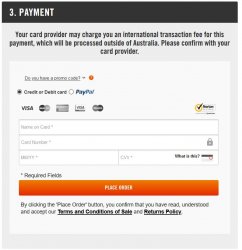

I purchased a Norton product 29/6 and paid with this card.. The cost was in AUD, the charge was in AUD including GST.

On 30/6 the card was charged 3%international transaction fee.

After calling Norton, who confirmed the charge was in AUD, called Qantas Premier Platinum. I was informed that regardless of the charge being in AUD if the supplier is not Australian, even if they have an office here, they have an arrangement with Mastercard that there will be an international transaction fee charged. But, as a goodwill gesture, he will reverse the charge but it's a one off and to make sure to avoid purchasing from companies that are not Australian. What about all the card offers I get bombarded with? Undoubtedly most of them would not be from Australian owned companies like Adidas, Dell etc.

How would I know what company is Australian owned? Is this something new? Or just somebody made a mistake and hence the willingness to refund.

Never heard anything like it. I do expect a fee if I purchase and get charged in foreign currency but not with AUD.

On 30/6 the card was charged 3%international transaction fee.

After calling Norton, who confirmed the charge was in AUD, called Qantas Premier Platinum. I was informed that regardless of the charge being in AUD if the supplier is not Australian, even if they have an office here, they have an arrangement with Mastercard that there will be an international transaction fee charged. But, as a goodwill gesture, he will reverse the charge but it's a one off and to make sure to avoid purchasing from companies that are not Australian. What about all the card offers I get bombarded with? Undoubtedly most of them would not be from Australian owned companies like Adidas, Dell etc.

How would I know what company is Australian owned? Is this something new? Or just somebody made a mistake and hence the willingness to refund.

Never heard anything like it. I do expect a fee if I purchase and get charged in foreign currency but not with AUD.