Letzblaze6432

Newbie

- Joined

- Jan 19, 2020

- Posts

- 7

Hey guys,

I have a quick question regarding RewardPay.

I recently got a AMEX Business Platinum Card and none of my suppliers use any credit card facilities.

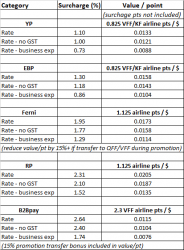

I roughly spend around $200,000 on supplier bills and ATO bills per month and was wondering if using RewardPay is worth while using. I know there is a fee involved with transactions and that would be tax deductible, but I really wanted to know if the fee vs points is worth it for me or not.

Kind regards,

I have a quick question regarding RewardPay.

I recently got a AMEX Business Platinum Card and none of my suppliers use any credit card facilities.

I roughly spend around $200,000 on supplier bills and ATO bills per month and was wondering if using RewardPay is worth while using. I know there is a fee involved with transactions and that would be tax deductible, but I really wanted to know if the fee vs points is worth it for me or not.

Kind regards,