- Joined

- Aug 21, 2011

- Posts

- 15,756

- Qantas

- Platinum

- Virgin

- Platinum

- SkyTeam

- Elite Plus

- Star Alliance

- Gold

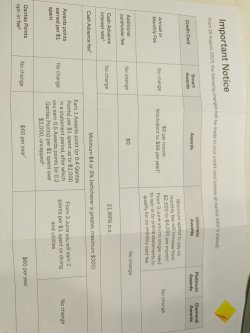

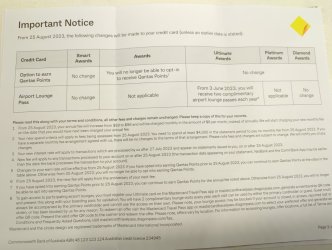

Looks like CommBank has removed its Platinum Awards and Diamond Awards cards from sale, and replaced them with a new "Smart Awards" card.

It has a $19 monthly fee (works out to be a maximum of $228 per year), waived if you spend at least $2,000 in the month.

Earns 1.5 CommBank Awards points or 0.6 Qantas points per $1 spent up to $5,000/month, thereafter the rate reduces to 0.5 Awards or 0.2 Qantas points per $1. You also get 1.5x points at major supermarkets, department stores, petrol stations, dining and utilities; and double points on your largest purchase each statement period (up to a maximum of 1,000 Awards points or 400 Qantas points).

Interestingly, there are no international transaction fees.

There's a sign-up bonus on the card of 80,000 CommBank Awards points or 50,000 Qantas points (if you opt-in to Qantas direct earn for an extra $60 per year). Offer ends 30 September 2023.

www.commbank.com.au

www.commbank.com.au

It has a $19 monthly fee (works out to be a maximum of $228 per year), waived if you spend at least $2,000 in the month.

Earns 1.5 CommBank Awards points or 0.6 Qantas points per $1 spent up to $5,000/month, thereafter the rate reduces to 0.5 Awards or 0.2 Qantas points per $1. You also get 1.5x points at major supermarkets, department stores, petrol stations, dining and utilities; and double points on your largest purchase each statement period (up to a maximum of 1,000 Awards points or 400 Qantas points).

Interestingly, there are no international transaction fees.

There's a sign-up bonus on the card of 80,000 CommBank Awards points or 50,000 Qantas points (if you opt-in to Qantas direct earn for an extra $60 per year). Offer ends 30 September 2023.

Smart Awards credit card - Bonus Awards - CommBank

Earn points and bonus points across a range of day-to-day purchases with the Smart Awards credit card. No monthly fee if you meet the minimum spend criteria.