dein_gesicht

Active Member

- Joined

- Aug 18, 2011

- Posts

- 653

I didn't know you could file an alternative address in Australia...interesting

Struggling to use your Frequent Flyer Points?

Frequent Flyer Concierge takes the hard work out of finding award availability and redeeming your frequent flyer or credit card points for flights.

Using their expert knowledge and specialised tools, the Frequent Flyer Concierge team at Frequent Flyer Concierge will help you book a great trip that maximises the value for your points.

Just let them know you are travelling overseas .This is a good idea. Is your account address still US? As in you just asked them to send you a new one to Aus?

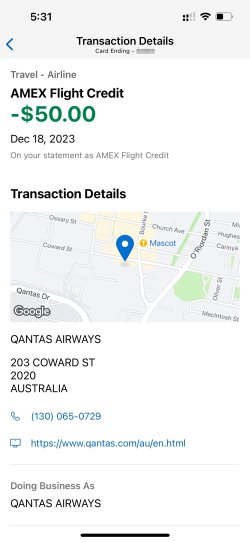

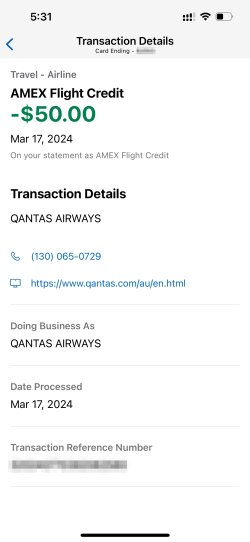

Pay taxes applicable to reward flight bookings with Qantas or any other airline. Or according to some sources, shopping on Qantas Wine, Qantas Hotels etc will also trigger. This $50 quarterly credit is so much more flexible than before, so it's really not advisable to bank it on United.Hilton Aspire card holders - how are you guys using the quarterly flight credit? ($50 per quarter) - I'm just banking it on united. Is there any better way?

OMG! I thought it only applied to US airlines!! Thanks for this !Pay taxes applicable to reward flight bookings with Qantas or any other airline. Or according to some sources, shopping on Qantas Wine, Qantas Hotels etc will also trigger. This $50 quarterly credit is so much more flexible than before, so it's really not advisable to bank it on United.

View attachment 382272

View attachment 382271

Or according to some sources, shopping on Qantas Wine

What did you produce to survive FR in that case?As an international customer who has never resided in the US and does not have a US job and income, which means I’m definitely not able to provide a US tax return (Form 4506-T) and a pay stub (payslip as we Australians normally say), I prepared for the worst, i.e., account closure, when their FR hit me over two weeks ago. So this is an outcome I’m really happy with.

I reckon it's trigged by a bit too many airline ticketing purchases (not for flying myself), as well as general purchases and subsequent refund (due to change of mind or merchant order cancellation etc.)Any idea what may have triggered the FR?

Mostly statements from Wise as I said in my post (I use Wise to pay my Amex US cards), as well as two statements from my HSBC US Premier account.What did you produce to survive FR in that case?

That’s good news @Mr He, I’m glad it worked out for youJust survived the stressful FR process from Amex US last month, and came out all good, with lowered credit limits though!

As an international customer who has never resided in the US and does not have a US job and income, which means I’m definitely not able to provide a US tax return (Form 4506-T) and a pay stub (payslip as we Australians normally say), I prepared for the worst, i.e., account closure, when their FR hit me in early May. So this is an outcome I’m really happy with.

Can’t say enough how much I love Amex. Thanks Amex US, for approving my first Global Transfer application many years ago, purely based on my credit history and creditworthiness as an Amex Australia cardmember, and for approving my subsequent applications over the years. Thanks for the flexibility and true customer care shown during the past weeks, and for the super nice and helpful staff (I’ll always remember one saying “Get some sleep, Mr He” when she realised the vast time difference between the two countries before ending the call).

And thanks @wiseaccount as well, for producing the requested documentation, and for serving as a backup payment method for my Turkey YouTube Premium subscription, at a time when my Amex US account was suspended because of the FR.

Surprised they accepted only bank statements. Great outcome though. Did you offer to provide Australian pay slips? Or were they only willing to accept US ones?Mostly statements from Wise as I said in my post (I use Wise to pay my Amex US cards), as well as two statements from my HSBC US Premier account.

I said I could, but they only accept US-based documents.Surprised they accepted only bank statements. Great outcome though. Did you offer to provide Australian pay slips? Or were they only willing to accept US ones?

Mmmmm, well, that’s going to be a problem then. I have no US based documents. My account is paid via my Wise account which was opened in Australia………. as they only accept US-based documents. Even for Wise, they had a bit issue understanding this truly international institution and tried to do a three way call.

Maybe it's time to consider applying for some US-based bank accounts - HSBC US would be one of the easiest. As for Wise, if FR ever happens to you (hope you won't have to go through this, by using your card/s in a good way and to Amex's total satisfactionMmmmm, well, that’s going to be a problem then. I have no US based documents. My account is paid via my Wise account which was opened in Australia

ThanksMaybe it's time to consider applying for some US-based bank accounts - HSBC US would be one of the easiest. As for Wise, if FR ever happens to you (hope you won't have to go through this, by using your card/s in a good way and to Amex's total satisfaction), just download Wise USD dollar statements. Anyway, it's always better to cooperate and provide whatever you have, than to ignore their FR document request.