exceladdict

Established Member

- Joined

- Mar 26, 2014

- Posts

- 4,845

- Qantas

- Platinum

- Virgin

- Silver

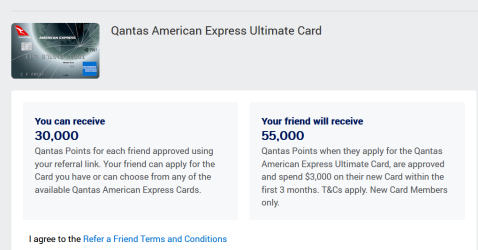

Hot on the heels of the Worst shop small ever?, the Amex QF Ultimate referral offer has dropped to 55,000 with no end date (avoiding a link here, as they live in the Referral Offers forum).

This card has previously hit or exceeded 120k points, with SCs or even cashbacks offered as well. Yes, the $~450 annual fee is offset by the $450 QF flight credit "if you were going to be flying anyway" but I worry that the trend is not looking good for us... erm.. 'practiced' applicants:

Do we think this is a different approach from amex marketing in AU?

This card has previously hit or exceeded 120k points, with SCs or even cashbacks offered as well. Yes, the $~450 annual fee is offset by the $450 QF flight credit "if you were going to be flying anyway" but I worry that the trend is not looking good for us... erm.. 'practiced' applicants:

- January through March: 110k points for 3k spend, 30k for referrer

- Noting some (seemingly new referrers?) had a 130k offer with 50k for the referee

- April: 120k / $3k spend; 40k for referee

- May: 110k / $3k / 40k

- June-August: 100k points split into 75k first + 25k second year

- To 19 Oct: 75k points

- 2 Nov on: 55k, undated

Do we think this is a different approach from amex marketing in AU?