sageybadegey

Junior Member

- Joined

- Feb 22, 2018

- Posts

- 12

I never had a credit card except for this year when I started reading forums like this that my mind starts opening up to the idea. Since last month (January 2018) I started opening up these cards in this order:

1. Coles No Annual Fee Card

2. Woolworths Money Everyday Platinum

3. AMEX Velocity Platinum

4. ANZ Rewards Black

5. Virgin Money High Flyer Card

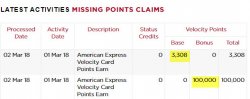

I probably will be closing Coles and Woolies once I get the $100 voucher from them. I've spent the minimum spent on AMEX Velocity and ANZ Rewards, so I'm just waiting to get the bonus points of 100k velocity from AMEX and 75k rewards points from ANZ. I only got approved for my Virgin Money High Flyer, so I'm just waiting for the card to arrive for me to start spending to get the 120k velocity sign-up bonus points.

My primary purpose for churning these cards is to take my wife and 2-year-old daughter on a lovely holiday sometime next year.

I know churning will have a significant ding on my credit but I'm not looking to buy any property soon, so this is not a big deal for me.

My central question is, am I done for this year accumulating all these credit cards? How many open credit card is the maximum per year? Is there some rule of thumb regarding the number of credit card applications in a year?

Also, what card should I plan to get next? NAB? St. George? Westpac?

Thank in advance!

P.S. I don't have any balance on any of those cards, so I think I use them responsibly and pay them off on time. The only downside for me temporarily is that I'm not able to invest in shares which I usually do every month and that's stopping at the moment because of the minimum spent on these cards.

1. Coles No Annual Fee Card

2. Woolworths Money Everyday Platinum

3. AMEX Velocity Platinum

4. ANZ Rewards Black

5. Virgin Money High Flyer Card

I probably will be closing Coles and Woolies once I get the $100 voucher from them. I've spent the minimum spent on AMEX Velocity and ANZ Rewards, so I'm just waiting to get the bonus points of 100k velocity from AMEX and 75k rewards points from ANZ. I only got approved for my Virgin Money High Flyer, so I'm just waiting for the card to arrive for me to start spending to get the 120k velocity sign-up bonus points.

My primary purpose for churning these cards is to take my wife and 2-year-old daughter on a lovely holiday sometime next year.

I know churning will have a significant ding on my credit but I'm not looking to buy any property soon, so this is not a big deal for me.

My central question is, am I done for this year accumulating all these credit cards? How many open credit card is the maximum per year? Is there some rule of thumb regarding the number of credit card applications in a year?

Also, what card should I plan to get next? NAB? St. George? Westpac?

Thank in advance!

P.S. I don't have any balance on any of those cards, so I think I use them responsibly and pay them off on time. The only downside for me temporarily is that I'm not able to invest in shares which I usually do every month and that's stopping at the moment because of the minimum spent on these cards.