Qantas Frequent Flyer has expanded its insurance offering with Qantas Car Insurance. As part of the deal, car insurance customers can earn 1 Qantas point per dollar on insurance premiums and bonus points when taking out a new policy by 20 December 2019. But is it worth it?

About Qantas Car Insurance

Qantas Car Insurance is underwritten by Auto & General, which also underwrites insurance products for Budget Direct, Virgin Money, ING and Australia Post (among others).

There are three types of car insurance cover offered:

- Comprehensive

- Third Party Property, Fire and Theft

- Third Party Property Only

Car insurance is just the latest Qantas insurance product, with Qantas already offering health insurance, life insurance, income insurance and travel insurance. Qantas Loyalty says that it plans to launch home insurance in 2020.

Earn Qantas points with car insurance

You can earn 1 Qantas point per $1 spent on Qantas Car Insurance premiums and roadside assistance packages.

As an introductory offer, Qantas is also offering up to 20,000 bonus points if you sign up for a new insurance policy by 20 December 2019 and keep it for at least 60 days. However, the full bonus of 20,000 points is only available if your annual premium is at least $2,000. Most customers will be offered a lower amount of sign-up bonus points.

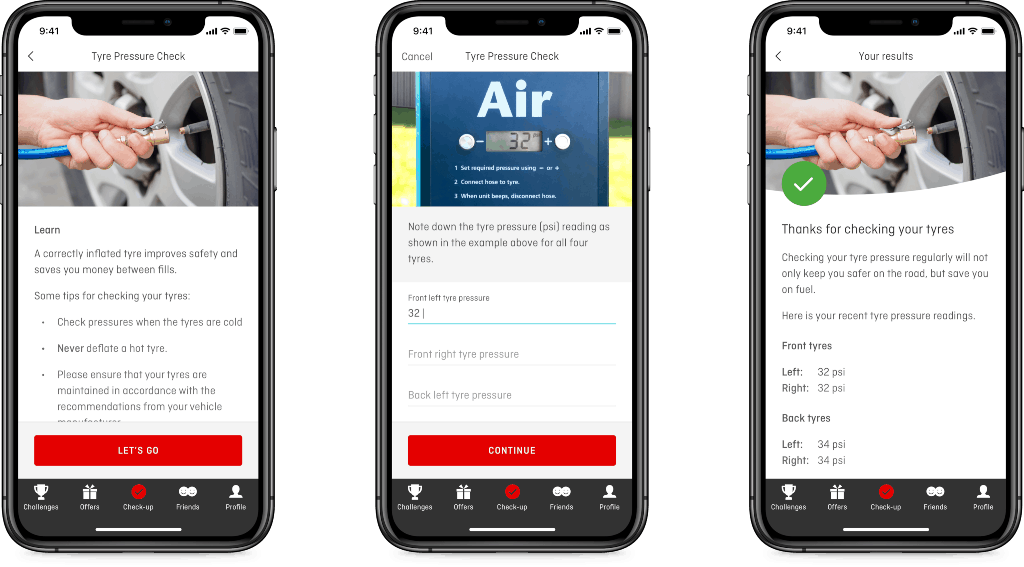

Qantas says that customers can earn up to 6,000 additional points per year by completing car safety challenges through the Qantas Wellbeing App. This includes checking your tyre pressure, brakes and taking your car in for a service.

But to earn the full advertised amount of 6,000 Qantas points, the fine print says that “the primary policyholder must complete all car-based challenges, and participate in the highest daily and weekly sleep and stepping challenges”. This means that, once again, the actual number of Qantas points earned is likely to be less than 6,000 per year.

Is Qantas Car Insurance worth it?

If your Qantas Car Insurance premium is similar to the price you would pay with other insurers, the opportunity to earn Qantas points could be welcome.

“These are competitive products that have the added benefit of earning points, and we’ve seen that work well with health insurance and credit cards. We expect Qantas Car Insurance to be popular for same reason [sic]”, according to Qantas CEO Alan Joyce.

But many AFF members have found that the premiums quoted by Qantas Car Insurance are much higher than what they are currently paying for a comparable policy. In this case, the number of Qantas points offered may not be enough to make the switch worthwhile.

Here are some of the comments posted on the Australian Frequent Flyer forum…

You’d have to be mad to sign up for most of these Qantas insurances. Way more expensive than comparable products and the bonus points rarely if ever offset that. Even if the bonus points do offset the cost, I prefer cold hard cash in my hands rather than Qantas points, which can be devalued at will and can be hard to redeem.

About $400 more for my car.

Wow – $394 currently vs $1370.99. Reckon I know who I’ll be staying with – (And yes the cover was comparable and reputable)

For at least one AFF member, though, there may be value in switching.

I will have to investigate this further as from the very first screen I noticed that the insurance is offered by the same insurer as I currently use ie Budget Direct aka Auto & General. My current insurance is $560 and the quote via Qantas is $450. Quote from AAMI is >$800. Better I read the T&Cs to see if I can get the 3,050 Qantas points plus the $110 saving.

Join the discussion on the Australian Frequent Flyer forum: Qantas car or vehicle insurance, 20000 bonus points plus 1 point per $1 spent