Does Travel Insurance Cover Lost Points?

Travel insurance is essential to ensure you aren’t left out of picket if your trip is disrupted by events outside of your control.

If you’re unable to continue your journey as planned, for example, travel insurance may cover the cost of rebooking or cancelling your flights, or purchasing a replacement ticket. But what if you’ve booked your trip using frequent flyer points?

The good news is that most major Australian travel insurance policies may also reimburse you for lost frequent flyer points if your trip is disrupted and you cannot recover the points in any other way.

When might travel insurance compensate for a loss of frequent flyer points?

Most frequent flyer programs allow you to cancel award flight bookings for a small fee. So if you can’t use your booking, you should try to cancel and claim the points back from the airline in the first instance. But travel insurance could come into play if you have to forfeit an award booking due to reasons outside your control and your airline won’t refund it.

For example, you might be able to claim on travel insurance if:

- You have an accident on the way to the airport or there is an extreme weather event preventing you from reaching the airport and you can’t make your flight, causing the airline to consider you a “no show”,

- You need to change or cancel your flight due to reasons beyond your control and the airline changes a large fee in the form of frequent flyer points to complete the request, or

- You can’t travel due to unforeseen circumstances covered by your insurer, and are unable to change or cancel your award booking because you’ve already commenced your trip and the frequent flyer program (e.g. Singapore Airlines KrisFlyer) doesn’t allow alterations to half-used tickets.

Travel insurance would not generally refund you for delays or cancellations caused by the airline, as it’s the airline’s job to rebook or compensate passengers for this. But travel insurance may cover your other out-of-pocket expenses resulting from such delays if the airline does not do so.

It’s not clear whether travel insurance would cover a situation where you missed an onward flight booked on a separate award ticket due to a delay to the inbound flight. While this may be covered in some circumstances, you should still allow sufficient time to allow for possible delays when booking flights on separate tickets. A failure to ensure there is a reasonable connection time between flights on separate tickets could potentially be used by an insurer to avoid paying out a claim.

How does travel insurance reimburse for lost points?

Accurately calculating the value of frequent flyer points is more complicated than with plane tickets bought using money because points don’t have a fixed monetary value. Indeed, Qantas Frequent Flyer points could be worth as little as 0.5 cents or more than 5 cents each, depending on how they are spent.

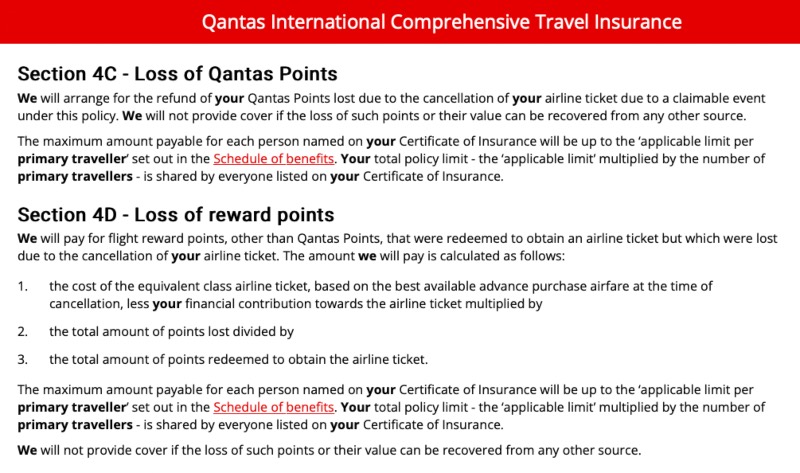

Qantas Travel Insurance, as an exception, says it will give you back your actual frequent flyer points. Here’s the relevant section from the Qantas International Comprehensive Travel Insurance Product Disclosure Statement (PDS):

Some insurers, such as Travel Insuranz, will alternatively reimburse you for the cost of purchasing top-up points to replace the lost frequent flyer points. For example, if you had to cancel your trip and lost 50,000 Qantas points that you couldn’t otherwise recover, you could be entitled to $1,427 as this is the amount Qantas charges for 50,000 top-up points.

For reference, this is the relevant wording on page 10 of the Travel Insuranz PDS:

