Bankwest is reducing the number of Qantas Frequent Flyer points that can be earned with its Qantas Transaction Account.

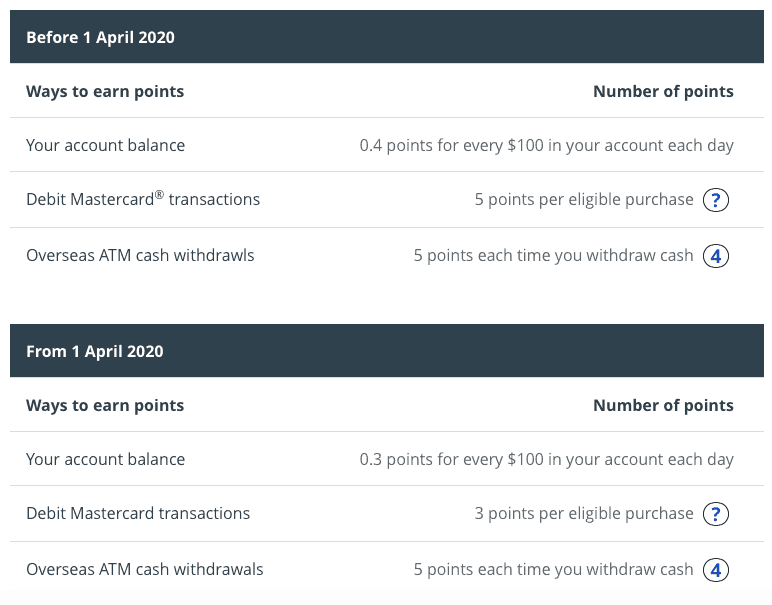

Currently, you can earn 5 Qantas points per transaction made using the debit card that comes with this bank account. The bank account balance also accrues interest in the form of Qantas points at a rate of 0.4 points per day for every $100 in the account. That works out to be 12 Qantas points/month per $100.

From 1 April 2020, the earn rate per transaction will drop from 5 to 3 Qantas points. In addition, the interest rate will be reduced from 0.4 Qantas points/$100, per day to 0.3 Qantas points/$100, per day.

The interest rate on the Bankwest Qantas Transaction account is only 0.01% per annum, so the Qantas points effectively replace cash interest on this bank account.

With this account, you’ll also earn 5 Qantas points for overseas ATM withdrawals. This remains unchanged. However, it would be unwise to withdraw cash from an overseas ATM using this card anyway – given the 2.95% currency conversion fee – when there are other debit cards that don’t charge international transaction fees.

The revised earn rates are listed on the Bankwest website:

This account has a $6 monthly account fee which is waived if you deposit at least $2,000 per month.

The Bankwest Qantas Transaction Account has been popular with AFF members for years, so this devaluation is disappointing. It’s one of the few debit cards in Australia that awards Qantas points, and as there is no minimum purchase amount to earn 5 (soon 3) Qantas points, it’s ideal for smaller purchases.

Join the discussion on the Australian Frequent Flyer forum: Bankwest Transaction account [General Discussion]