sudoer

Senior Member

- Joined

- Feb 23, 2015

- Posts

- 5,847

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

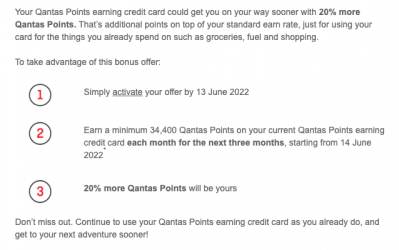

My partner and I both just received variations of the below email:

Wondering if this can be used as a defacto Amex Ascent Premium transfer bonus, i.e. transfer in blocks over the next 3 months to get the 20%, or if it needs to be a direct earning card.

Card products referred to are not Qantas products and not offered or issued by Qantas but by the relevant Card partners. The applicable Card Partner is the credit provider and credit licensee under the National Consumer Credit laws. Points are offered by the relevant Card partner and partner reward program and can only be earned on eligible purchases.

This offer is only valid for the intended recipient of this communication and is not transferable. You must be targeted with this offer to be eligible.

This offer is available when you click to activate by 13 June 2022. You will need to earn at least 34,400 Qantas Points on your Qantas Points earning credit card in each of your next three consecutive statements to qualify for this offer. The 20% bonus points will only be applicable on your standard earn rate over the next three months and will not be awarded on acquisition bonus points.

If you have successfully fulfilled the offer requirements, please allow up to 8 weeks after your offer period has ended for the bonus Qantas Points to be credited to your Qantas Frequent Flyer account.

This offer is only valid for the intended recipient of this communication and is not transferable. You must be targeted with this offer to be eligible.

This offer is available when you click to activate by 13 June 2022. You will need to earn at least 34,400 Qantas Points on your Qantas Points earning credit card in each of your next three consecutive statements to qualify for this offer. The 20% bonus points will only be applicable on your standard earn rate over the next three months and will not be awarded on acquisition bonus points.

If you have successfully fulfilled the offer requirements, please allow up to 8 weeks after your offer period has ended for the bonus Qantas Points to be credited to your Qantas Frequent Flyer account.

Wondering if this can be used as a defacto Amex Ascent Premium transfer bonus, i.e. transfer in blocks over the next 3 months to get the 20%, or if it needs to be a direct earning card.