Why is Dynamic Currency Conversion Even Legal?

Last month, the United States banned resort fees and other “junk” charges because they are misleading and bad for consumers. This kind of “drip pricing” has already been outlawed under Australian Consumer Laws for years, for the same reason.

Dynamic currency conversion is similarly almost always bad for consumers, yet is perfectly legal. I can’t help but wonder why.

What is dynamic currency conversion?

For those unfamiliar, dynamic currency conversion (DCC) is where you’re given the option to pay for a foreign currency transaction in your home currency.

For example, when buying something in the United Arab Emirates with your Australian credit card, the business’s EFTPOS terminal might give you the option to pay in Australian Dollars instead of the local Dirham currency.

Or, when withdrawing from an overseas ATM, the ATM might offer to convert the transaction amount to Australian Dollars for you on the spot. The ATM might even warn that it’s “more risky” to let your bank do the currency conversion because you won’t know upfront what exchange rate they will use.

Spoiler alert: Your own bank will almost certainly give you a better exchange rate!

Some examples of dynamic currency conversion in action

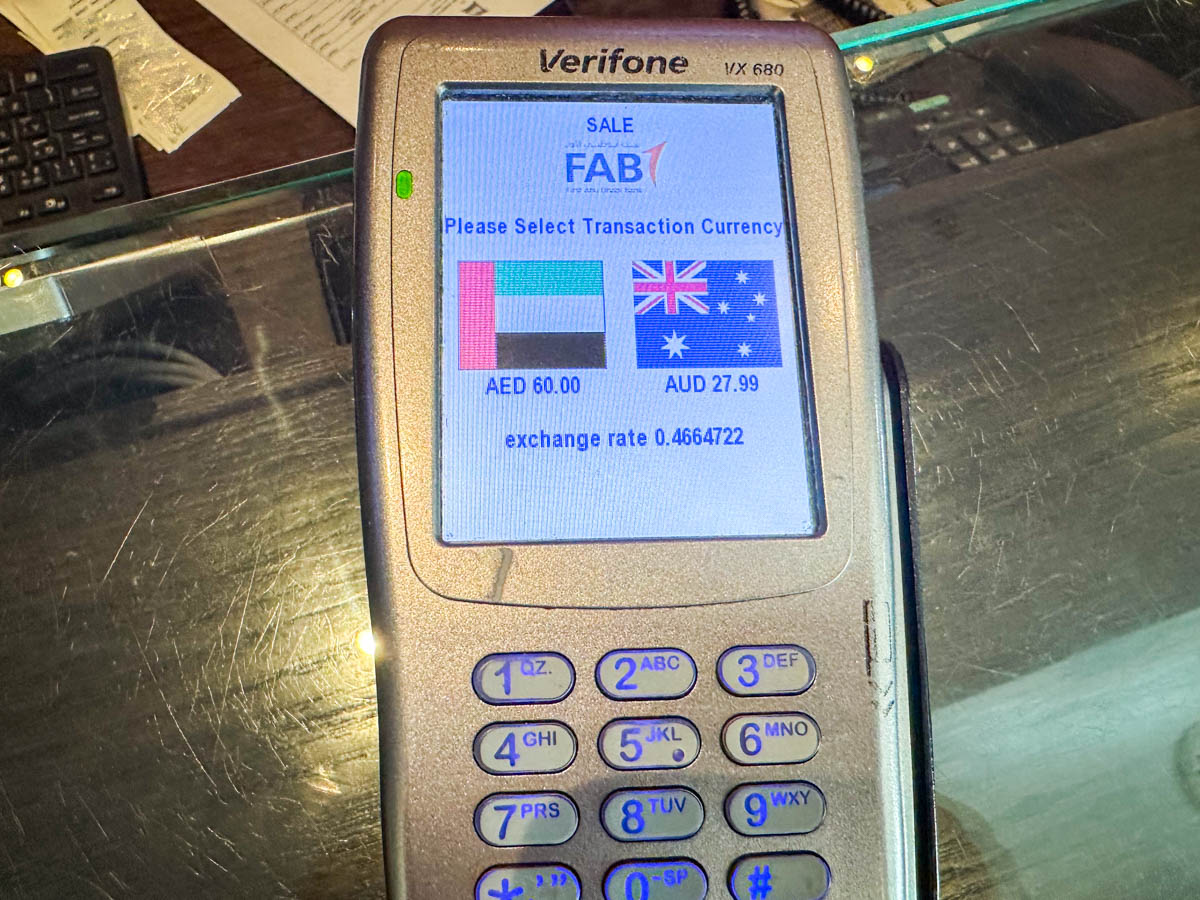

Case in point: The photo at the top of this article shows a dynamic currency conversion offer on a payment terminal in the United Arab Emirates.

