Should You Pay Reward Flight Taxes with Points?

When booking a reward flight using Qantas or Velocity points, you’ll also need to pay any applicable taxes & carrier charges in addition to the points. This extra co-payment includes Virgin’s $11 carrier charge or Qantas’ $14 carrier charge per domestic flight (it’s higher for most international flights), plus any third-party airport fees, security charges and government-imposed taxes.

While the taxes & carrier charges are quoted in dollars, both Qantas and Virgin provide the option to cover these amounts using additional points. But should you?

To answer this question, let’s have a look at how many points you’d be spending to cover reward booking taxes & charges, and whether it’s worth it…

Paying taxes & carrier charges with Qantas points

When booking a Classic Flight Reward on the Qantas website, you have the option to pay some, all or none of the taxes & carrier charges using Qantas points.

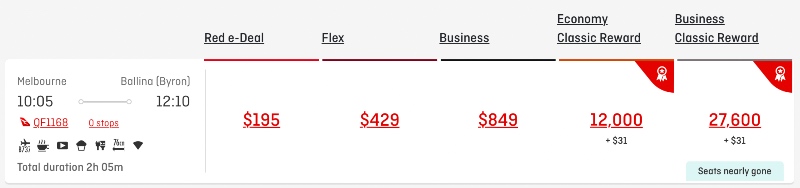

For example, a Business Classic Reward seat from Melbourne to Ballina with Qantas normally costs 27,600 Qantas points + $30.71 in taxes & charges (rounded up to $31 on this page):

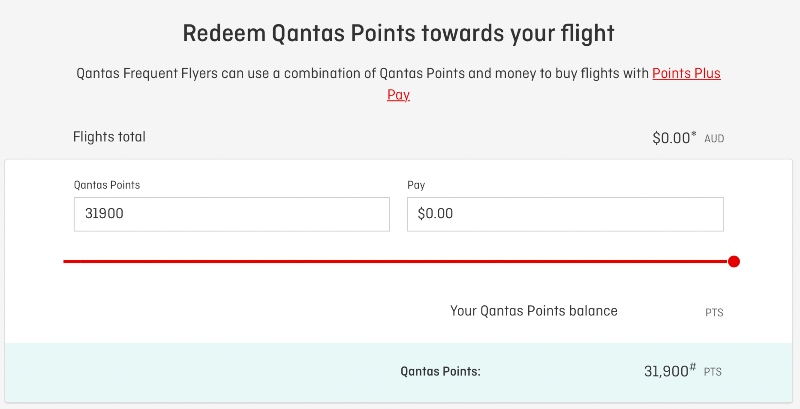

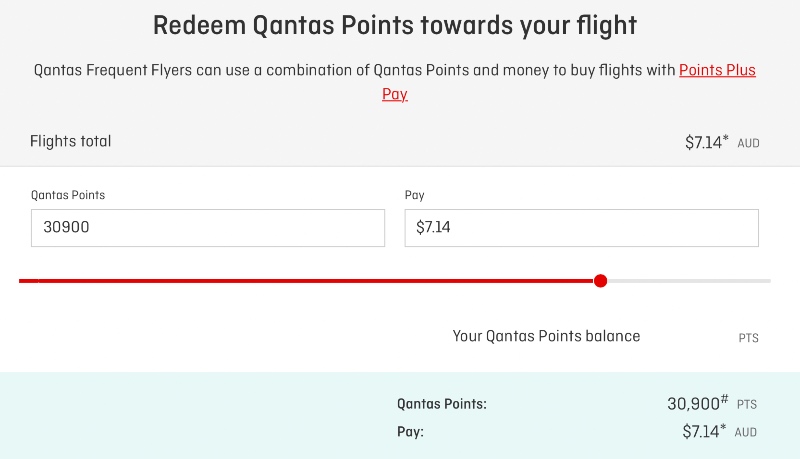

On the next page, there’s a slider that lets you adjust how much of the taxes you pay using points. (The default setting is to pay all of the taxes with money.)

In this example, you would need to spend an extra 4,300 Qantas points to cover $30.71 worth of taxes. This values your Qantas points at around 0.71 cents per point.

As a matter of interest, a Qantas Points Plus Pay booking gives you around 0.65 cents per value for each Qantas point. So this is slightly better value than an outright Points Plus Pay booking.

When you redeem your Qantas points for gift cards or products on the Qantas Rewards Store, you’re typically only getting less than half a cent of value per point. So, this is also a better deal than redeeming for gift cards (or toasters, for that matter).

