RykcmanNpoints

Newbie

- Joined

- Sep 8, 2024

- Posts

- 3

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Sapphire

Hi everyone. I'm a points nerd by heart, but during covid things took a turn for the worse for me and my business.

I unfortunately missed 2 payments due to business being horrid and Amex cancelled my American Express Gold card and sent my card balance to a receiver... paid it in full, yet it was still put down as a default...

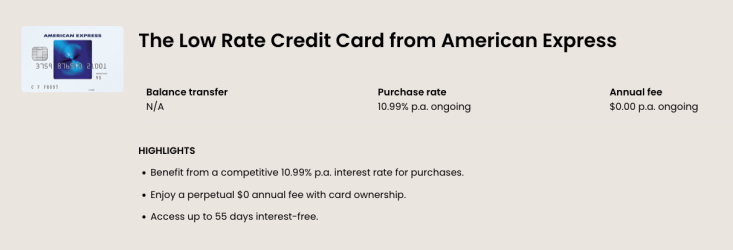

Looking to get another Amex, but I'm hearing people say it is next to impossible to get back with American Express once this has happened?

I really would appreciate any guidance.

I unfortunately missed 2 payments due to business being horrid and Amex cancelled my American Express Gold card and sent my card balance to a receiver... paid it in full, yet it was still put down as a default...

Looking to get another Amex, but I'm hearing people say it is next to impossible to get back with American Express once this has happened?

I really would appreciate any guidance.