- Joined

- Nov 12, 2012

- Posts

- 27,638

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Silver

What do people think about the up-coming IPO of Latitude Financial (they run the 28 Degrees card), co-managed by CommSec? Worth putting some Super money into?

According to the e-mail I got from CommSec – ‘ The offer is for approximately 622.4 million shares issued by the Company (expected ASX code: LFS) (Securities), at an indicative price range of $2.00 to $2.25 per Security, to raise up to $1,400.4 million.’

How popular do you think the offer will be? That will drive the final price, and the resultant dividend yield etc Broker firm opens 4 October, closes 14 October, bookbuild is 15/16 October

From CommSec:

According to the e-mail I got from CommSec – ‘ The offer is for approximately 622.4 million shares issued by the Company (expected ASX code: LFS) (Securities), at an indicative price range of $2.00 to $2.25 per Security, to raise up to $1,400.4 million.’

How popular do you think the offer will be? That will drive the final price, and the resultant dividend yield etc Broker firm opens 4 October, closes 14 October, bookbuild is 15/16 October

From CommSec:

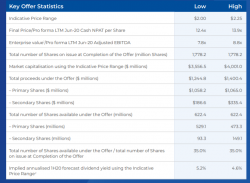

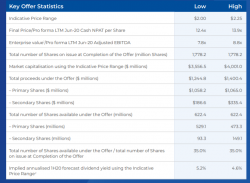

| Key Offer Statistics | |

| Issuer | Latitude Financial Group Limited (ACN 625 845 883) and Latitude SaleCo Limited (ACN 625 845 874) |

| Proposed ASX Code | LFS |

| Indicative Price Range | $2.00 - $2.25 |

| Final Price / Pro forma LTM Jun-20 Cash NPAT per Share | 12.4x – 13.9x |

| Enterprise value / Pro forma LTM Jun-20 Adjusted EBITDA | 7.8x – 8.8x |

| Total number of Shares on issue at Completion of the Offer (million Shares) | 1,778.2 |

| Market capitalisation using the Indicative Price Range ($ millions) | $3,556.5 - $4,001.0 |

| Total proceeds under the Offer ($ millions) | $1,244.8 - $1,400.4 |

| Total number of Shares available under the Offer (millions) | 622.4 |

| Total number of Shares available under the Offer / total number of Shares on issue at Completion of the Offer | 35% |

| Implied annualised 1H20 forecast dividend yield using the Indicative Price Range | 5.2% - 4.6% |