But consider that the Melbourne-Ballina Business fare normally costs $849, and you’re getting this for 27,600 Qantas points + $30.71 in taxes. Effectively, this means you’re getting $818.29 worth of “value” (once we account for the taxes) for 27,600 Qantas points with this Classic Flight Reward. That works out to be more than 3 cents per point.

If you have more Qantas points than you know what to do with, redeeming for taxes & carrier charges may not be the worst thing. But for everyone else, using points to cover the co-payment on reward bookings is a bit of a waste of points that could be put towards other more valuable rewards – such as other more Classic Flight Rewards or upgrades.

Paying taxes & carrier charges with Velocity points

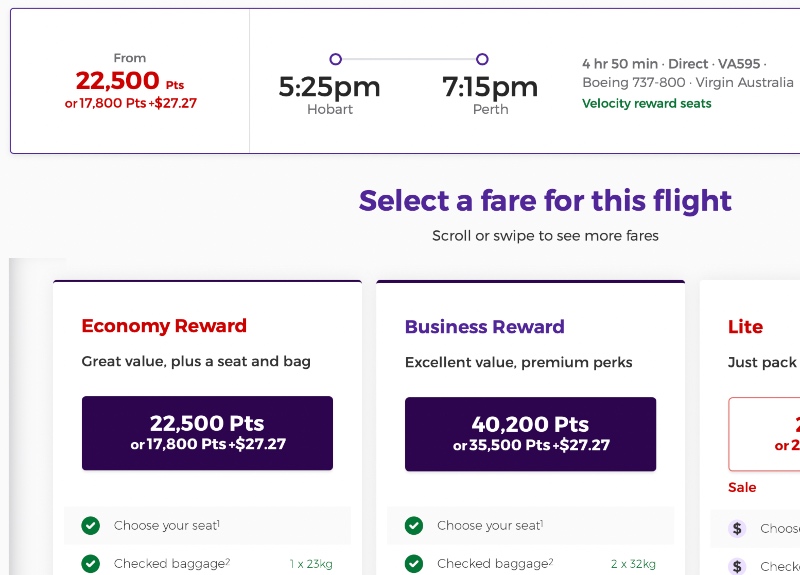

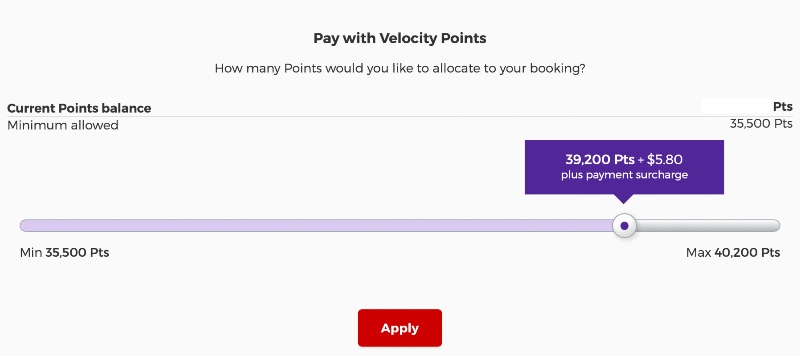

It’s a similar story with Velocity Frequent Flyer. When booking reward seats on the Virgin Australia website, you’ll have the option to cover some, all or none of the taxes in increments of 100 Velocity points.

Let’s look at an example. When redeeming Velocity points for a reward seat from Hobart to Perth, you could choose to pay an extra 4,700 Velocity points to cover $27.27 worth of taxes & carrier charges.

If you chose to pay for the taxes using Velocity points by adjusting the slider on the payment page, this values your Velocity points at approximately 0.58 cents each. This is the same rate at which Virgin Australia converts commercial fare prices to Velocity points when redeeming for an “Any Seat” reward.

Again, this is slightly better value than redeeming Velocity points for gift cards, which typically gets you around half a cent in value from each point.

But if you were to pay for the taxes & charges using money and save your Velocity points, you could use them towards another reward booking in the future and get significantly better value. In this example, the regular airfare for a Hobart-Perth flight in Business Class is $699. So you’re getting 1.89 cents worth of value for each Velocity point spent on this reward seat booking. That’s more than triple the value per point.

Conclusion

If you have lots of frequent flyer points, using points to cover the taxes on reward flight bookings is not the absolute worst possible value. But most people will be much better off paying for the taxes using a credit card, saving their points towards another flight in the future.