At the start of 2020, Qantas was selling around 34,000 weekly seats between Australia and five destinations in the continental United States. It’s now operating just over 13,000 weekly seats in this market, with services to Los Angeles and Dallas only.

Virgin Australia, meanwhile, has stopped flying to the United States altogether. Virgin used to have five Boeing 777s dedicated to its Los Angeles routes, offering more than 13,000 seats per week.

At the same time, the US airlines have slightly increased the number of flights they operate into Australia compared to pre-COVID levels.

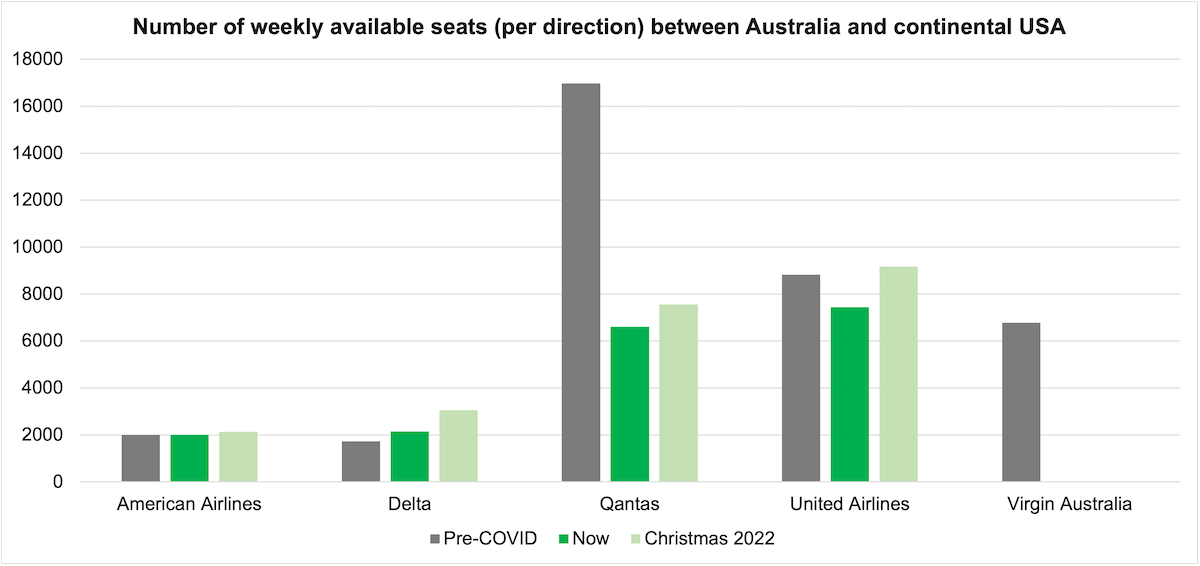

But the total number of seats being operated between Australia and the continental US (excluding Hawaii), as of November 2022, is still only half of what it was before the pandemic. Combined with high demand, that’s a major part of the reason airfares to the United States are so expensive at the moment.

The good news is that the number of seats available from Australia to the USA will increase to 60% of pre-COVID capacity by Christmas. But even over the busy Christmas period, there will be around 29,000 fewer weekly seats operating overall between Australia and the US mainland.