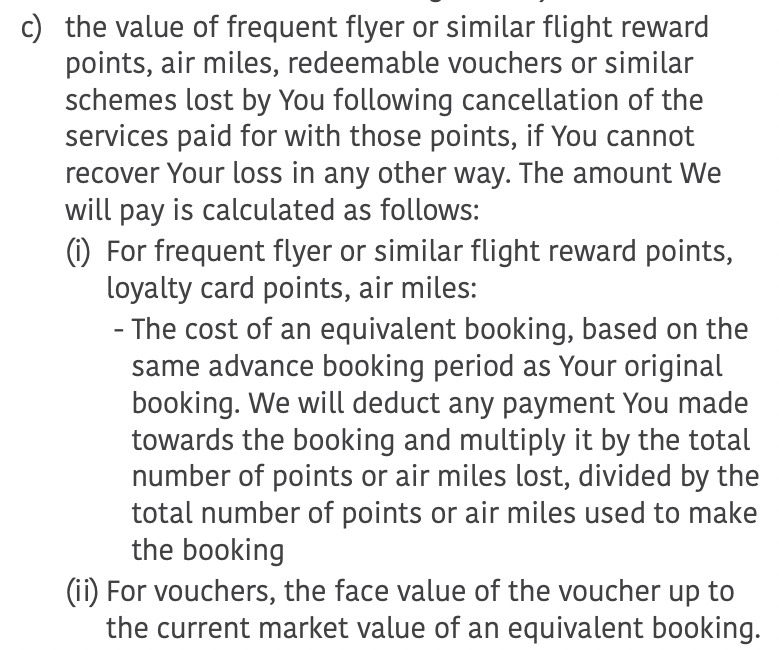

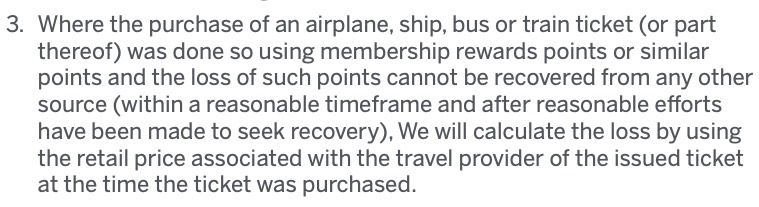

But most travel insurance will simply reimburse you for the equivalent cost of a commercial airfare. For example, this is what it says about cancellation costs for tickets booked using points in the Cover-More PDS:

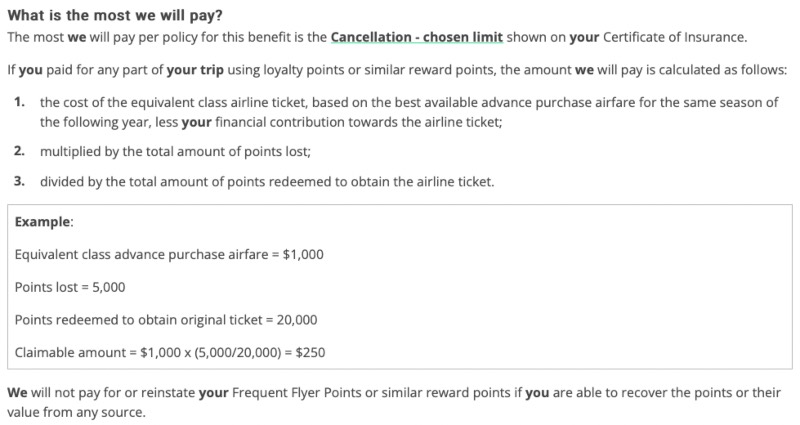

To give you an idea of how this would work in practice, here’s an extract from the Travel Insurance Direct PDS:

This AFF thread also contains some discussion about how the loss of points would be calculated: Allianz insurance – frequent flyer point bookings

What about credit card travel insurance?

Most Australian credit card travel insurance policies will also cover lost frequent flyer points if you are unable to recover them in any other way. This includes the travel insurance that comes with the premium credit cards offered by Amex, ANZ, NAB, Westpac, St George, CommBank, Bankwest and Qantas Money.

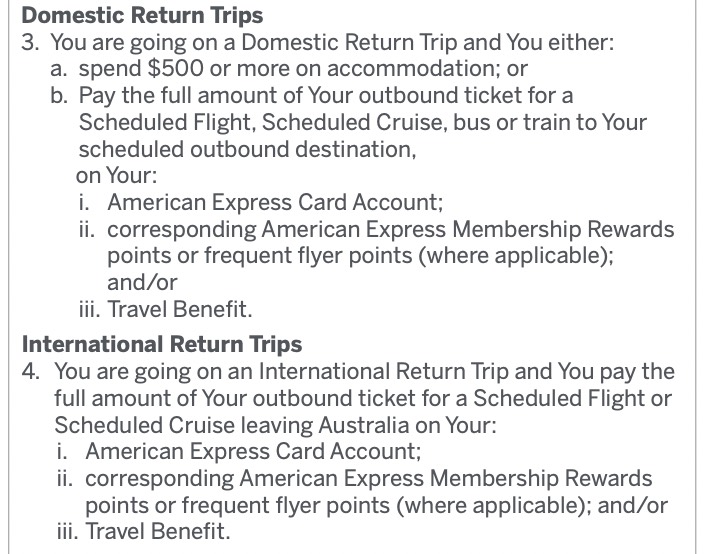

For example, this is how American Express credit card insurance reimburses the loss of reward points:

However, if using points to book your trip, make sure you’re aware of any requirements that may exist to activate your policy. Some credit card travel insurance requires you to pay for your flights in full using your credit card in order to receive coverage during your trip. Award bookings made using points may not count.

For example, to activate the overseas return trip insurance that comes with the Qantas Premier Platinum credit card, you would need to “pay the full amount of a return Scheduled Flight or Cruise ticket for each Covered Person” using a Qantas Premier credit card or using Qantas points earned on the Qantas Premier credit card.

If you booked a Qantas Classic Flight Reward ticket using points that were not entirely earned on that credit card, you would therefore not be eligible for travel insurance. You also would not be covered if booking an award ticket using a different frequent flyer program such as Velocity and paying the taxes using your Qantas Premier card.

Similarly, American Express cardholders would need to pay the full amount of their flight or cruise ticket using their Amex card in order to activate insurance cover. However, if using American Express Membership Rewards points or frequent flyer points that you transferred directly from Membership Rewards, and covered the taxes & charges using your Amex card as well, you should be covered.

Read the PDS carefully

Of course, only the insurance companies themselves can give a definitive answer on what is & isn’t covered, and this can vary between policies. Before purchasing or relying on any insurance product, make sure you read the Product Disclosure Statement (PDS).

When looking for information on coverage for frequent flyer points, a shortcut is to search for the keyword “points” when reading the PDS document on a computer.

If you have any questions or doubts, contact the insurer directly.

You can leave a comment or discuss this topic on the Australian Frequent Flyer forum.

Community Comments

Loading new replies...

Join the full discussion at the Australian Frequent Flyer →