And I was waiting with popcorn to hear the arguments. Oh well... we kind of knew it would settle...Hmm, so they don't want to test their 'bundle of rights' argument. Maybe they want to look good to head off any passenger rights legislation that may be comtemplated.....

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

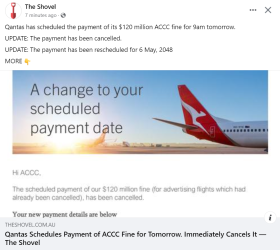

ACCC action re cancelled Qantas flights

- Thread starter support

- Start date

justinbrett

Enthusiast

- Joined

- Mar 6, 2006

- Posts

- 11,877

- Qantas

- Platinum 1

- Oneworld

- Emerald

I’m surprised ACCC settled for so little considering they were crowing about getting a much higher amount earlier.

I’m guessing there were flaws on both sides.

I’m guessing there were flaws on both sides.

downgraded

Active Member

- Joined

- Apr 2, 2014

- Posts

- 700

- Qantas

- LT Gold

Perhaps not, but doesn't this acknowledgement by QANTAS and the the position of the ACCC already undermine the whole Bundle of Rights proposition. Both parties seem to agree that the commitment was for a particular flight, not just to get you from A to B at about the right time, or there would have been nothing for QF to concede. If the rights had been all that had been sold then cancelling any one flight wouldn't have put QFs position in jeopardy.Hmm, so they don't want to test their 'bundle of rights' argument. Maybe they want to look good to head off any passenger rights legislation that may be comtemplated.....

anat0l

Enthusiast

- Joined

- Dec 30, 2006

- Posts

- 12,330

- Qantas

- Platinum

- Virgin

- Red

- Oneworld

- Emerald

- Star Alliance

- Gold

We can put someone in jail, which effectively shuts their life down, if temporarily, but it does have a marked effect in most cases.Be careful what you wish for.

ACCC, in whatever action they take, still have a responsibility to support consumer competition. Imagine if they pushed hard for a $1bn fine and QF ended up scaling back their fleet expansion plans in order to pay? Not sure that would be seen as a win for competition and appropriate support for the Australian consumers.

At what point does a company not deserve another chance at all to do the right thing?

Well, how about these punishments:So, should we tolerate illegal behaviour against consumers because the consequences of punishing it sufficiently to deter it again might be bad for those consumers?

The answer is of course no. The fine needs to be sufficient to deter the behaviour, while still weighing the impact on consumers. I don't think $1bn would strike the right balance (and isn't what the ACCC ever asked for), but nor do I think $100m does.

- Qantas forced to liquidate and shut down - probably the most desirable choice for any opposition airline

- Qantas forced to suspend all operations for a fixed amount of time (e.g. 3 months) - the cost of managing the suspension is borne by the company

- New sales (new income) by Qantas are suspended for a fixed amount of time, or are seized completely

- Qantas income garnished by some certain amount for a fixed amount of time (e.g. 50% for 2 years)

- The entire Qantas board is imprisoned

- The entire Qantas board is forced to resign - all severance clauses resulting in monetary gain during exit from the company are null and void

- The Qantas share price is forced to be set to zero for a fixed amount of time

- Qantas route rights are suspended in accordance to where they sold ghost flights. For example, if there were 500 ghost SYD-MEL flights sold, the airline is forced to stop operating 500 SYD-MEL flights within some certain time period

Ultimately , monetary punishments were never well calibrated to adequately impact very large companies like Qantas; aside from the difficulty of convicting in the first place, that's why they are slaps on wrists. Laws aren't written correctly to apply to various companies which would, for these kinds of violations, cripple a company like Qantas but would completely wipe the floor off of a smaller company (not just SMEs). Given who politicians are, I don't see anyone entertaining the possibility of making such punishments much more proportional to the company size (and who is to say a company will basically try and split out into shells to avoid "big company size fines").

The only punishment that has a proportional effect without directly involving much accounting is suspension of operation, which in a way is the same as sending a person to prison.

anat0l

Enthusiast

- Joined

- Dec 30, 2006

- Posts

- 12,330

- Qantas

- Platinum

- Virgin

- Red

- Oneworld

- Emerald

- Star Alliance

- Gold

My understanding is that any legal representation is somewhat immune from punishment dished to their client if they were representing their client.Not to mention senior legal counsel . They were there through every single other Qantas debacle.

