…

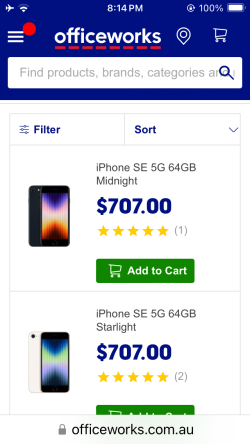

I suppose even if I paid duty, I'd still save ~$81 in GST since the first $900 should still be duty-free.

Just thought I’d leave this here to prevent any surprises

What happens if I exceed the duty free limits?

If you exceed Australia’s duty free limits, duty and tax will apply on all items of that type (general goods, alcohol or tobacco), not just the goods over the limit.