You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

New Amex redemption rates for SQ/EK; adding transfers to QR/HA

- Thread starter ms1

- Start date

-

- Tags

- redeem points

- Joined

- Feb 25, 2020

- Posts

- 929

- Qantas

- Platinum

- Virgin

- Platinum

Does this mean Avios is essentially open to points transfers now? If so this is really good news.

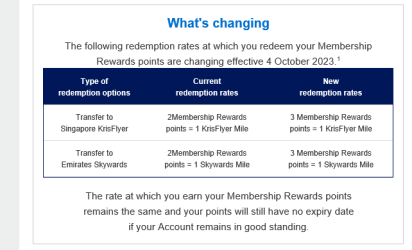

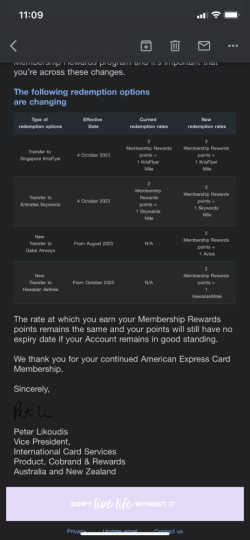

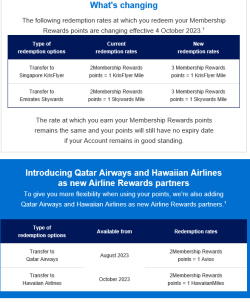

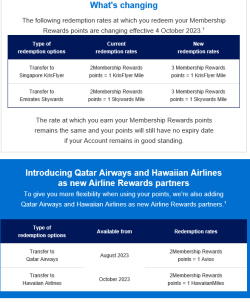

Amex are dramatically devaluing the MR transfer rates to Silverkris from 3/10. Good news though is they (as a conveniently timed sweetner) are adding HA & QR as partners.

Guess this goes to show how valued and expensive SQ points are to some... but it does add a bit of an opportunity with a couple of alternative airlines that are pretty solid.

Guess this goes to show how valued and expensive SQ points are to some... but it does add a bit of an opportunity with a couple of alternative airlines that are pretty solid.

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,548

MathNerd

Active Member

- Joined

- Sep 2, 2018

- Posts

- 833

- Qantas

- Bronze

- Virgin

- Silver

Damn, currently in SIN SKL J and received this email too.

Knew that the words "American Express is making some changes to your Membership Rewards program and it’s important that you’re across these changes" meant a devaluation and damn it turned out to be true.

Another nail in the coffin for SQ KF earning opportunities...

Knew that the words "American Express is making some changes to your Membership Rewards program and it’s important that you’re across these changes" meant a devaluation and damn it turned out to be true.

Another nail in the coffin for SQ KF earning opportunities...

That's a huge blow and I am reluctant to transfer points to Singapore with their harsh expiry policy.

Post automatically merged:

no AugustDoes this mean Avios is essentially open to points transfers now? If so this is really good news.

Got the email too. Very bad news for those of us attached to KrisFlyer. It’s now a very difficult currency to accumulate in Australia.

The addition of QR is very good - since they’ve adopted Avios there are some excellent options, though the main problem is availability.

The addition of QR is very good - since they’ve adopted Avios there are some excellent options, though the main problem is availability.

- Joined

- Jan 14, 2013

- Posts

- 6,588

- Qantas

- Qantas Club

- Virgin

- Red

- Oneworld

- Sapphire

- Star Alliance

- Silver

Bad news about KF but fabulous about QR given ability to switch to BA (and Iberia and Aer Lingus as well).

1+ Avios per AUD is a good earning rate

1+ Avios per AUD is a good earning rate

Seems like everyone's devaluing... so what's the game plan? Churn all the way?That's an unlike for sure. Got the same email. Hmmmm, there goes amex warehousing and a likely cancellation for me.

It’s definitely a possibility. If the miles game is so dead I may as well give in to the wife and have another kid.Seems like everyone's devaluing... so what's the game plan? Churn all the way?

SeaWolf

Established Member

- Joined

- Jan 24, 2007

- Posts

- 1,716

- Qantas

- Bronze

- Virgin

- Platinum

- Star Alliance

- Gold

This would devalue the churn points as well, so I guess doing that will not be useful as it used to be.Seems like everyone's devaluing... so what's the game plan? Churn all the way?