Since lawyers must defend their client's interests zealously, even if they come up with the most immoral means to do so and they can successfully argue that the world is flat, they can't be pinned to the wall, even if their client loses. Not that the law in general was intended to be moral anyway.

RooFlyer

Veteran Member

- Joined

- Nov 12, 2012

- Posts

- 31,706

- Qantas

- Platinum

- Virgin

- Gold

- Star Alliance

- Gold

Remember that Alan Joyce was given permission by the board ?Chairman? to sell his truckload of Qantas shares after the ACCC action was launched. I wonder if the board now considers a $100 million fine not to be material and therefore the decision to allow Joyce to sell shares still okay.

Is $100 million material on the Qantas P&L or not?

Is $100 million material on the Qantas P&L or not?

RooFlyer

Veteran Member

- Joined

- Nov 12, 2012

- Posts

- 31,706

- Qantas

- Platinum

- Virgin

- Gold

- Star Alliance

- Gold

Geoffrey Thomas (Aviation expert) is pretty confident the ACCC's case will fail.

Geoffrey Thomas keeps his reputation intact

justinbrett

Enthusiast

- Joined

- Mar 6, 2006

- Posts

- 11,877

- Qantas

- Platinum 1

- Oneworld

- Emerald

Geoffrey Thomas keeps his reputation intact

Well it did, they settled. For a whole lot less than ACCC was asking for.

RooFlyer

Veteran Member

- Joined

- Nov 12, 2012

- Posts

- 31,706

- Qantas

- Platinum

- Virgin

- Gold

- Star Alliance

- Gold

Oh really, - you really think that a settlement, admission of wrongdoing by Qantas, paying a fine and paying compensation to its affected customers means the case “failed” as you quoted Geoffrey Thomas saying it would?Well it did, they settled. For a whole lot less than ACCC was asking for.

Well, I guess that’s what Qantas’ legal council might be telling the board today.

In a court case in general, if the prosecution doesn’t get the judge to give the sentence they asked for, doesn’t mean that they lost the case.

Then there is the matter of costs and legal bills, which was another prediction up thread.

justinbrett

Enthusiast

- Joined

- Mar 6, 2006

- Posts

- 11,877

- Qantas

- Platinum 1

- Oneworld

- Emerald

Oh really, - you really think that a settlement, admission of wrongdoing by Qantas, paying a fine and paying compensation to its affected customers means the case “failed” as you quoted Geoffrey Thomas saying it would?

Yes. ACCC was crowing about much larger amounts. Faults were already found in ACCCs allegations. The key clause in QF’s media statement - “The ACCC is no longer proceeding with its claims against Qantas about wrongful acceptance of payment, including any allegation that Qantas received payment for a service it did not, and had no intention of, providing.”

As always the truth is somewhere in the middle and that has been reflected in the settlement.

SeatBackForward

Senior Member

- Joined

- Jun 20, 2006

- Posts

- 5,628

- Qantas

- LT Gold

- Oneworld

- Emerald

There was a case in Vietnam where a head of a bank basically stole millions of dollars from account holders. She was sentenced to death, but we don't have that punishment in Australia.

That's downplaying it a tad. It was equivalent to about $12.5bn USD and represented 3% of the entire countries GDP at the time.

anat0l

Enthusiast

- Joined

- Dec 30, 2006

- Posts

- 12,330

- Qantas

- Platinum

- Virgin

- Red

- Oneworld

- Emerald

- Star Alliance

- Gold

This is interesting - we've seen similar things in the US where companies agree to settle or otherwise proceed with compensation without explicitly admitting wrongdoing.Yes. ACCC was crowing about much larger amounts. Faults were already found in ACCCs allegations. The key clause in QF’s media statement - “The ACCC is no longer proceeding with its claims against Qantas about wrongful acceptance of payment, including any allegation that Qantas received payment for a service it did not, and had no intention of, providing.”

As always the truth is somewhere in the middle and that has been reflected in the settlement.

Now to the average pub goer that's just as good as admission and ruling of guilty, but from a legal standpoint, it is not, particularly if others are relying on it to open other cases against the company. Sure, it's another example of the immorality of law and weaponisation of the legal system.....

albatross710

Established Member

- Joined

- May 15, 2004

- Posts

- 3,845

What is the process for determining who is going to get some of the $$?

I'd like to think my 2023 BNE-LAX flight would qualify but don't know where to start to join the queue.

I'd like to think my 2023 BNE-LAX flight would qualify but don't know where to start to join the queue.

