- Joined

- Oct 13, 2013

- Posts

- 16,116

Though if they withdrew the CNY from the Us that will just put downward pressure on the USD making US tariffs in China effectively worseThis is one lever China could employ in retaliation for the tariffs.

Though if they withdrew the CNY from the Us that will just put downward pressure on the USD making US tariffs in China effectively worseThis is one lever China could employ in retaliation for the tariffs.

Thank you, someone else that sees the reality.The real crunch comes when the EU announces new tariffs on the USA as they have threatened, The EU are real hypocrites having the highest tariffs on many countries and outright bans on many products. Remember when Brexit occurred? The EU banned our agricultural products. Fortunately the UK finally allowed them back to the UK.

Topped up my CSL. Not a good dividend payer but hopefully returns to some decent gain.Who is going to buy what whenever they choose to jump back in? I am thinking CSL, QUAL, MCQ and NAB but mind is far from made up

Trump has given China until sometime today/tonight to remove their retaliatory 34% tariff or he is going to add an additional 50% to the China tariffs - and this morning China has said that they aren't going to remove the tariffs - so that might play out on Wall St later tonight.China has already retaliated but that was expected as they would like to see the US economy damaged.

The real crunch comes when the EU announces new tariffs on the USA as they have threatened, The EU are real hypocrites having the highest tariffs on many countries and outright bans on many products. Remember when Brexit occurred? The EU banned our agricultural products. Fortunately the UK finally allowed them back to the UK.

So watch t he EU. My feeling is that they will increase tariffs on the USA and markets will plunge. because Trump has already promised to double up if countries retaliate. My worst fear is that Trump will exit NATO. Europe then will be in crisis and the stock markets are the least of our worries.

MQG still above their 52 week low.Topped up my CSL. Not a good dividend payer but hopefully returns to some decent gain.

I don’t have MQG at all unfortunately and the amount to make it worth while is probably not worth the risk in the current climate.

Most things will be by close of session today - after yesterday! But let’s see what tomorrow has in store….MQG still above their 52 week low.

If Ottowa pull the electrical plug it will likely bankrupt them. From what I have read selling electricity to USA is their major income stream.As far as I'm aware Canada hasn't announced their retaliation yet - and they can do things to America that don't involve tariffs like selling their crude oil elsewhere instead of feeding it down the pipeline to the U.S. - or ceasing to supply electricity to about 4 million houses in the U.S.

Was not predicting anything as I do not know enough, simply making an observation.Most things will be by close of session today - after yesterday! But let’s see what tomorrow has in store….

Although MQG is trading lower than it was 2yrs ago.

They did commission the newly built Trans Mountain Pipeline Expansion to British Columbia last year - it goes to a loading port and apparently they can export 890,000 barrels a day through that infrastructure that otherwise gets piped to the U.S.If Ottowa pull the electrical plug it will likely bankrupt them. From what I have read selling electricity to USA is their major income stream.

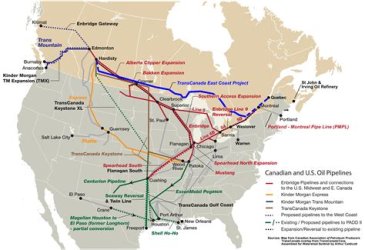

As for oil. Years ago Canada was going to build a pipeline that traversed the country West to East. It would supply oil from the oil rich western provinces to Quebec which has no oil, The TransCanada East Coast Project. They did not build it and so the pipeline still runs down to the US where it is redirected up another pipeline to supply Quebec. Canada is not in a good bargaining position.

View attachment 438500

I wasn't aware of that but as of this week they are saying that Quebec gets 70% of it's oil from the US.They did commission the newly built Trans Mountain Pipeline Expansion to British Columbia last year - it goes to a loading port and apparently they can export 890,000 barrels a day through that infrastructure that otherwise gets piped to the U.S.

There will be some pressure to change that I suspect.I wasn't aware of that but as of this week they are saying that Quebec gets 70% of it's oil from the US.