Bankwest is capping the number of Qantas points that can be earned on Bankwest Qantas Transaction Account balances from 1 November 2021.

Currently, Bankwest Qantas Transaction accountholders can earn 0.3 Qantas points for every $100 held in their account each day. That works out to be 9 Qantas points per $100 in the account in each month. This is in addition to earning 3 Qantas points for every eligible purchase made using the account’s debit card.

With this product, Qantas points are effectively earned on the account’s balance in lieu of a competitive interest rate. The Bankwest Qantas Transaction account offers a cash interest rate of just 0.01%, so the main benefit is the Qantas points earned.

Unfortunately, from 1 November 2021, Bankwest will no longer award Qantas points on account balances over $50,000. This notice appears on the Bankwest website:

Upcoming changes to earning Qantas Points

From 1 November 2021 any balances over $50,000 will no longer earn Qantas Points. You can still earn 0.3 Qantas Points per $100 each day for any balance under this cap.

Points earned on each eligible purchase and from an overseas ATM cash withdrawal remains unchanged.

If you had a Bankwest Qantas Transaction account balance of $50,000 or more, this means that you would not be able to earn more than 150 Qantas points per day on the balance. That’s a maximum of 54,750 Qantas Frequent Flyer points per year.

According to the Bankwest Qantas Rewards Program terms & conditions, Bankwest is only required to give 30 days’ written notice of material changes including the rate of accrual of Qantas points. This written notice only has to be given by publishing a notice in a national newspaper or on the Bankwest website.

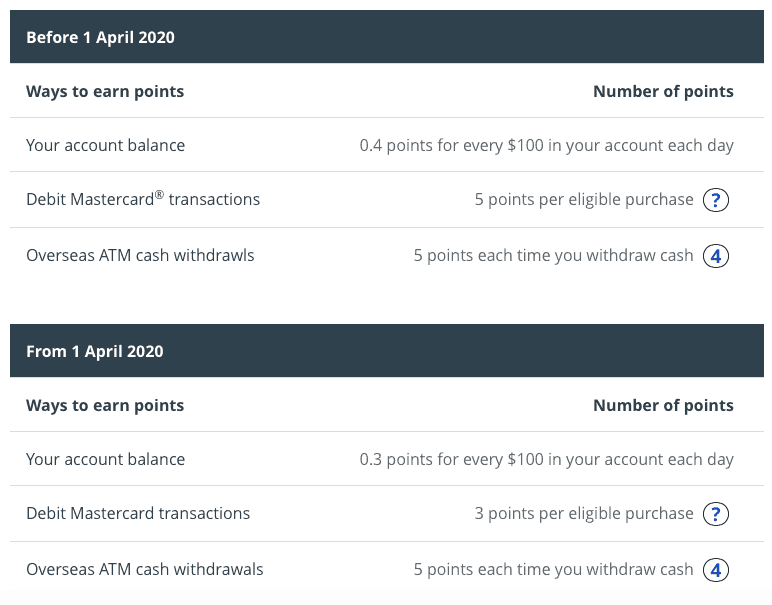

This is the second devaluation to the Bankwest Qantas Transaction account in two years. In April last year, Bankwest reduced the amount of Qantas points earned on the account balance and per transaction.

Alternative bank accounts that earn Qantas points

If you’re now looking for a Qantas points-earning alternative to the Bankwest Qantas Transaction account, there are a couple of other Australian bank accounts that award Qantas points on the balance.

One is the free Qudos Bank Qantas Points Saver account, which awards 400 Qantas points per $1,000 held in the account each year up to a maximum balance of $1 million. This is a lower Qantas points earn rate than the Bankwest Qantas Transaction account, but it has a much higher balance limit. This account does also have a higher regular interest rate (currently 0.45% p.a.).

The BOQ Specialist Everyday Plus account also has no fees and gives 1 Qantas or Velocity point per $10 of the account balance each month. That’s a slightly higher earning rate than the Bankwest account. The BOQ Specialist account does not cap Qantas points, but it doesn’t earn any regular interest and is only available to health care workers, vets and accountants.

Join the discussion on the Australian Frequent Flyer forum: Bankwest Transaction account [General Discussion]