this worked for me so hopefully does for you too.The last time I applied 3 months ago, I actually got a call at like 7am in the morning from someone with a very Australian accent (or very good at faking one) asking me to verify some details. Then, I was declined on the phone.

I suppose that this was better than getting auto declined. Maybe I'm in with a chance after 0 new ccs in the past year, not even churning energy providers!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

AMEX rejection

- Thread starter doctorstrangelove

- Start date

I applied again yesterday and got the 5-10 business day email. Called them this morning and told not approved.

Last AMEX application was 4 months ago, haven't opened or closed a card since November 2024 but prior to that churned 4-5 a year. This is the 4th time AMEX have rejected me with applications every 5-6 months over the past 20 months or so.

Clearly Im still very much on their churning cough list.

Last AMEX application was 4 months ago, haven't opened or closed a card since November 2024 but prior to that churned 4-5 a year. This is the 4th time AMEX have rejected me with applications every 5-6 months over the past 20 months or so.

Clearly Im still very much on their churning cough list.

- Joined

- Mar 1, 2019

- Posts

- 2,770

- Qantas

- Silver Club

- Virgin

- Platinum

- Oneworld

- Sapphire

Gee I'm due to cancel my amex velocity platinum, I may never get one again by sounds of this thread.

Cancelling due to removal of centurial lounge passes removal. Dog act.

Cancelling due to removal of centurial lounge passes removal. Dog act.

infrequent_flyer

Junior Member

- Joined

- May 12, 2024

- Posts

- 13

Just to add another data point here, partner and myself both rejected by AMEX. Both applied for the AMEX Velocity card to take advantage of the 30k bonus points during April. I've churned 3 cards in the last 12 months, she's done 2. Both on decent income, good credit score and repayment history, paying balances in full etc.

She's had an AMEX 5+ years ago and I've never had an AMEX but clearly the churning was a factor. Applied for Virgin Velocity High Flyer and was approved on the same day I found out I was rejected by AMEX

She's had an AMEX 5+ years ago and I've never had an AMEX but clearly the churning was a factor. Applied for Virgin Velocity High Flyer and was approved on the same day I found out I was rejected by AMEX

Exactly the same situation here. Partner and I applied for the AMEX Velocity Platinum Card, both with excellent six figure salaries, excellent credit scores, no kids and low mortgage, but for the first time we were rejected with no decent explanation. We were quite shocked to receive the rejection letters to be honest.Just to add another data point here, partner and myself both rejected by AMEX. Both applied for the AMEX Velocity card to take advantage of the 30k bonus points during April. I've churned 3 cards in the last 12 months, she's done 2. Both on decent income, good credit score and repayment history, paying balances in full etc.

She's had an AMEX 5+ years ago and I've never had an AMEX but clearly the churning was a factor. Applied for Virgin Velocity High Flyer and was approved on the same day I found out I was rejected by AMEX

Dr Ralph

Enthusiast

- Joined

- Jan 21, 2014

- Posts

- 13,551

- Qantas

- Bronze

- Virgin

- Red

Don't be shocked or take it personally. It's most certainly not embarrassing. It's all a game. I've detailed my (very few) rejections here:Exactly the same situation here. Partner and I applied for the AMEX Velocity Platinum Card, both with excellent six figure salaries, excellent credit scores, no kids and low mortgage, but for the first time we were rejected with no decent explanation. We were quite shocked to receive the rejection letters to be honest.

Credit Card Offers - Citi Premier Sign-Up Bonus Offers & Discussion

Credit Card Offers - G&C Mutual Bank Platinum Visa Credit Card. 50,000 bonus QFF points for a new card.

The game is always changing. Play hard! Massive point earning opportunities have moved on from credit cards, and you should too.

Thanks for the response Dr Ralph. I think what is the must frustrating for me is the lack of explanation; it simply doesn't make sense why the rejection and hence is hard to stomach.Don't be shocked or take it personally. It's most certainly not embarrassing. It's all a game. I've detailed my (very few) rejections here:

Credit Card Offers - Citi Premier Sign-Up Bonus Offers & Discussion

Credit Card Offers - G&C Mutual Bank Platinum Visa Credit Card. 50,000 bonus QFF points for a new card.

