Interesting

Here is my take on the issue.

If I switched my hypothetical million in cash from Bankwest to Ubank, this year I will earn 3.6% interest PRE-TAX (assuming no further interest rate rises which would make an even better value proposition)

So this time next year I will have $36,000*0.65 assuming a 35% tax rate = $23,400 in the bank

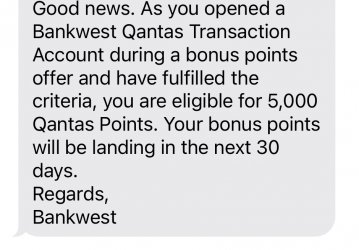

Leaving my money with Bankwest (let's pretend I have 20 accounts in different names with 50k in each) I'd earn 1,095,000 points.

The 318,000 points needed for an award J rtn to Europe, assuming I can find one, would be equivalent to $6,795 in interest from Ubank. Then I need to add taxes which vary from $300 JAL to $3000 Emirates. Best case scenario my points flight costs me more than $7,000.

But the real kicker.....

Just 6 months ago I was more than happy to leave my "million dollars" in the bank earning 1.095 million points - enough for 3.4 J rtns to Europe. At that time I would never have dreamt of paying even $4,000 for a fare to London. Yesterday I looked at booking two flights to CDG for $6,000 a pop. I get points and perks and won't get bumped. I get free insurance with my card - no worrying about terms and conditions.

And I have $2,000 left over on the equivalent investment from April.

Please tell me where I am going wrong here??

And DON'T say cash is the worst value investment - I know that. I should have put it in the All-Ords where it would now be worth $891,000