moa999

Enthusiast

- Joined

- Jun 23, 2003

- Posts

- 13,590

But he's also going to block Chinese (and Mexican) competition which is a +ve for TeslaIsn’t Trump going to repeal all the EV incentives?

But he's also going to block Chinese (and Mexican) competition which is a +ve for TeslaIsn’t Trump going to repeal all the EV incentives?

and up again almost 9% o/n against a small fall on the Nasdaq. Heading back towards the all time high of ~US$410.But he's also going to block Chinese (and Mexican) competition which is a +ve for Tesla

Yes, would agree with that but plenty would claim that by dumbing down green tech in America he’s giving China a leg up in an area they are already looking like leading, so a gain in the US (of a reduced market) may translate into a loss everywhere else.But he's also going to block Chinese (and Mexican) competition which is a +ve for Tesla

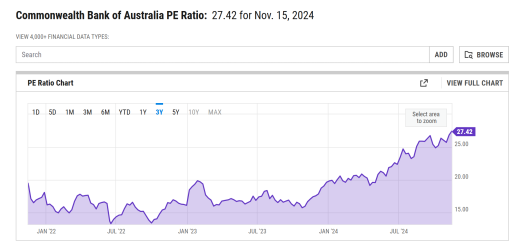

Don't argue with the chart. The banks, all of the banks, have more upside to come.CBA holding above $150. The buyers at this price are quite mad - but more power to them!

Because it's a bank and it's the right time for banks.Why does the CBA run continue ?

In anticipation of interest rates heading down.

Seems to me this was asked and answered

My answer is not based on hope. There is only so much that I will say on an open forum.Seems to me this was asked and answered….

The answers so far were (IMnsHO…) less substantive than I had hoped, hence the repost ( seeking discussion not argument)

The answers seem to me to encapsulate apparent reality… there is no reason just hope

Because it's a bank and it's the right time for banks.

Yet the analysists have had 'hold' at best and 'hard sell' at worst for at least six months. They can't all be nongs.

LOL. Why not, they often are.Lemmings follow each other over the cliff often.