I was listening to a finance podcast this weekend that mentioned most of Qantas' fuel hedging ends in July.

A quick Google confirmed that:

www.afr.com

www.afr.com

Is that a reason to suspect that the fuel levies on Qantas reward tickets will significantly increase in June/July? As they have with Emirates in the last few months.

A quick Google confirmed that:

Qantas is temporarily insulated from soaring fuel costs thanks to its hedging program through to the end of June, but a reduced hedging level from July could expose it to higher prices if the war in Ukraine continues to roil energy markets.

It probably means an increase in airfares later this year to maintain yields, even as the carrier tries to entice travellers back into the air after a bruising two years of COVID-19.

Mr Longo said Qantas had a good line of sight and could plan well for the periods when the most substantial parts of the recovery would come. The airline has 90 per cent of its fuel needs hedged until the end of June, and Mr Longo did not think that any airfare price shocks were coming immediately.

Qantas faces higher fuel pressures after June

Qantas’ unique fuel hedging position should see it weather sky-high fuel prices for the rest of the financial year, but pressures will intensify past June.

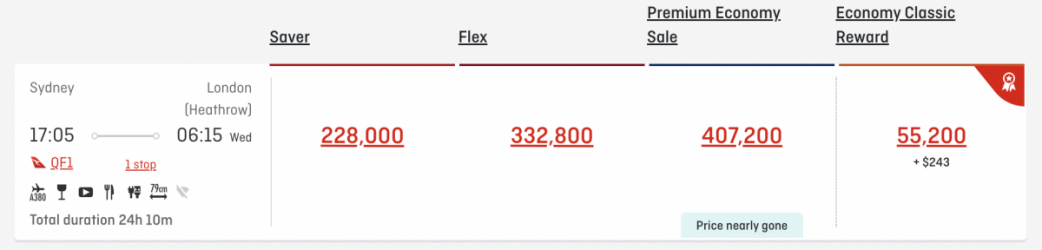

Is that a reason to suspect that the fuel levies on Qantas reward tickets will significantly increase in June/July? As they have with Emirates in the last few months.