I think St. George just devalued their transfer to Krisflyer as well so it's possible the SQ is upping the cost of the points in the Australian market.

desafinado74

Active Member

- Joined

- Sep 13, 2015

- Posts

- 924

Another BS change. Totally disinterested with Aussie cards now. American credit cards are the way to go now.

- Joined

- Jun 4, 2009

- Posts

- 1,878

Changes like this can really make overseas-based frequent flyer programs much less appealing.

Skywards already recently lost all of its Citibank transfers (which included not just Citi Rewards, but also Suncorp Rewards, Diners Club Rewards and a couple of others). Add to that, having a conversion rate from AMEX that'll be the least appealing of the Big Three Middle Eastern airlines (with MR to Etihad and Qatar being 2:1), and the only other card partner being CBA where the conversion rate is already terrible. With the super high carrier charges to redeem on Emirates, it makes the whole loyalty prospect on Emirates rather 'pointless' for most points-collecting Aussies.

Then, with SQ... the whole appeal of SQ used to be better redemption rates paired with better availability. Then the redemption rates kept creeping up and up, to the point that they're basically on par with Qantas and Velocity. (Sure, there are sweet spots in some cases, but often the number of miles needed is comparable for the flights I'd often book.) So, when you consider that KrisFlyer miles are now harder to earn - especially given the devaluation announced just a few days ago with Amplify Rewards - but the redemption rates aren't significantly better, it also falls closer to the 'why bother' pile. It still has the advantage of no carrier charges on SQ reward bookings, versus what you pay redeeming through Velocity, but most partner airline bookings have extremely high fees (e.g. a Lufthansa domestic flight can run up to $200 just in co-pay fees, on top of the high number of miles needed). So, I'm leaning towards transferring just enough to KrisFlyer for what I'd need for one more reward flight, and then probably disengaging from the program.

Skywards already recently lost all of its Citibank transfers (which included not just Citi Rewards, but also Suncorp Rewards, Diners Club Rewards and a couple of others). Add to that, having a conversion rate from AMEX that'll be the least appealing of the Big Three Middle Eastern airlines (with MR to Etihad and Qatar being 2:1), and the only other card partner being CBA where the conversion rate is already terrible. With the super high carrier charges to redeem on Emirates, it makes the whole loyalty prospect on Emirates rather 'pointless' for most points-collecting Aussies.

Then, with SQ... the whole appeal of SQ used to be better redemption rates paired with better availability. Then the redemption rates kept creeping up and up, to the point that they're basically on par with Qantas and Velocity. (Sure, there are sweet spots in some cases, but often the number of miles needed is comparable for the flights I'd often book.) So, when you consider that KrisFlyer miles are now harder to earn - especially given the devaluation announced just a few days ago with Amplify Rewards - but the redemption rates aren't significantly better, it also falls closer to the 'why bother' pile. It still has the advantage of no carrier charges on SQ reward bookings, versus what you pay redeeming through Velocity, but most partner airline bookings have extremely high fees (e.g. a Lufthansa domestic flight can run up to $200 just in co-pay fees, on top of the high number of miles needed). So, I'm leaning towards transferring just enough to KrisFlyer for what I'd need for one more reward flight, and then probably disengaging from the program.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- Cessna 180

- markis10

- Dalec

- mouseman99

- There'sOnlyOneJimmy

- sanne

- Easy Tiger

- Saab34

- SydneySwan

- Rocks

- defurax

- HockeyMonkey

- pauly7

- Capricornus

- torks

- wandering_fred

- wentworthmeister

- Feintz

- michaelm

- gpurcell

- Cottman

- jase05

- DaveLoftus

- mrsterryn

- Ttwines

- flypriority

- Tlee

- I love to travel

- WrenchHammerMcTool

- SJF211

- snooze

- sleepybear

- JessicaTam

- SOPOOR

- Townsend

- TheRealTMA

- Hawk529

- Junior royal

- tgh

- Scr77

- vmile

- tielec

- redbigot

- gty222

- emirates777

- Mattg

- nige_perth

- daft009

- azza_1992

- sihyonkim

Total: 1,594 (members: 87, guests: 1,507)