Many credit cards offer airport lounge access as a benefit for cardholders. Some come with airport lounge passes, while several Australian credit cards even offer cardholders unlimited, complimentary visits to a global network of airline lounges. But there are also some credit cards in Australia that advertise airport lounge access as a benefit, even though it really isn’t a benefit at all.

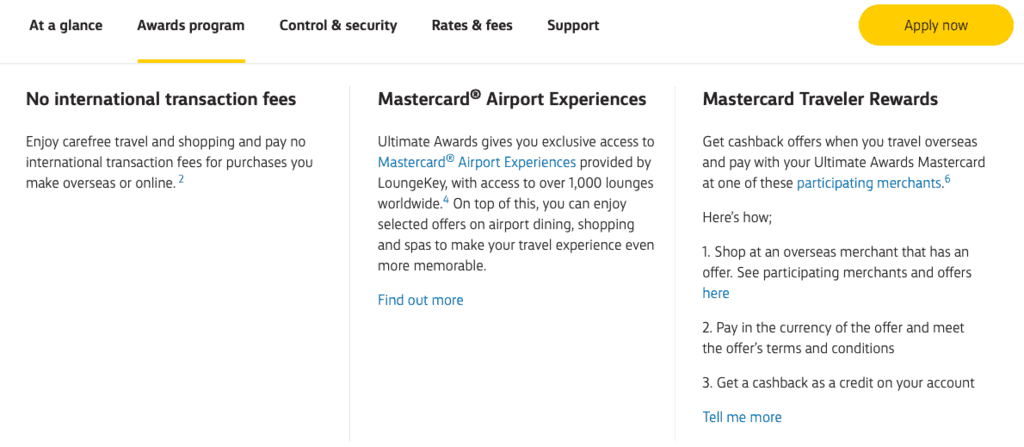

In January, Commonwealth Bank launched its new Ultimate Awards credit card. One of the advertised benefits of this card on the CommBank website is “access to over 1,000 lounges worldwide”.

That sounds great, but there’s a catch… the lounge access is not free! Buried in the fine print is the following information:

Each time you visit a lounge, you will be charged a lounge visit fee to your Ultimate Awards card. You will also be charged a lounge visit fee for each additional guest you bring with you.

We contacted Mastercard Airport Experiences, who told us that the fee charged to your credit card for every lounge visit is USD32 (~$49) per person.

We find this rather misleading for a few reasons. Firstly, it’s quite likely that most people would assume that “access to over 1,000 airport lounges” means the lounge access is included with the card. Besides, many other banks do genuinely offer complimentary airport lounge access as a credit card benefit.

The benefit, in fact, is that cardholders can contact Mastercard Airport Experiences, who can facilitate paid lounge access to airport lounges affiliated with LoungeKey. This is similar to the benefit of Standard Priority Pass membership, which costs USD99 per year at full price. But many of the participating airport lounges will simply sell you entry at the door, or through a free service such as Lounge Buddy – negating the need to arrange access through Mastercard Airport Experiences.

In Australia, there are 8 participating airport lounges and 15 participating airport bars and restaurants that you can “access” with a CommBank Ultimate Awards credit card. Of these, you can purchase entry at the door of six of these lounges for less than what you’d pay to use your credit card “benefit”. Only the Plaza Premium lounges in Melbourne and Brisbane charge more than the Mastercard fee for paid entry at the door.

(Note that you can pre-purchase access to The House lounges in Sydney and Melbourne for $64 as a Velocity Frequent Flyer member; as a CommBank cardholder you’d pay $69 for entry due to a $20 surcharge that applies at these lounges.)

There are also 15 airport bars and restaurants in Australia that partner with LoungeKey. By using your credit card, you can receive a $36 food & beverage credit to spend at any of these outlets. That’s a very poor deal when the voucher is costing you $49!

Australian Frequent Flyer contacted Commonwealth Bank, who agreed that its website did not make it clear enough that cardholders would have to pay for airport lounge access. The bank said that it is now taking steps to update its information.

“We agree that the description of the way a cardholder accesses airport lounges for a fee can be clearer,” a Commonwealth Bank spokesperson said.

“We apologise if we gave our customers the wrong impression. It certainly wasn’t our intention to do that. We will now update our customer information and website to rectify this so that where such benefits are provided through one of our partners and there is a fee, it is clearly stated.

“We’re extremely proud to have launched the new CommBank Ultimate Awards credit card with the features and benefits it provides, including earning three Awards points on all international transactions in store or online, earn unlimited Awards points each year, and no international transaction fees on any overseas purchases in store or online.”

In fairness to Commonwealth Bank, they have now updated their website to add the word “paid” to the information about lounge access with this credit card.

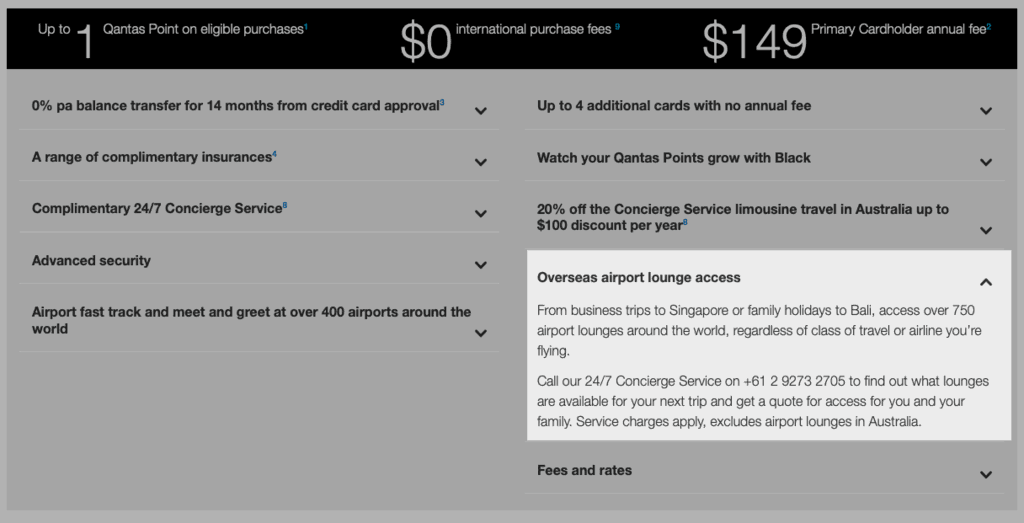

Macquarie Bank also advertises “overseas airport lounge access” as a benefit of the Macquarie Black credit card. This is also not free. In fact, the benefit can’t even be used at airports in Australia. But at least Macquarie displays this crucial information prominently on its website.

So, if you’re considering applying for a credit card, make sure you read the fine print! And if you’d like a credit card that actually offers complimentary lounge access, be sure to check out our guide to the best Australian credit cards for lounge access.