- Joined

- Jun 18, 2015

- Posts

- 615

- Qantas

- Bronze

- Virgin

- Red

Thanks for that. Due for something new and was hoping to get the KrisFlyer a boostYou will almost certainly get a better sign up bonus by opting into QF.

Thanks for that. Due for something new and was hoping to get the KrisFlyer a boostYou will almost certainly get a better sign up bonus by opting into QF.

Your best bet for that is Amex which currently has a promo on worth 120k Kris Flyer points. Failing that, try Western Pacific which has 180k attitude points worth 60k Kris Flyer.Thanks for that. Due for something new and was hoping to get the KrisFlyer a boost

Thanks for that. Exhausted the AMEX avenue so i will also take a look at Westpac,Your best bet for that is Amex which currently has a promo on worth 120k Kris Flyer points. Failing that, try Western Pacific which has 180k attitude points worth 60k Kris Flyer.

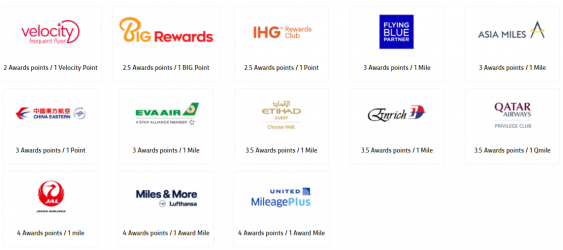

Commbank does not seem to have SQ as a reward partner. This is their reward table. Bear in mind that the sign up bonus is 100k award points or 70k QF - so almost certainly better value to go with QF for the sign up bonus.Thanks for that. Exhausted the AMEX avenue so i will also take a look at Westpac,

cheers

I had the same problem! I called them and they said to wait 7-10 business days....Offer has been extended till June 30 2022 now

My experience so far

Applied for the Card with QF points, entered my QF number during the application. Once the card arrived I logged into the website and could see I had opted for QF and a day after activation I was charged the QF fee.

Made my $5k spend, following statement showed 100k Awards points on it instead of QF points and the next day those points were converted over to QF so I got roughly 42k QF points including the spend points.

Called CBA to get the error fixed, at first they said too bad it‘d done now. I said no, this is not my mistake, you charged me for QF and awarded the wrong points. They raised a complaint for me.

Complaints dept called few days later to get further details.

Waiting to hear back…

This is still ongoing for me.I had the same problem! I called them and they said to wait 7-10 business days....

Push for compensation.This is still ongoing for me.

Waited 14 days as they said the points would be sorted by then. I called again to follow this up as I was told I would be contacted if they points had not arrived on the 14th day. I then had to make a complaint about the case manager who was not getting back to me.

Case manager called few days later to say points should be in as it’s the new billing cycle. I explained nothing is still there and the statement had 0 on it. I was asked to give a copy of my current QF statement.

Still waiting to hear back….

I'd lodge a complaint with AFCA (and have done so in the past when banks haven't honoured their promotions). Normally sorted very quickly, and the financial institution also gets hit with a complaint fee from AFCA.This is still ongoing for me.

Waited 14 days as they said the points would be sorted by then. I called again to follow this up as I was told I would be contacted if they points had not arrived on the 14th day. I then had to make a complaint about the case manager who was not getting back to me.

Case manager called few days later to say points should be in as it’s the new billing cycle. I explained nothing is still there and the statement had 0 on it. I was asked to give a copy of my current QF statement.

Still waiting to hear back….

Well played.Push for compensation.

Cth mucked me around with my application. I got the full annual fee paid up front as compensation. I cancelled the card after the points landed, never paid any of the monthly fees so ended up with them giving me the points and several hundred dollars as well.

Apologies , if it has already been asked. I have the wealth package from Commbank to be renewed in less than 4 weeks and if I were to churn more points which commbank card is best suited to be applied for free. I am looking for more options to transfer to velocity/krisflyer for the upcoming international travel. Thanks for your tips/suggestions.

Thanks @Mr H , I should have put in my query better. I have been paying for wealth package each year and have been rejecting the offer to have a credit card with annual fee waived.Churning is applying for lots of cards one after another to get the sign up bonus. You can generally not get a sign up bonus if you have held a card from that bank in the past 12 months (18 months for Amex). The best sign up bonuses tend to come with the highest annual fees. Free cards generally don't come with many (if any) bonuses.

Most of us need one card we don't churn so we can set up direct debits and get rewards for daily spend. If your bank account gives you a free card, you might as well take it and use it for daily spend points rather than trying to churn it.

My question was mainly to check if there is any comm bank card with bonus points that can be clubbed with wealth package , so I get the points at technically zero annual fee. Even if the number of points is 20K QF , it will make for one round trip MEL-SYD reward tickets.

Usually if there is no annual fee through package one does not receive sign up bonus points .Thanks @Mr H , I should have put in my query better. I have been paying for wealth package each year and have been rejecting the offer to have a credit card with annual fee waived.

My question was mainly to check if there is any comm bank card with bonus points that can be clubbed with wealth package , so I get the points at technically zero annual fee. Even if the number of points is 20K QF , it will make for one round trip MEL-SYD reward tickets.