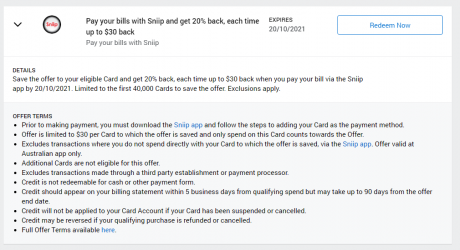

I'm after some quick advice. I sold some shares that I'd held for many years and I now have a $90k capital gains tax bill to pay as part of my income tax assessment. This is a personal income tax issue, not a business tax one. I've only just received the assessment but the due date for payment is listed as 8 June 2021. This is all very new to me so some assistance would be appreciated. How much attention do I need to pay to the due date having already passed? Is it worth paying this with a credit card in order to get points? I have a Macq Bank QFF visa card and a grandfathered AMEX platinum reserve credit card (which is my preferred CC for points with SQ). I also have a sniip account but have never used it.

Or should I just pay the amount via bpay from a bank account?