- Joined

- Nov 12, 2012

- Posts

- 27,656

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Silver

In the Oz on-line: Why Qantas chief Alan Joyce isn’t prioritising Qantas’ ageing fleet If paywalled, try 12ft – Hop any paywall

A few excerpts. Would be interesting to see a graph of average age of the QF fleet (or even just the jet fleet) over the past 20-30 years or so.

Airliners.net place the average age of the group they cover at 14 years. I found this on-line

And a bit of discussion on Joyce's successor

A few excerpts. Would be interesting to see a graph of average age of the QF fleet (or even just the jet fleet) over the past 20-30 years or so.

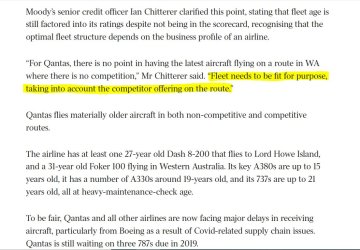

Faced with its oldest average plane fleet age in living memory – at 15.4 years including freighters – Qantas Airways has determined this measure is no longer a main strategic requirement, according to Qantas group treasurer Greg Manning.

“Average age has always been a factor in our fleet planning process, but it’s definitely not the main factor and hasn’t been for some time,” Mr Manning said.

“For the period of time we keep most aircraft, we’ll replace the cabins and replace or refurbish engines, so it’s not as simple as the date of manufacture.”

It’s a significant change from previous management who liked to keep average fleet age at about 10 years and cited the better fuel efficiency, longer range and greater reliability of newer aircraft as a key reason to spend figures such as $US110m ($164m) per Boeing 787 aircraft.

Airliners.net place the average age of the group they cover at 14 years. I found this on-line

Numerous former top-level executives shake their heads at the idea that chief executive Alan Joyce and his team no longer consider fleet age a main strategic imperative for Qantas.

“He is leaving a financial mess for the next CEO to contend with and it was a mess that was developing long before Covid,” says one senior staffer.

There are certainly many who question whether Qantas has been deferring capital expenditure to boost profitability and boost the share price. Its other decision – while understandable – to write down the value of aircraft parked in the desert during Covid – has also given it an unusually depreciation expense-free period.

And a bit of discussion on Joyce's successor

Even looking at the record profit – when Mr Joyce was asked “is this as good as it gets” – there remains some tricky figures among the detail.

The company’s net assets per ordinary share is 0.01 cents as at December 2022 and debt to debt plus equity ratio is at 99.8 per cent. Qantas’s current assets to liabilities shows a near $5bn shortfall, and revenue received in advance – which is a cash advance from passengers prior to travel and frequent flyer credits – has bulged to $5.7bn.

This figure is high in part because of the difficulties people have had getting refunds or flights from Covid-stalled travel.

So how does this play into who should be the next CEO?

At first glance the Qantas board might think Ms Hudson, the current chief financial officer, will be best placed to steady the plane when it comes to fleet strategy. However, she has also been the direct line into Mr Joyce on all fleet decisions since becoming CFO.

Ms Wirth, the CEO of the highly profitable frequent flyer unit, has been distant from decisions on fleet – having run marketing and customer service units – before taking on her current position.