You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Superannuation Discussion + market volatility

- Thread starter JohnK

- Start date

OATEK

Senior Member

- Joined

- Apr 12, 2013

- Posts

- 5,686

Market volatility is when the big wins and losses can occur, and my Crystal Ball got thrown out in a council clean up years ago. so I am just sitting tight.

My adviser proposed a year ago that owing to uncertainty with the US election that we should hold more in cash to be used to pay our income stream for a few years, leaving growth elements to do their thing. Seems very good advice in retrospect.

About to do my final withdraw/recontribute early in next financial year, and from there will just ride it out and see how it goes.

My adviser proposed a year ago that owing to uncertainty with the US election that we should hold more in cash to be used to pay our income stream for a few years, leaving growth elements to do their thing. Seems very good advice in retrospect.

About to do my final withdraw/recontribute early in next financial year, and from there will just ride it out and see how it goes.

- Joined

- Jun 20, 2002

- Posts

- 17,754

- Qantas

- Gold

- Virgin

- Platinum

I was just sent this in an investment report from Vanguard :

This article from Morningstar [mp.morningstar.com] may be useful to put the recent volatility into context.

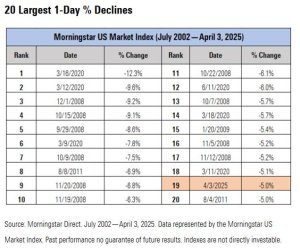

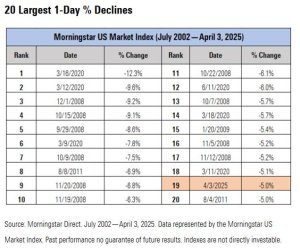

“…we should be mindful not to become prisoners of the moment. April 3 was a bad day, but it barely cracked the top 20 worst single days for markets since 2002, coming in at number 19…”

Cautioning investors against tactical portfolio changes

Given potential tariff countermeasures and their effects, Vanguard believes it would be imprudent to attempt to identify specific investment implications immediately following the announcement. Financial markets may respond quickly to developments as they unfold in the near term, but we caution long-term investors against reacting with tactical or short-term changes to well-considered investment plans as it is proven to be challenging to add value on a consistent basis when utilising a TAA on a long-term basis.

This article from Morningstar [mp.morningstar.com] may be useful to put the recent volatility into context.

“…we should be mindful not to become prisoners of the moment. April 3 was a bad day, but it barely cracked the top 20 worst single days for markets since 2002, coming in at number 19…”

Cautioning investors against tactical portfolio changes

Given potential tariff countermeasures and their effects, Vanguard believes it would be imprudent to attempt to identify specific investment implications immediately following the announcement. Financial markets may respond quickly to developments as they unfold in the near term, but we caution long-term investors against reacting with tactical or short-term changes to well-considered investment plans as it is proven to be challenging to add value on a consistent basis when utilising a TAA on a long-term basis.

SydneySwan

Established Member

- Joined

- Jan 12, 2014

- Posts

- 4,055

- Qantas

- Gold

- Virgin

- Red

@MEL_Traveller - if you did move to cash then I hope you moved it back yesterday. Today is not the sort of 'up' day you want to miss. We are living in a period of absolutely unprecedented volatility.Noted, thanks!

I know I have missed today’s pending downturn, but if it continues even tomorrow then I should be in front.

This is only temporary as a one off, for a few days. Not particularly looking to switch back at the best time, just ‘a’ time after the market has gone down. If I miss one day of rebound i’ll habe to wear that too.

MEL_Traveller

Veteran Member

- Joined

- Apr 27, 2005

- Posts

- 29,756

Indeed. But I really can’t tell what impact, if anything, it’s had!@MEL_Traveller - if you did move to cash then I hope you moved it back yesterday. Today is not the sort of 'up' day you want to miss. We are living in a period of absolutely unprecedented volatility.

Balances seem to be displayed about three days behind. I seem to have ‘lost’ about 3%. But I don’t know what it would have been if I’d left it.

- Joined

- Apr 6, 2018

- Posts

- 2,756

Hazmat suit on

Its times like these I am glad to be in PSS

Makes up for the tax +++ I pay although retired

Its times like these I am glad to be in PSS

Makes up for the tax +++ I pay although retired

- Joined

- Jun 20, 2002

- Posts

- 17,754

- Qantas

- Gold

- Virgin

- Platinum

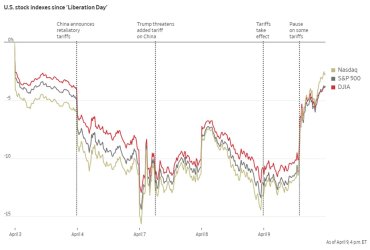

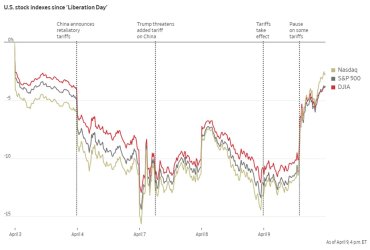

So for everyone worried about the market volatility, this chart shows that all of the US markets have almost fully recovered their losses. For those that rode the wave, very little impact.

Expect more of this type of activity but a great reminder why trying to time markets and ‘day trading’ is a mugs game.

Here's the ASX numbers. Look at the performance figures - going back 12 months. https://www.marketindex.com.au/asx200

Expect more of this type of activity but a great reminder why trying to time markets and ‘day trading’ is a mugs game.

Here's the ASX numbers. Look at the performance figures - going back 12 months. https://www.marketindex.com.au/asx200

Last edited:

CaptJCool

Established Member

- Joined

- May 31, 2012

- Posts

- 4,095

Hazmat suit on

Its times like these I am glad to be in PSS

Makes up for the tax +++ I pay although retired

CSS here

Tax is barely 10% of earnings

It’s amazing

how fortunate am I

OZDUCK

Established Member

- Joined

- Aug 1, 2010

- Posts

- 4,131

My feelings as well being in the same situation.CSS here

Tax is barely 10% of earnings

It’s amazing

how fortunate am I

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.