Lost Redditor

Member

- Joined

- Mar 21, 2023

- Posts

- 399

I've yet to be refused except for one where I put in bad information by accident and I've been churning quite a bit since late 2019. Back when I began I had just started earning 6 figures, I'm now well above where I was then.

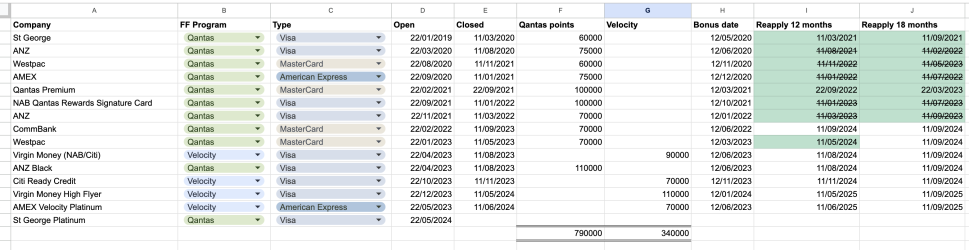

Here's a (dates modified) chart of my churning. I'm missing a card in there I think, and I have yet to do a Citi card. I probably won't now that NAB owns them.

For total credit limit I try not to exceed 30% of my income. Not any golden rule or a secret Experian number, just something that I've stuck with.

Here's a (dates modified) chart of my churning. I'm missing a card in there I think, and I have yet to do a Citi card. I probably won't now that NAB owns them.

For total credit limit I try not to exceed 30% of my income. Not any golden rule or a secret Experian number, just something that I've stuck with.