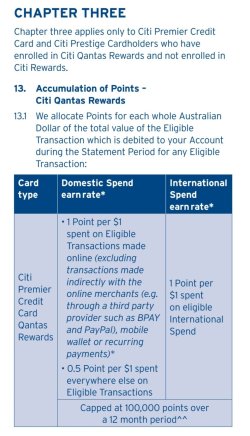

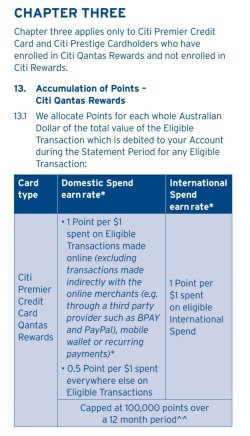

I am in dispute with Citibank re: the amount of points for a particular statement period. One transaction alone was $6297 to a travel agent. The reward points in total for that statement period were 4200.

As it is impossible to contact directly with rewards, I am told by (the poor) in between people that rewards have investigated and there is no fault. When I say they are incorrect, they say they will pass it on again, to rewards team for investigation and the roundabout continues!

Any suggestions how/where to take this further, welcome please? It is the only time I have checked and if it wasn't for the amount involved I wouldn't have known. HELP!

As it is impossible to contact directly with rewards, I am told by (the poor) in between people that rewards have investigated and there is no fault. When I say they are incorrect, they say they will pass it on again, to rewards team for investigation and the roundabout continues!

Any suggestions how/where to take this further, welcome please? It is the only time I have checked and if it wasn't for the amount involved I wouldn't have known. HELP!

Last edited: