I'm one of those people who think giving the banks enough information to stop them lending to people who cant afford it IS actually good for the consumer.All of this to say, from what I've gathered, having accounts open "to prove you're creditworthy" seems to be a myth in AU.

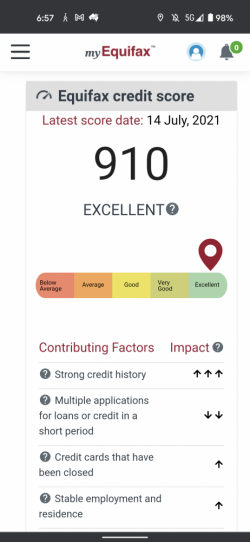

- AFAIK, comprehensive credit reporting has delivered no benefits to consumers yet i.e. there seem to be no positive impacts to your score by having an account open that you pay off regularly. But, the banks now have more options to reject you on the basis of (they see the total reported current credit limit but not utilisation, and they can see if you only keep accounts only open for short periods of time).

On your last point, not sure what you mean by proving credit worthiness but length of credit history and the last two years repayment history are taken unto account by lenders. As a general rule people who have had loans longer are a better credit risk (they have proven ability to pay off loans) but they really look closest at recent repayment history, i.e. if you were paying on time most of last two years but recently have dropped behind its a reasonably strong indicator of financial stress. Not 100% but a good indicator.