- Joined

- Aug 21, 2011

- Posts

- 16,130

- Qantas

- Platinum

- Virgin

- Platinum

- SkyTeam

- Elite Plus

- Star Alliance

- Gold

NAB is making the following changes to its NAB Rewards Signature credit card from 12 June 2024:

www.nab.com.au

www.nab.com.au

- $24 monthly fee instead of $295 annual fee (adds up to $288/year) - this monthly fee is waived if you spend $5,000 or more during the month

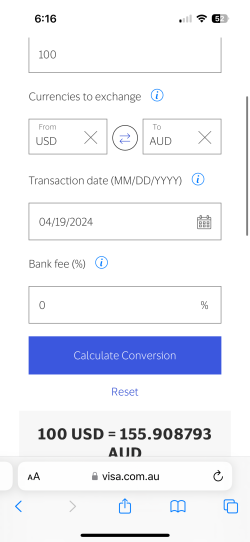

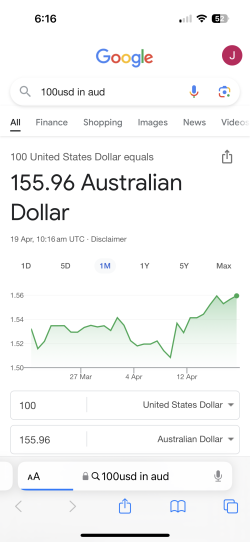

- No international transaction fee

- Points booster on Webjet purchases changing from 3x to 2x points, no more Points boosters on purchases in major department & hardware stores or on international transactions

- Change to earn standard earn rate: instead of the current 1.25 NAB Rewards points per $1 spent you'll earn 1.5 points up to $15,000 then 0.5 points per $1 thereafter

- Addition of a "delayed flight lounge pass"

We’re changing NAB Rewards Signature

Learn about the improvements and new features that have been made to the NAB Rewards product range. Compare with the old NAB Rewards offering today.