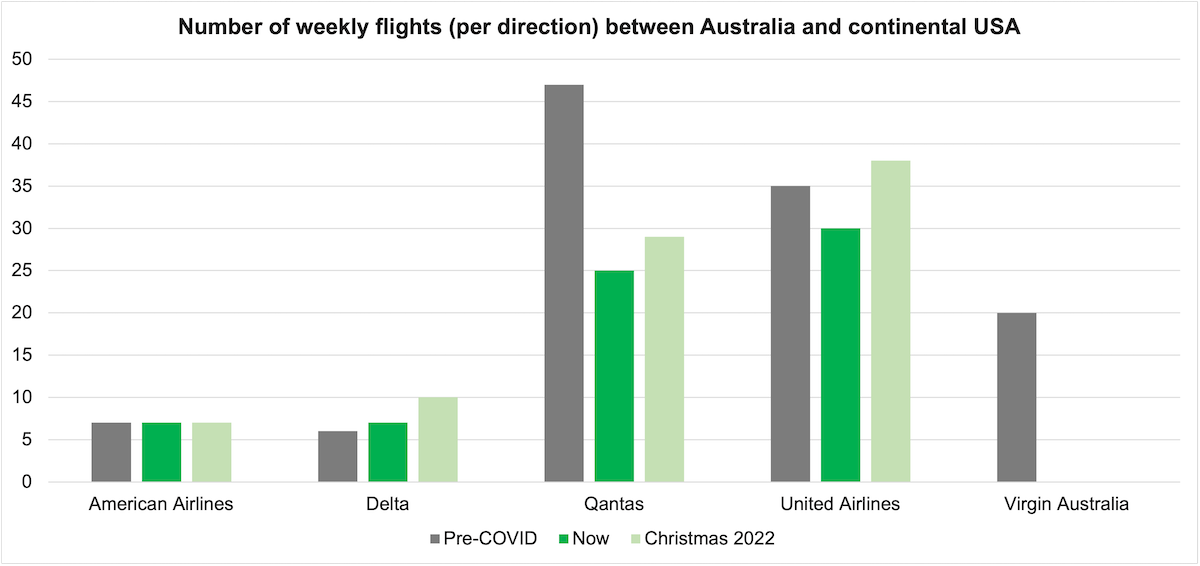

Capacity on Australia-USA routes before vs after COVID-19

We analysed the number of weekly flights available in each direction between Australia and the United States (except Hawaii) for each airline as of late 2019 (pre-COVID). The chart below compares the pre-COVID figure to the number of flights currently operating, as well as the number scheduled to be operating over the peak upcoming Christmas period:

As you can see, the number of flights offered by the US airlines is relatively stable or increasing to above pre-COVID levels. But this doesn’t tell the whole story because some flights are now being operated by larger or (in the case of Qantas) smaller aircraft with different numbers of seats available.

So, we created a second chart which compares the number of weekly seats available for sale across all the different routes operated by each airline:

The US airlines have added capacity into Australia

American Airlines is upgrading its daily Sydney-Los Angeles flight from a Boeing 787-9 to a larger Boeing 777-300ER over the peak Christmas period, giving it a slight bump in the number of available seats next month. Meanwhile, Delta has switched from flying a Boeing 777-200LR on Sydney-Los Angeles to an Airbus A350-900 with slightly more seats. It has also increased the number of weekly flights.

Before COVID-19, United flew Boeing 787s on all its Australian routes. It still mostly uses Boeing 787-9s, which now have slightly fewer total seats due to the introduction of Premium Economy (which United calls Premium Plus) on these planes. But United’s daily Sydney-San Francisco flight has been upgraded to a larger Boeing 777.

As of late October, United is now back flying all five of the routes it operated before COVID-19. A couple of these routes are not yet back to running daily, but will be next month. In addition, United has just launched a new 3x weekly Brisbane-San Francisco flight.

Overall, this means that by Christmas, United, American and Delta will all be offering more seats into Australia than they did before the pandemic.

United is also the only airline that maintained continuous air service between Australia and the USA for the entire duration of the pandemic.

Australian carriers have drastically reduced capacity

The loss of Virgin Australia flights to Los Angeles has obviously taken a large amount of capacity out of the market. But Qantas is also operating just a shell of its pre-COVID schedule to the United States.

Qantas is now only operating on four of the seven non-stop routes to mainland USA that it flew before COVID-19. (That would be eight pre-COVID routes, if you count the Brisbane-Chicago flights that Qantas had sold tickets on and planned to launch in April 2020.)

On all of the four routes that Qantas is operating, there are fewer weekly seats available. The reduction of capacity on the Brisbane-Los Angeles route (due to an Airbus A330 operating the flight instead of a Boeing 787) is only marginal. But there are now 30% less seats on Qantas’ Sydney-Los Angeles route because four of the seven weekly flights are now on Boeing 787s instead of Airbus A380s.

On the Sydney-Dallas route, there are now 1,416 weekly seats in both directions instead of 2,910 before the pandemic. That’s less than half the capacity.

But Qantas’ Melbourne-Los Angeles route is the most affected. The aircraft now operating this route are half the size and flights are no longer even running daily, leaving 69% fewer seats available compared to 2019.

Meanwhile, Qantas has not yet resumed flights to San Francisco (the Sydney-San Francisco relaunch has just been delayed again – this time until May 2023) and Brisbane-Chicago is not coming back.

There are green shoots, though. Qantas will next month launch a new direct route from Melbourne to Dallas, and next June will start Sydney-Auckland-New York flights.

US airlines doing the heavy lifting

Before COVID-19, Australian airlines operated two-thirds of the available seats between Australia and the United States every day, with US carriers operating the other third. This has now reversed. Today, US carriers control two-thirds of the capacity in this market.

You can leave a comment or discuss this topic on the Australian Frequent Flyer forum.

Community Comments

Loading new replies...

Join the full discussion at the Australian Frequent Flyer →