You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

AFF Member Real Estate Discussion

- Thread starter tgh

- Start date

NZ prices have already dropped significantly (over 20% in many case) mainly due to changes in tax laws (in the process of being reversed mainly). And surprise, surprise the market didn’t fall out of the rental market despite many predictions it would, in fact just recently read that landlords are currently unable to increase rents and renters seem to have regained some power in the market. Admittedly NZ is in recession!I don’t disagree with you @drron.

In New Zealand prices are dropping now even though interest rates are being cut.

Perth real estate is being chased by eastern states buyers.

Riverfront properties are going to mainly Indian and Chinese buyers.

Bank of mum and dad must be getting stretched now.

Additionally while prices have yet to stabilise recent reports are that first home buyers are out looking again so probably not long until they will.

- Joined

- Nov 16, 2004

- Posts

- 49,168

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

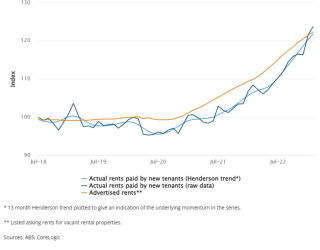

It's recovered and gone beyond.It’s funny (not) that there’s been a lot of coverage of rent increases post COVID but zero mention that’s off the back of massive rent reductions during COVID (Uni students, casual and professionals all went home).

In Capital cities:

- In December 2019 the national median house rent was $446 per week, down 0.7% YoY

- In September 2024 the national median house rent was $650 per week, up 5.8% YoY

Last edited:

Tonight we are housing around 160 folks in our social housing business. We had thought that we could get up to 400 but red tape and NIMBYs have slowed our progress. The change in values in WA has made acquisitions more difficult.

Separately we invested in Aspen Group who have had success in renovating a pile of Buckeridge flats that had drifted into disrepair following his death.

Mrscove is alarmed at the renovation fees and exit fees from land lease communities. Some of those contracted fees need to be reviewed and possible legislation is needed to prevent older folks from taking a hit from signing onerous contracts. I was thinking an exit fee of 15% would not cripple this industry. It would possibly make it fairer.

Separately we invested in Aspen Group who have had success in renovating a pile of Buckeridge flats that had drifted into disrepair following his death.

Mrscove is alarmed at the renovation fees and exit fees from land lease communities. Some of those contracted fees need to be reviewed and possible legislation is needed to prevent older folks from taking a hit from signing onerous contracts. I was thinking an exit fee of 15% would not cripple this industry. It would possibly make it fairer.

lovestotravel

Senior Member

- Joined

- Sep 18, 2008

- Posts

- 7,530

We do not consider Victoria as being a State where we can consider buying more real estate. Land taxes are going to continue to rise to put a bandaid over the financial mess that continues to grow. We do have a 3,000 square metre office/warehouse and an apartment in Southbank but nothing more.

I was speaking to my commercial agent this week and he is even saying commercial real estate is now going down the same as residential here in VIC.

I have a family member based in Melbourne and between him and Macro Business reports on Victoria the downside may run for some years.

He has invested in Perth after selling some places in Melbourne.

The whole Australian housing market is now overpriced but that doesn’t mean that there will be a big pull back nationally.

It would take a full blown recession to trigger a reset of Australian house prices.

He has invested in Perth after selling some places in Melbourne.

The whole Australian housing market is now overpriced but that doesn’t mean that there will be a big pull back nationally.

It would take a full blown recession to trigger a reset of Australian house prices.

- Joined

- Nov 16, 2004

- Posts

- 49,168

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

There's a built in safety catch - most mortgage holders will starve before they sell their property for less than what they owe.The whole Australian housing market is now overpriced but that doesn’t mean that there will be a big pull back nationally.

It would take a full blown recession to trigger a reset of Australian house prices.

Yes @serfty that is a difference between Australia and the US. We bought a “short sale” over in the US during their last recession and the property seller was not required to pay the shortfall on the mortgage. He just moved out quickly and never bothered to pay the HOA dues but popped up on Facebook seemingly leading an upmarket life.

In Australia you get chased for a mortgage shortfall.

In Australia you get chased for a mortgage shortfall.

Happy Dude

Established Member

- Joined

- Oct 13, 2006

- Posts

- 3,222

This topic has been covered in depth by Four Corners recently. Check it out on iView. Incredibly onerous and one-sided contracts that many signed without advice or understanding.Tonight we are housing around 160 folks in our social housing business. We had thought that we could get up to 400 but red tape and NIMBYs have slowed our progress. The change in values in WA has made acquisitions more difficult.

Separately we invested in Aspen Group who have had success in renovating a pile of Buckeridge flats that had drifted into disrepair following his death.

Mrscove is alarmed at the renovation fees and exit fees from land lease communities. Some of those contracted fees need to be reviewed and possible legislation is needed to prevent older folks from taking a hit from signing onerous contracts. I was thinking an exit fee of 15% would not cripple this industry. It would possibly make it fairer.

Yes @Happy Dude many have now watched that Four Corners episode. We now need government intervention as some signed exit fees at 35% after a renovation that the occupant pays to bring the property back to its original condition.

prozac

Senior Member

- Joined

- Jan 7, 2010

- Posts

- 6,170

I can still remember the mortgagee in possession wording on for sale signs on Sydney's Northern Beaches around this time.People are ignoring the fact that our 5 major housing markets are in the seriously unaffordable range in World rankings with Sydney number 2, Melbourne 9th. Adelaide 14th, Brisbane 15th and Perth 50th.

So for Australian prices to keep rising you will need the average punter to be able to keep their income rising at the same rate. I doubt that will happen. There will come a time when the bank of mum and dad will not be able to keep up with the rising subsidy needed. Then there will be a bust. The only problem is no one can forecast when that will happen.

