- Joined

- Mar 25, 2010

- Posts

- 1,315

Why is Dynamic Currency Conversion Even Legal? is an article written by the AFF editorial team:

www.australianfrequentflyer.com.au

www.australianfrequentflyer.com.au

You can leave a comment or discuss this topic below.

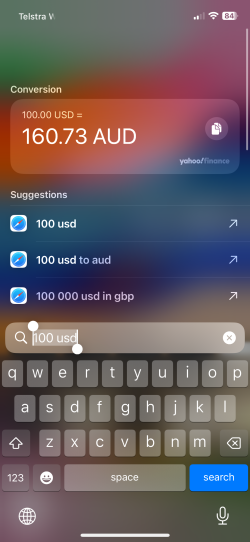

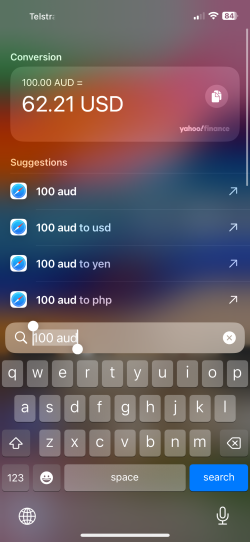

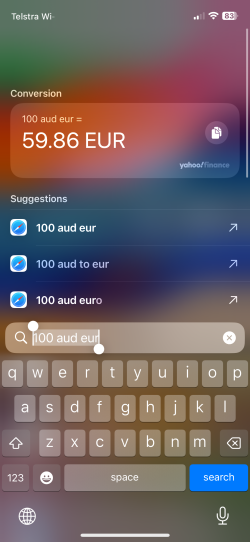

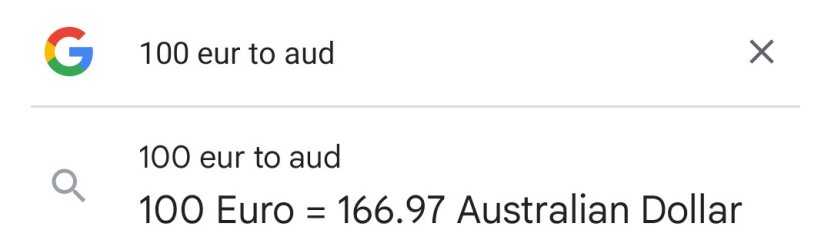

Why is Dynamic Currency Conversion Even Legal?

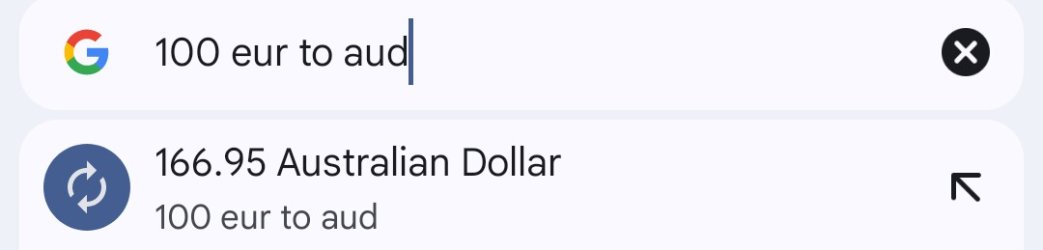

Most countries ban junk surcharges like "resort fees" because they can trick people into paying more and are bad for consumers. So, why is dynamic currency conversion (DCC) is still legal?

You can leave a comment or discuss this topic below.