Air Canada’s Aeroplan program has long used dynamic pricing for its own flights, meaning the number of Aeroplan points required to book an Air Canada flight is not fixed.

Aeroplan is not alone here. Dynamic pricing on reward tickets has been an industry trend for some time, with many US airlines even removing award charts completely.

Australian frequent flyer programs have begun to head in this direction, with Velocity now offering five tiers of domestic Economy redemption prices, and Qantas introducing Classic Plus last year.

Contents

Most programs still have consistent partner airline award pricing

However, most frequent flyer programs have continued to offer consistent, fixed point costs on partner airline awards.

They don’t have control over partner airline award availability, so they can’t just raise or drop the price for each flight according to demand. The partner airline either releases the seat, or not, and the program pays a fixed cost to the other airline for it if one of its members books it.

But as frequent flyers become more attuned to the value of points, demand for reward seats has grown exponentially. In order to offer more availability on partner flights, programs such as Alaska Airlines Mileage Plan have already started working more closely with their partner airlines. Alaska’s loyalty program now offers more partner airline reward seats to its members, but at higher prices on flights with higher demand.

Aeroplan too will soon introduce dynamic pricing on more partner airlines. This is something we’re likely to see a long more of going forward…

Aeroplan introducing dynamic pricing on partners

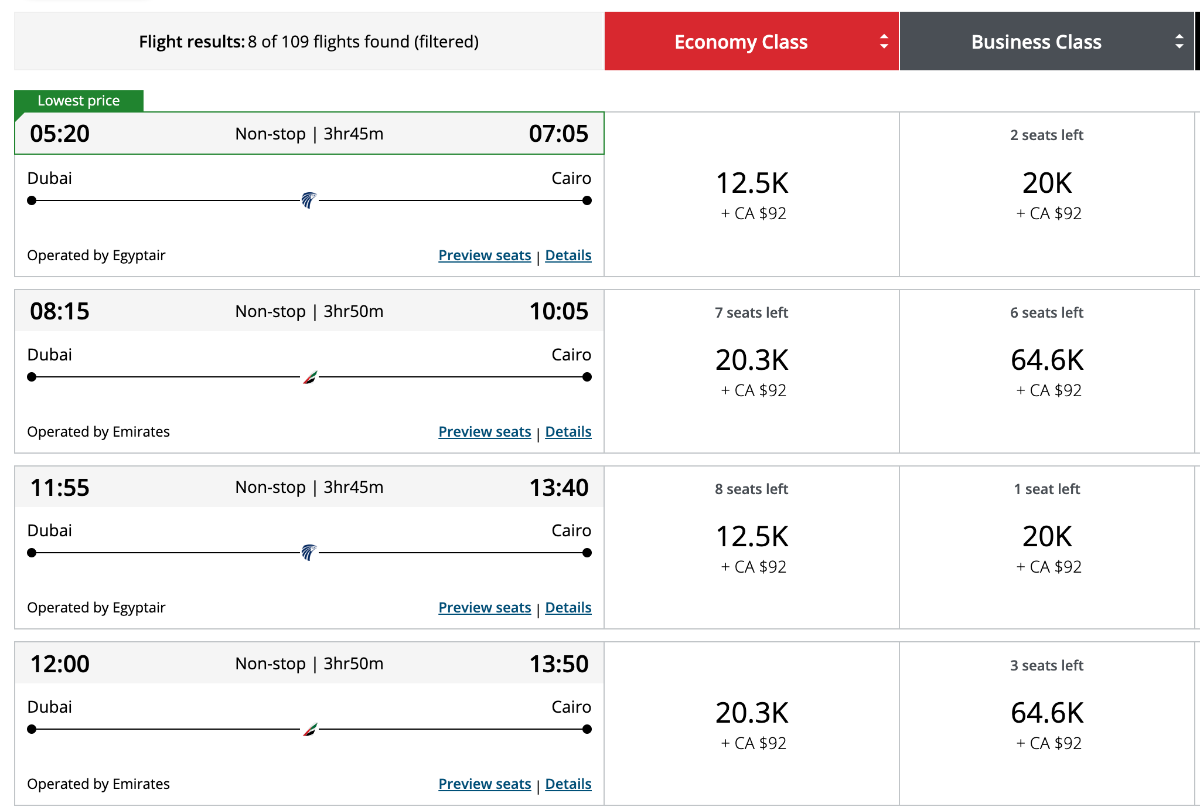

Aeroplan currently has separate award charts that use dynamic pricing for partner awards on Emirates and flydubai.

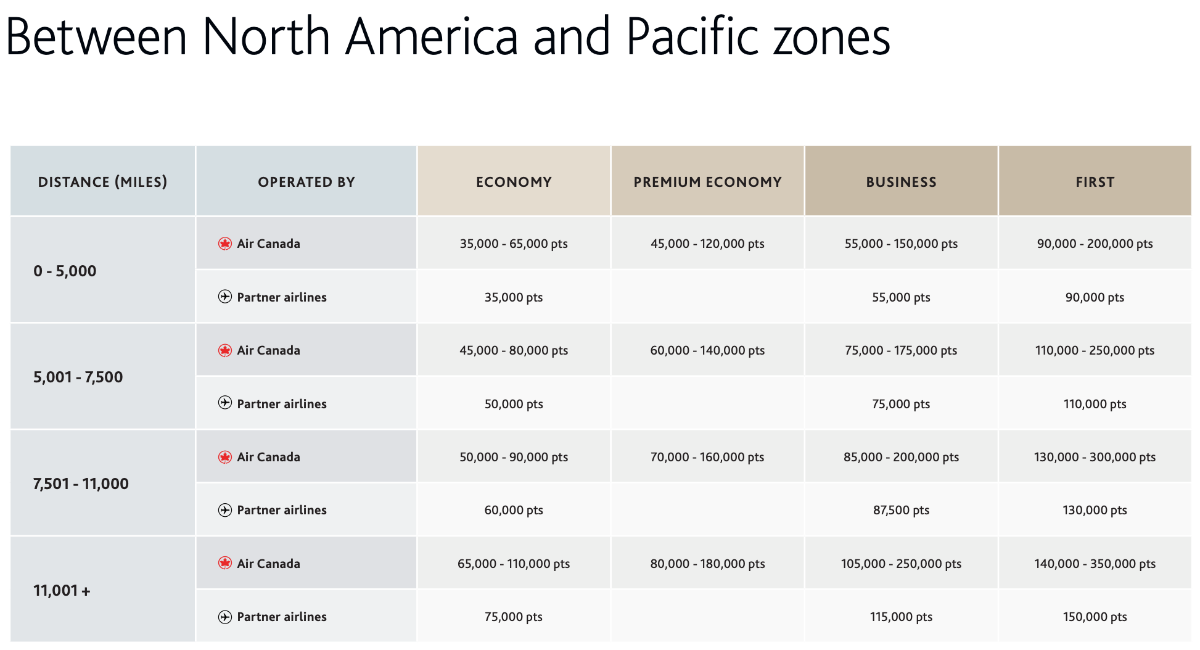

From 25 March 2025, Emirates and flydubai will move to the Air Canada award chart. In addition, United, Etihad and some regional Canadian carriers will move from the general partner award chart to the Air Canada award chart as well. This means that instead of fixed points prices or ranges on these airlines, award pricing will be fully dynamic.

For example, Aeroplan will soon price awards on United Airlines between Australia and North America “starting at” 85,000 miles. This is instead of the previous fixed rate of 87,500 miles. You can be fairly sure that most flights will not cost 85,000 miles.

Also, Aeroplan will now publish the median price of awards booked in the last four quarters. This is instead of providing specific ranges of points that Aeroplan members can expect to pay, as it does now for Air Canada awards. However, this is only for awards from, to and within North America. It also excludes international First Class.