This is interesting - we've seen similar things in the US where companies agree to settle or otherwise proceed with compensation without explicitly admitting wrongdoing.

Now to the average pub goer that's just as good as admission and ruling of guilty, but from a legal standpoint, it is not, particularly if others are relying on it to open other cases against the company. Sure, it's another example of the immorality of law and weaponisation of the legal system.....

I think it's notable that the press release includes a restatement of the exact allegation, rather than "Qantas does not admit any wrongdoing" or something more generic. I get the feeling that somehow that wording was a result of careful negotiation with the ACCC. Does that mean that the confidential settlement actually did include an admission of some lesser wrongdoing? Such that it excluded them from completely denying everything, and thus only being able to deny the most serious allegation.

Read our AFF credit card guides and start earning more points now.

AFF Supporters can remove this and all advertisements

Qantas will be notifying impacted customers via email from next month with details about how they can lodge a claim. Further information can be found at www.qantasremediation.deloitte.com.auWhat is the process for determining who is going to get some of the $$?

I'd like to think my 2023 BNE-LAX flight would qualify but don't know where to start to join the queue.

Quickstatus

Enthusiast

- Joined

- Oct 13, 2013

- Posts

- 17,459

There is always going to be to and fro-ing in any case like thisI’m surprised ACCC settled for so little considering they were crowing about getting a much higher amount earlier.

Eventually they both discover the truth lies somewhere in the middle.

Pragmatism wins in the end

So they will just add another $100 to the airfares....

justinbrett

Enthusiast

- Joined

- Mar 6, 2006

- Posts

- 11,877

- Qantas

- Platinum 1

- Oneworld

- Emerald

I think it's notable that the press release includes a restatement of the exact allegation, rather than "Qantas does not admit any wrongdoing" or something more generic. I get the feeling that somehow that wording was a result of careful negotiation with the ACCC. Does that mean that the confidential settlement actually did include an admission of some lesser wrongdoing? Such that it excluded them from completely denying everything, and thus only being able to deny the most serious allegation.

The two press releases (QF vs ACCC) have entirely different tones and it doesn’t sound to me like much was agreed.

I think if ACCC were so confident in their allegations they wouldn’t have settled. Far from the largest ACCC penalty in history, this case is now comfortably in “slap on the wrist” territory for a company the size of QF.

Eventually they both discover the truth lies somewhere in the middle.

Pragmatism wins in the end

Yep that’s the point I made earlier.

Just heard “aviation consultant” Neil Hansford being interviewed by ABC News24 about this. His views:

- Qantas negotiated a good outcome for the company’s bottom line

- “Customers should initiate credit card chargebacks for services paid for but not received” - whilst simultaneously noting “many”(?) Pax were rebooked onto flights with ETD within 3 hours of original

He lost performance points, in my view, for referring to VH & ST as “the girls running [the Qantas group]”

- Qantas negotiated a good outcome for the company’s bottom line

- “Customers should initiate credit card chargebacks for services paid for but not received” - whilst simultaneously noting “many”(?) Pax were rebooked onto flights with ETD within 3 hours of original

He lost performance points, in my view, for referring to VH & ST as “the girls running [the Qantas group]”

Quickstatus

Enthusiast

- Joined

- Oct 13, 2013

- Posts

- 17,459

Is the $100m fine the largest ACCC fine

Are there any larger fines?

BlueScope many years got a $60M fine for price fixing IIRC -but that went all the way to the Federal court. Can't remember when. Likely that remains the largest (accounting for inflation)

Are there any larger fines?

BlueScope many years got a $60M fine for price fixing IIRC -but that went all the way to the Federal court. Can't remember when. Likely that remains the largest (accounting for inflation)

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- dandandan

- AIRwin

- 306

- aussie flyer

- am0985

- justinbrett

- dajop

- logos 01

- wenglock.mok

- randompunter

- RSD

- Aussiepicker

- mviy

- IrishPete

- mole

- kestrel1977

- suziec

- Dreamlander

- tgh

- Vekor

- Cottman

- Aussie Wanderer

- 33kft

- LionKing

- AustraliaPoochie

- Lukerayment

- crosscheck

- Harrison_133

- risaka

- burmans

- midnight

- QF WP

- anat0l

- tanahflyer

- Nate-Dawg

- REM

- Mrsfefe

- Beer_budget

- AppleJune

- vhojm

Total: 1,457 (members: 48, guests: 1,409)