Commonwealth Bank has launched a new credit card that could be attractive to frequent travellers. The CommBank Ultimate Awards card offers frequent flyer points, no overseas transaction fees and a waived monthly fee if you spend at least $2,500 per month.

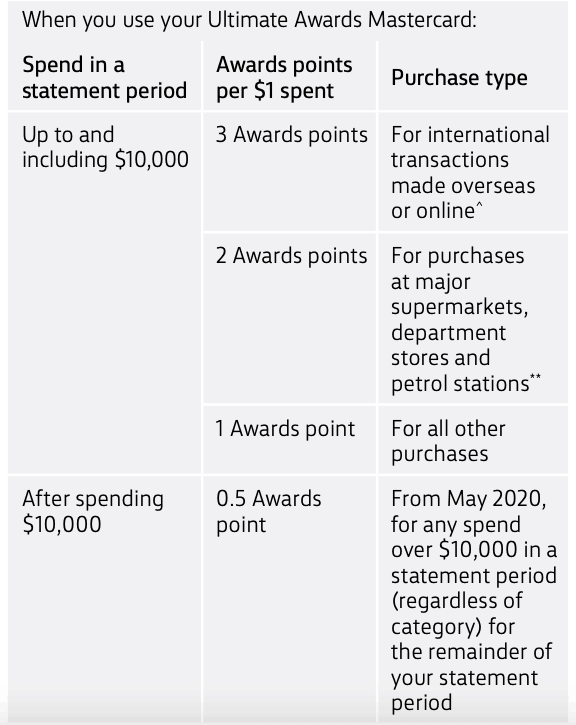

With this card, you’ll earn up to 3 CommBank Awards points per $1 spent on international purchases, either while overseas or online. Combined with the waived international transaction fee, that could be a good deal – although it also depends on the exchange rate that CommBank is using for its currency conversion.

In addition, you’ll earn 2 CommBank Awards points per dollar spent at major supermarkets, department stores and petrol stations in Australia. All other eligible purchases earn one Awards point per $1.

Awards points are only earned at the full rates on the first $10,000 spent each month. After this, the earn rate reduces to just 0.5 Awards points per $1 spent on the card. However, as an introductory bonus, this cap is not being implemented until May 2020.

CommBank Awards points can be converted to Velocity Frequent Flyer points at a 2:1 rate, meaning 2 CommBank Awards points are worth 1 Velocity point. You can also transfer CommBank Awards points to a diverse range of other frequent flyer programs, although the conversion rates are very much set in the bank’s favour. For example, 4 CommBank Awards points are worth only 1 United MileagePlus mile.

Commonwealth Bank Awards cardholders can also opt-in to Qantas Frequent Flyer Direct for a $30 annual fee. By opting in, all of the points you earn with your credit card will be automatically transferred to Qantas Frequent Flyer at a 2.5:1 rate each month. Under this system, 1 Awards point is valued at only 0.4 Qantas points.

The CommBank Ultimate Awards credit card has a $35 monthly fee, adding up to $420 per year if you pay the fee every month. However, this fee is waived for each month that you spend at least $2,500 on the card.

CommBank Awards credit cards have historically been very poor value, particularly when it comes to earning frequent flyer points, compared to other cards in the Australian market. However, this card could make sense for some frequent travellers that spend between $2,500 and $10,000 per month, including on some overseas purchases. It compares reasonably favourably with other Australian credit cards without international purchase fees.

Join the discussion on the Australian Frequent Flyer forum: New Ultimate Awards card (uncapped till May 2020)