I have an Australian credit card with no currency conversion fees and selected to pay in UAE Dirhams. The AED60 transaction shown in the image above ended up posting to my Australian credit card as $26.32. This means the Dynamic Currency Conversion offer would have added 6.3% to the cost of that particular payment.

Here’s another example…

This photo shows an ATM in Finland offering to convert my withdrawal amount and fee of €32.45 into AUD57.54. I declined this offer, and my Australian bank ended up debiting AUD54.07 from my account. That’s a difference of almost 6.5%, which is the entire exchange rate margin the ATM operator would have charged.

This is almost always a bad deal for consumers

Some banks argue that dynamic currency conversion is more convenient for customers because they’ll know at the time of the transaction exactly how much they are paying in their home currency. Perhaps you could also argue that some business travellers prefer this because they’ll immediately know what amount to expense, without checking their bank statement later on. But this “convenience” comes at a cost.

The reality is that the exchange rates offered through dynamic currency conversion are usually inflated. So, you’ll end up paying more.

And even if the merchant converts your purchase into Australian Dollars, your Australian bank might still charge an additional foreign transaction fee if the payment is processed outside of Australia. A double whammy!

Obviously, the companies that process payments with dynamic currency conversion like this model. They earn good money from it. Many businesses also like it when their customers use dynamic currency conversion because they’ll often earn a percentage of that extra mark-up as commission.

But for consumers, this is pretty much always a bad deal. Barely anybody would actively prefer to pay with dynamic currency conversion unless they didn’t understand what it was or were tricked into it.

This is why I wonder if it could be time for governments to step in and ban this practice.

I’ve been ripped off by dynamic currency conversion

Since I know how DCC works, I always choose to pay in the local currency. So should you.

But there have been a couple of instances where I wasn’t given this choice.

A few years ago, I was settling a hotel bill in Asia and the receptionist selected the “AUD” option on the EFTPOS terminal for me without asking me. This resulted in me paying around 7% more than I should have.

I asked the receptionist why they did that, and it was quickly obvious that they didn’t actually understand what DCC is. Apparently the hotel management had told their staff that foreign customers found it more convenient to pay in their home currency. They didn’t bother informing staff that the hotel makes a commission, nor that customers would end up paying more.

More recently, I booked a flight online with TAP Air Portugal. Throughout the entire booking process, the price was displayed in Euros (since my flight originated in Europe). TAP never asked if I wanted to pay in another currency.

Despite this, TAP automatically converted the amount it charged my credit card into Australian Dollars. As a result, I ended up paying around $21 more than I would have if my bank had done the conversion as I use a credit card with no international transaction fees.

That may not be a huge amount of money. But if the company is doing this routinely, those small amounts must add up to a big amount.

When I contacted TAP Air Portugal to question the currency they used for the transaction, they claimed that they had charged me in Euros and that I should contact my bank in Australia. So I did, and my bank told me that TAP had indeed processed the payment in Australian Dollars. In fact, my bank also suggested that I should initiate a chargeback as the airline did this without my consent.

Under European Union laws regarding cross-border payments, businesses offering dynamic currency conversion must give customers the option. They must also display the exchange rate used. But the European Union does not ban DCC altogether.

Why not just ban dynamic currency conversion?

I have long wondered why this practice is still not only legal, but widely accepted around the world. Maybe I’ve missed something and DCC is actually beneficial for some consumers? If you can think of an instance where people are actually better off, I’d love to know!

I guess one hurdle could be the issue of jurisdiction. By its very nature, currency exchange involves multiple countries. So, even if Australia banned the practice (for example), it could still be prevalent around the world unless other countries did the same.

That said, there is some level of precedent here. In 2015, Australia’s Federal Court fined Visa Worldwide $18 million for anti-competitive conduct. At the time, the ACCC released a statement saying:

The Court indicated that the penalty should send a clarion call to large multi-national corporations with operations in Australia, that whatever decisions may be made globally, Australia will not tolerate conduct that contravenes its competition laws and will not tolerate conduct likely to substantially lessen competition in Australian markets.

Ironically, this penalty was actually a result of Visa’s actions to stop rival companies offering DCC services on the Visa payment network. But the Australian court case was not about dynamic currency conversion itself. Rather, it was about Visa’s anti-competitive actions against rival companies which threatened to take away some of Visa’s own revenue.

What do you think? Assuming it would be possible to do so, should dynamic currency conversion be banned?

Community Comments

Loading new replies...

Join the full discussion at the Australian Frequent Flyer →