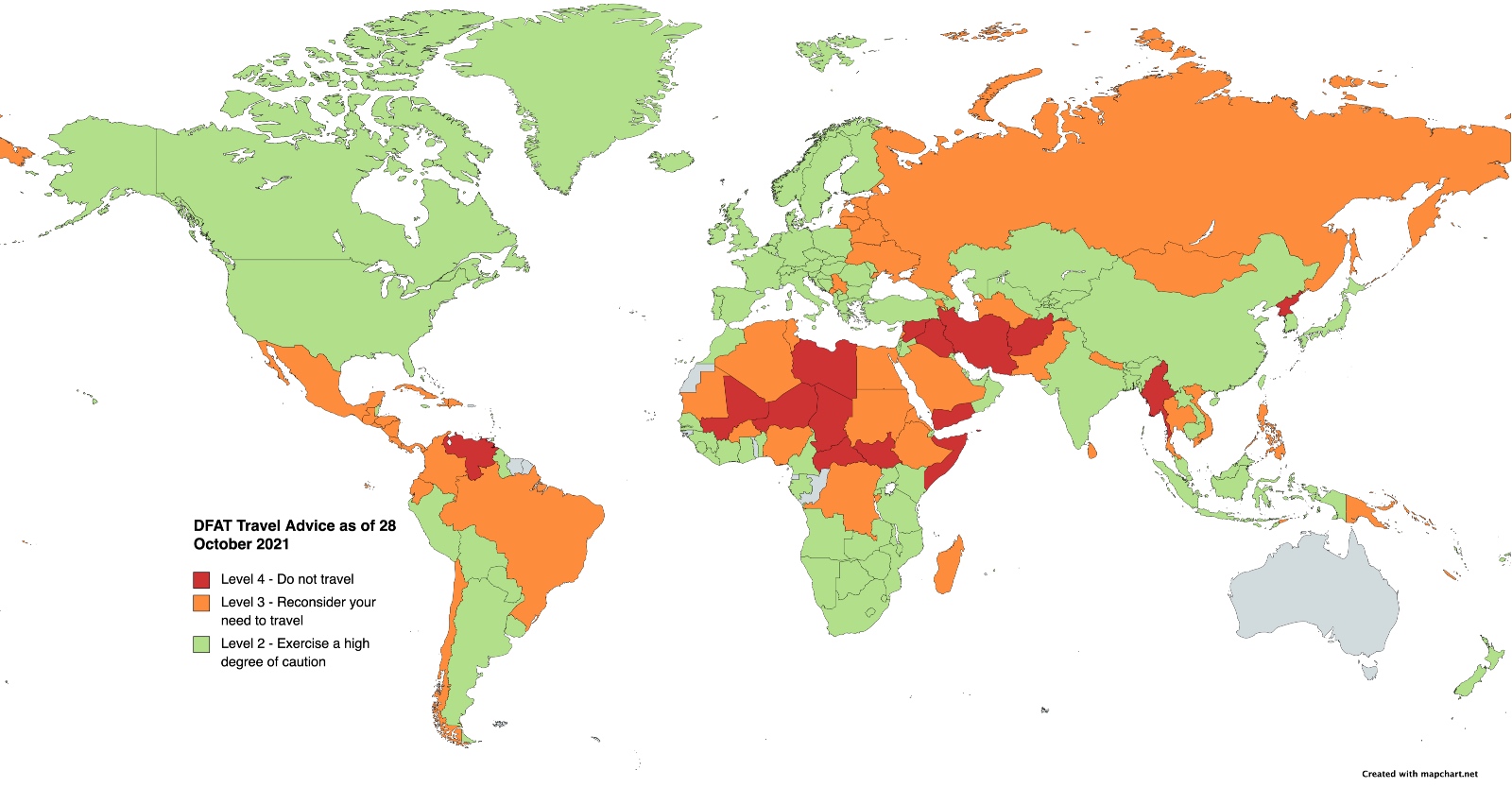

The Australian government has removed its global “Do Not Travel” advisory that had seen every other country except New Zealand classified as a “Level 4” risk – the highest category – since March 2020. This will make it much easier for Australians to get international travel insurance cover once Australia reopens its international border to vaccinated residents next week.

In total, 15 countries still remain at Level 4 for various reasons such as the threat of terrorism or civil unrest within the country. But 162 of the 177 countries for which Australia maintains travel advisories have now been downgraded from Level 4 to either Level 3 or Level 2.

There are four official Australian government travel advice levels:

- Level 1 – Exercise normal safety precautions

- Level 2 – Exercise a high degree of caution

- Level 3 – Reconsider your need to travel

- Level 4 – Do not travel

The travel advice for most countries has now been downgraded from Level 4 to Level 2. However, some countries including Nepal, Papua New Guinea, Sri Lanka, Colombia, Estonia and Timor-Leste are now at Level 3 due to a particularly high risk of contracting COVID-19 or other risks.

At this stage, no country will be classified lower than Level 2 (“Exercise a high degree of caution”) due to the ongoing risk associated with COVID-19.

You can see a full list of Australian government travel advisories on the Smartraveller website.

Travel insurance implications

This is excellent news for Australians travelling overseas because it will make travel insurance covering COVID-19 much more accessible.

Most travel insurers will not provide cover for travel to destinations with an Australian government “Level 4” travel warning in place. Some insurers may also limit cover to destinations classified as Level 3, but just about all travel insurance will cover international travel to “Level 2” destinations.

With COVID-19 still an ongoing risk around the world, it’s more important than ever to be insured when travelling overseas. Thankfully, many travel insurance providers including Go Insurance have now updated their cover to provide insurance for COVID-19. Today’s Australian government travel advisory changes will also pave the way for more insurers including Qantas Insurance to resume offering international travel insurance.

When selecting a travel insurance policy, it’s very important that you read the Product Disclosure Statement (PDS) to see what is and isn’t covered, and check that the policy is appropriate for your needs. Some policies may not cover certain risks relating to COVID-19.

Join the discussion on the Australian Frequent Flyer forum: Covid Travel Insurance?