Increased availability, but at what cost?

Aeroplan claims there will be an increase in availability as a result of dynamic pricing. Etihad Business Class awards will also finally be available again for Aeroplan redemptions from 25 March, for the first time since Etihad began restricting partner availability.

All other Aeroplan partners, such as Virgin Australia and Singapore Airlines, will stay on the existing partner airline charts with fixed points costs. At least, for now.

While an increase in availability is good news, it’s unlikely there will be much in the way of “Saver” (lowest) level awards on airlines that are switching to the new chart.

One other implication is that dynamic pricing also applies to Aeroplan awards that merely include at least one flight on an airline that uses the Air Canada award charts. The ability to combine flights with multiple Aeroplan partner airlines onto a single award ticket is a great feature of Aeroplan… but now, simply having one Etihad or United flight on your ticket will mean the whole itinerary will probably cost a lot more.

Why Aeroplan is doing this

On one hand, not a whole lot will realistically change for most customers. The change has re-opened awards on Etihad Business Class, which aren’t currently available to Aeroplan customers. Likewise, customers will probably see more availability on United.

But this availability comes at a cost, quite literally. You’ll likely pay much more in points to book most awards on these airlines. So if the price of award tickets is multiple times higher than previously, it’s more unattainable anyway.

In the current case of Emirates (and flydubai), being able to adjust the number of points payable means Aeroplan can cover more of the costs that Emirates passes on for award tickets. Simply put, this move is more down to the program wanting to mitigate any potential losses on partner awards.

As Aeroplan doesn’t pass on carrier charges, this may be a route to compensating for the ridiculously high carrier charges Emirates and Etihad pass on to their customers.

This is similar to the arguments Qantas made when introducing Classic Plus. And while Qantas has not definitively reduced Classic Reward availability, there is a perception that Qantas Frequent Flyer doesn’t release enough redemption seats. Airlines like Emirates, which release so few awards at the lowest points cost, are in the same boat (or plane).

Despite the availability issues, I’m not sure it’s fair to say that members of frequent flyer programs are happy with flights costing three times as many points as they did before.

This is the future of award travel

Historically, airlines would offer award seats on flights that most likely wouldn’t be full. There’s very little marginal cost in selling a seat for points that would otherwise have gone out empty.

But this dynamic has changed, especially post-COVID. Supply chain issues across the airline industry have reduced the ability for most airlines to grow capacity, especially after mass retirements during COVID-19. This has coincided with an increase in the demand for air travel.

This coincides with increasing engagement in frequent flyer programs, as more people have points and information on how to take advantage of these programs becomes more accessible.

So, airlines face a situation where they sell the vast majority of seats for money, and have less ability to increase capacity. And, frequent flyer programs are becoming better at selling points, so these extra points in circulation become larger liabilities on balance sheets.

To fix this issue, airlines can simply sacrifice their profit by increasing the availability of award seats at low, fixed rates. Or, they can offer more redemptions at higher rates, which costs the airline less and reduces outstanding points balances. Dynamic pricing is a no-brainer from an accounting point of view.

In the airline’s mind, this fixes a major complaint customers have for a program – not being able to get the flight they want with their hard-earned points. And as technology improves, the ability to roll out dynamic pricing beyond their own flights is too lucrative for airlines to ignore.

Lower-priced “Saver” awards still have their place – but more often as last-minute flights. This is when airlines are most sure of the demand for a flight, and allows them to minimise the cost of a reward seat.

To an airline that has a large domestic member base, the economics of dynamic pricing on partners makes sense. This comes at the potential cost of alienating members who may no longer feel like the points are valuable enough to continue collecting.

This isn’t yet the case with Aeroplan, which remains a valuable frequent flyer program for Australians. But this is the general direction that frequent flyer programs are likely to head over time.

Community Comments

Loading new replies...

Join the full discussion at the Australian Frequent Flyer →