The game is always changing. Play hard! Massive point earning opportunities have moved on from credit cards, and you should too.

But what are these massive point earning opportunities outside of the sign on bonuses of credit cards you refer to?

Last edited:

may be worth having a read of the last few pages of this thread, generally they are cracking down on people they perceive as churners. if you have opened and closed a number of cards in recent years then it fits their current approval/rejection process.Thanks for the response Dr Ralph. I think what is the must frustrating for me is the lack of explanation; it simply doesn't make sense why the rejection and hence is hard to stomach.

But what are these massive point earning opportunities outside of the sign on bonuses of credit cards you refer to?

If not then i understand your confusion.

Happy Dude

Established Member

- Joined

- Oct 13, 2006

- Posts

- 2,916

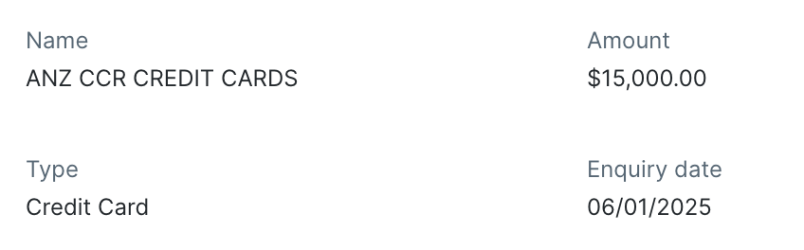

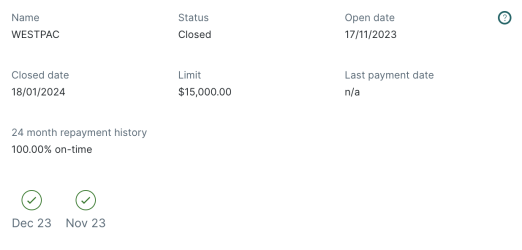

A little OT but relevant to the position that "churners" are being rejected, but does Amex see the providers and amounts in a credit application history?

For eg, can Amex see that credit for $xx has been applied for at CBA, WBC, NAB etc or do they just see that a credit application has been made?

For eg, can Amex see that credit for $xx has been applied for at CBA, WBC, NAB etc or do they just see that a credit application has been made?

- Joined

- Feb 23, 2015

- Posts

- 6,228

- Qantas

- Platinum 1

- Virgin

- Platinum

- Star Alliance

- Gold

Happy Dude

Established Member

- Joined

- Oct 13, 2006

- Posts

- 2,916

ooooh it even has the type of credit applied for. #nowheretohide

- Joined

- Feb 23, 2015

- Posts

- 6,228

- Qantas

- Platinum 1

- Virgin

- Platinum

- Star Alliance

- Gold

ooooh it even has the type of credit applied for. #nowheretohide

Yes - utilities, personal loans and mortgages all appear differently.

andyrb

Member

- Joined

- May 4, 2023

- Posts

- 146

both with excellent six figure salaries, excellent credit scores, no kids and low mortgage

the lack of explanation; it simply doesn't make sense why the rejection and hence is hard to stomach.

Amex doesn't owe you an explanation or justification of their decision. For whatever reason you didn't meet their criteria and they chose not to extend you credit.

Your "six figure salaries, excellent credit scores, no kids and low mortgage" were probably weighed up against other factors and it was determined you were not a good fit for them.

<redacted>

Last edited by a moderator:

I love to travel

Established Member

- Joined

- Jun 4, 2016

- Posts

- 3,036

- Qantas

- Gold

What about good customer relationship principles - I think that is what some people are questioning. And it is not whiningAmex doesn't owe you an explanation or justification of their decision. For whatever reason you didn't meet their criteria and they chose not to extend you credit.

Your "six figure salaries, excellent credit scores, no kids and low mortgage" were probably weighed up against other factors and it was determined you were not a good fit for them.

We really need to stop with the "I MAKE LOTS OF MONEY AND HAVE A CREDIT SCORE OVER 9000 HOW DARE AMEX NOT APPROVE ME" whining.