But in 1990/91 house prices in Melbourne dropped 18%. They then had to rise 20% to get back to sqare 1.

Mrscove likes to hide the mail when it is land tax time. Land tax is a big annual charge in Australia. You don’t have this with shares and all you pay is GST on the brokerage.

In the US we pay 1% of value for our property in Marina del Rey which is in LA County. If we had bought in Las Vegas which is in Nevada that would be zero.

In the US we pay 1% of value for our property in Marina del Rey which is in LA County. If we had bought in Las Vegas which is in Nevada that would be zero.

Happy Dude

Established Member

- Joined

- Oct 13, 2006

- Posts

- 3,222

Any issue with the valuation system there?Mrscove likes to hide the mail when it is land tax time. Land tax is a big annual charge in Australia. You don’t have this with shares and all you pay is GST on the brokerage.

In the US we pay 1% of value for our property in Marina del Rey which is in LA County. If we had bought in Las Vegas which is in Nevada that would be zero.

Our IP in Rosanna is a bedroom, a bathroom and a lockup garage lighter than most others in the suburb but Vic SRO says its value is equal to them. As a result of that, and the great covid cash clawback, our land tax bill has doubled since 2022 and is now our biggest annual cost (excluding my golf club). Prior to that, it doubled from 2018 to 2019 too.

I've queried the SRO valuation, providing numerous examples of houses for sale that clearly demonstrate their over-evaluation, but they batted that away. Judge, jury and executioner. Seriously thinking of joining the investor exodus from VIC but probably not a lot better elsewhere.

We have a colleague who has a beach holiday weekender out of Melbourne and his latest land tax was a bit over $30,000. Victoria also aggregates holdings so you cannot get away with splitting up holdings.

The exodus from Victoria must be running hot for those who can afford to leave.

The exodus from Victoria must be running hot for those who can afford to leave.

- Joined

- Apr 14, 2013

- Posts

- 700

The property is probably worth 2.5 million.We have a colleague who has a beach holiday weekender out of Melbourne and his latest land tax was a bit over $30,000. Victoria also aggregates holdings so you cannot get away with splitting up holdings.

The exodus from Victoria must be running hot for those who can afford to leave.

Quickstatus

Enthusiast

- Joined

- Oct 13, 2013

- Posts

- 17,367

Regional Australia is the only place in Australia I would consider buying Residential.

prozac

Senior Member

- Joined

- Jan 7, 2010

- Posts

- 6,170

They need to divorce then each has a principal place of residence and no land tax.We have a colleague who has a beach holiday weekender out of Melbourne and his latest land tax was a bit over $30,000. Victoria also aggregates holdings so you cannot get away with splitting up holdings.

The exodus from Victoria must be running hot for those who can afford to leave.

EDIT: Because it is a divorce settlement there should be no land tax on the transfer. At least this is how it worked in NSW when friends re-arranged their tax commitments.

Last edited:

- Joined

- Apr 6, 2018

- Posts

- 2,892

Its hard here in Vic

Land tax, land tax (in trust excess) , vacant land tax, air b’n’b tax

When I finalised my late fathers estate had to pay land tax (held in trust because… he died and its in the estate). 10’s of thousands for vacant land. Its not like you can earn anything from it or get benefit of a residence if its a holiday house.

I am not investing in any more property here - shares only

Land tax, land tax (in trust excess) , vacant land tax, air b’n’b tax

When I finalised my late fathers estate had to pay land tax (held in trust because… he died and its in the estate). 10’s of thousands for vacant land. Its not like you can earn anything from it or get benefit of a residence if its a holiday house.

I am not investing in any more property here - shares only

We have lots of real estate and lots of shares. Currently we favour shares as franked dividends are better than land tax bills.

That colleague is not married and his long term partner has bought in Perth and that property has an ocean view. It is probably up in value by more than 50% but tenants can be a problem.

That colleague is not married and his long term partner has bought in Perth and that property has an ocean view. It is probably up in value by more than 50% but tenants can be a problem.

Happy Dude

Established Member

- Joined

- Oct 13, 2006

- Posts

- 3,222

I had an interesting conversation with a relative who'd bought a little farm as a weekender out back of Daylesford. The details escape me but they don't have to pay land tax (or maybe a reduced tax?) if they can prove they live in it for more than XX months per year.

Seemed to be in conflict with @cove's colleague and my FiL who have weekenders (ie not tenanted) worth a few mill and stuck with >$30k land tax bills. In the case of my FiL, he's had it since the 80's so the increase in value and associated capital gain is substantial.

Seemed to be in conflict with @cove's colleague and my FiL who have weekenders (ie not tenanted) worth a few mill and stuck with >$30k land tax bills. In the case of my FiL, he's had it since the 80's so the increase in value and associated capital gain is substantial.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- TheCollecter

- V1V2

- TheRealTMA

- Boeyn

- Up in the clouds

- defurax

- Cottman

- zig

- BodohBordeaux

- Mr_Tee

- Doctore1003

- Oscarq

- Zero

- itchy feet

- gty222

- Matt_H

- im.daniel

- Quickstatus

- Hawk529

- MEL_Traveller

- ols

- smckay

- redwoodw

- kaceybutler

- gman83

- offshore171

- 33kft

- Strikes

- markis10

- A321

- AussieTim

- flyingfan

- ausfox

- CBR001

- There'sOnlyOneJimmy

- chrispy3276

- AIRwin

- pyusha

- bluecoconut

- justinbrett

- Mur@no70

- mjt57

- Bundy Bear

- Larko1

- redmaxo

- fletty

- The man with no name

- SydneySwan

- StayGoldPonyboy

Total: 2,098 (members: 56, guests: 2,042)