- Joined

- Mar 25, 2010

- Posts

- 1,555

Does Travel Insurance Cover Lost Points? is an article written by AFF editorial staff:

www.australianfrequentflyer.com.au

www.australianfrequentflyer.com.au

You can leave a comment or discuss this topic below.

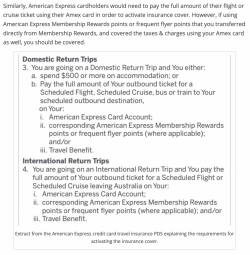

Does Travel Insurance Cover Lost Frequent Flyer Points?

Travel insurance may reimburse you for lost frequent flyer points if your trip is disrupted and you can't recover the points another way.

You can leave a comment or discuss this topic below.