Amex doesn't owe you an explanation or justification of their decision. For whatever reason you didn't meet their criteria and they chose not to extend you credit.

Your "six figure salaries, excellent credit scores, no kids and low mortgage" were probably weighed up against other factors and it was determined you were not a good fit for them.

We really need to stop with the "I MAKE LOTS OF MONEY AND HAVE A CREDIT SCORE OVER 9000 HOW DARE AMEX NOT APPROVE

Nasty! And totally unnecessary comments. By it's very definition this is a thread about AMEX rejection and so naturally people are going to give details as part of the discussion. If you can't say anything productive, you do have the choice to say nothing at all.Amex doesn't owe you an explanation or justification of their decision. For whatever reason you didn't meet their criteria and they chose not to extend you credit.

Your "six figure salaries, excellent credit scores, no kids and low mortgage" were probably weighed up against other factors and it was determined you were not a good fit for them.

<redacted>

Post automatically merged:

Nasty! And totally unnecessary comments. By it's very definition this is a thread about AMEX rejection and so naturally people are going to give details as part of the discussion. If you can't say anything productive, you do have the choice to say nothing at all.Amex doesn't owe you an explanation or justification of their decision. For whatever reason you didn't meet their criteria and they chose not to extend you credit.

Your "six figure salaries, excellent credit scores, no kids and low mortgage" were probably weighed up against other factors and it was determined you were not a good fit for them.

<redacted>

Nasty! And totally unnecessary comments. By it's very definition this is a thread about AMEX rejection and so naturally people are going to give details as part of the discussion. If you can't say anything productive, you do have the choice to say nothing at all.

Some people just can't keep their mouth shut! Part of living in this society

andyrb

Member

- Joined

- May 4, 2023

- Posts

- 146

And it is not whining

It kinda is. The thread is full of the same.

I've said it before and I'll say it again: Amex, nor any other credit provider, are under no obligation to justify themselves to applicants. Earning lots of money or having a good credit history is not, in and of itself, a pathway to acceptance.

Their business is making money off customers. If they're declining someone, they would have a reason for doing so.

These regular posts of the same thing add nothing of value.

If you can't say anything productive, you do have the choice to say nothing at all.

Very true. At this point I'll bow out, as I'm heading out for dinner. Which I'll be paying for on my Amex, which I was approved for.

- Joined

- Mar 1, 2019

- Posts

- 2,770

- Qantas

- Silver Club

- Virgin

- Platinum

- Oneworld

- Sapphire

Gee talk about wrapped in cotton wool.

Bit of critism in general, big deal, can easily say don't like what you read, just ignore it, forget about it.

I for one love both sides of the issues, with a bit of sting for flavour.

Cup of concrete anyone?

Bit of critism in general, big deal, can easily say don't like what you read, just ignore it, forget about it.

I for one love both sides of the issues, with a bit of sting for flavour.

Cup of concrete anyone?

it simply doesn't make sense why the rejection and hence is hard to stomach.

Why doesn’t it make sense? I think it makes perfect sense - Churners would not be profitable customers. Pretty obvious why they wouldn’t want us.

Flyfrequently

Established Member

- Joined

- Jun 20, 2022

- Posts

- 2,300

- Qantas

- Gold

And nor are retirees who pay their account on time and in full @NoNameChurners would not be profitable customers.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- jswong

- newmarket

- larry40

- scotty_mel

- ausfox

- Justinf

- Flyfrequently

- Peter78

- jrfsp

- ramamba

- points

- flydoc

- Larko1

- ellen10

- The Man in Blue

- MarkD

- quinch

- auriga

- SJF211

- ShelleyB

- azza007

- Cottman

- TheRealTMA

- love_the_life

- jason_c

- Harrison_133

- JessicaTam

- anat0l

- tph1177

- Denali

- jc14

- Amber_PP

- halostrike

- mviy

- poopiepoo

- crh66

- coolkid101

- Robliversage

- kiwipino

- StayGoldPonyboy

- onemorejohndoe007

- NoName

- Aeolus

- tassie6

- Steady

- ben95

- Scarlett

- Luni

- andyrb

- Beachy55

Total: 1,250 (members: 82, guests: 1,168)