[Please note: This card is currently unavailable for new applications]

Learn more about this card:

Citi Prestige Credit Card

Earn up to 3 Citi reward Points per $1 on eligible spend and receive unlimited airport lounge access with the Citi Prestige Credit Card.

What are the main benefits of this card?

- Sign-up bonus (currently unavailable)

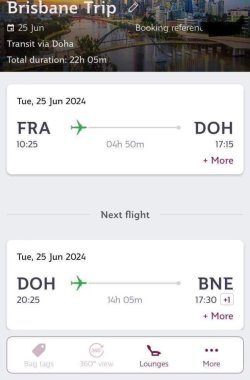

- Up to 15 annual Priority Pass airport lounge visits for you and/or guests, including food & beverage credits at participating airport restaurants.

- Get the 4th night free on Luxury Escapes bookings

- $10 cashback with BINGE every month until 31/10/25

- $100 cashback with Uber Premier

- Earn 1 Citi reward Point per $1 spent on everyday purchases, plus earn extra points with lots of bonus points-earning categories

Why we like the Citi Prestige credit card

Why we like the Citi Prestige credit cardThe Citi Prestige card is packed with benefits including Priority Pass airport lounge access for you and a guest travelling with you. You can even use this to access up to AUD36 per person (for up to 2 people) worth of food & beverage credits at participating Priority Pass airport bars, restaurants and cafés when you fly, with up to 15 included visits per year.

This card has lots of opportunities to earn bonus points. You'll earn:

- 1 Citi reward Point per $1 spent on everyday eligible purchases;

- 2 points per $1 at major supermarkets, petrol outlets and national retailers; or

- 3 points per $1 spent with major airlines, hotels and restaurants in Australia, as well as transactions online and overseas

See our card guide for the full details:

Citi Prestige Credit Card

Earn up to 3 Citi reward Points per $1 on eligible spend and receive unlimited airport lounge access with the Citi Prestige Credit Card.

Last edited by a moderator: