You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Duty Free Gate Delivery - Why?

- Thread starter Spacetravel

- Start date

- Status

- Not open for further replies.

But then NZ prices are not competitive?Gate delivery does not happen on flights from NZ so I'd agree that it's due to security compliance

Lynda2475

Suspended

- Joined

- May 1, 2009

- Posts

- 9,395

- Qantas

- Platinum

- Virgin

- Red

- Oneworld

- Emerald

If you want to buy something duty free before departing Australia, shop around and get the best retail deal and claim the tax back at the airport.

Much cheaper to buy your headphones at JB Hi Fi and claim the tax than buy at the airport where the price without duty is more than the price including duty at any large retail store.

Much cheaper to buy your headphones at JB Hi Fi and claim the tax than buy at the airport where the price without duty is more than the price including duty at any large retail store.

Last edited:

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 14,063

- Qantas

- Platinum

- Virgin

- Silver

- Oneworld

- Emerald

- Star Alliance

- Gold

But difficult to do for booze and larger items that come under LAGs. I usually pre-order booze for collection back in SYD on return.If you want to buy something duty free before departing Australia, shop around and get the best retail detail and claim the tax back at the airport.

Much cheaper to buy your headphones at JB Hifi and claim the tax than but at the airport where the price without duty is more than the price including duty at any large retail store.

AKL used to be relatively good compared to Oz - but can vary with relatively EX rate.But then NZ prices are not competitive?

I saw your question after I passed through HKG yesterday otherwise I would have asked. I don’t recall seeing any DF sealed bags for collection (like SIN). I was flying to DPS.Does Hong Kong do gate deliveries for Australian-bound flights like Singapore or is it possible to buy liquids over 100mL and take them with you at the time of purchase like Kuala Lumpur?

Anyone know if DPS is competitive for DF booze? Otherwise I’ll take my chances on arrival in PER…

Lynda2475

Suspended

- Joined

- May 1, 2009

- Posts

- 9,395

- Qantas

- Platinum

- Virgin

- Red

- Oneworld

- Emerald

But difficult to do for booze and larger items that come under LAGs. I usually pre-order booze for collection back in SYD on return.

I've never felt the need to buy booze before departing Aus, after all the lounge and plane offer free drinks and generally alcohol is much cheaper overseas where the taxes are lower.

Large items can be purchased retail and checked in whilst still claiming back tax, I have done this on luggage before.

I laughed that duty free store at SYD was promoting timtams on sale for $5/packet, when the sale price at Coles is usually $2.50/pack.

YMMV depends what you are buying.

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 14,063

- Qantas

- Platinum

- Virgin

- Silver

- Oneworld

- Emerald

- Star Alliance

- Gold

Yes, very rare that I’d buy something on departure. Unless I know I might be captive to “resort” prices and want complement that with an in room G&T (assuming you can buy tonic water on arrival!). I did that going to NOU.I've never felt the need to buy booze before departing Aus, after all the lounge and plane offer free drinks and generally alcohol is much cheaper overseas where the taxes are lower.

Absolutely zero desire to buy something in SYD to cart around and bring home. Hence why “preorder” for pickup on arrival home is extremely handy if buying something at your last port of call before home isn’t practical/competitive.

Elevate your business spending to first-class rewards! Sign up today with code AFF10 and process over $10,000 in business expenses within your first 30 days to unlock 10,000 Bonus PayRewards Points.

Join 30,000+ savvy business owners who:

✅ Pay suppliers who don’t accept Amex

✅ Max out credit card rewards—even on government payments

✅ Earn & transfer PayRewards Points to 10+ airline & hotel partners

Start earning today!

- Pay suppliers who don’t take Amex

- Max out credit card rewards—even on government payments

- Earn & Transfer PayRewards Points to 8+ top airline & hotel partners

Join 30,000+ savvy business owners who:

✅ Pay suppliers who don’t accept Amex

✅ Max out credit card rewards—even on government payments

✅ Earn & transfer PayRewards Points to 10+ airline & hotel partners

Start earning today!

- Pay suppliers who don’t take Amex

- Max out credit card rewards—even on government payments

- Earn & Transfer PayRewards Points to 8+ top airline & hotel partners

AFF Supporters can remove this and all advertisements

RooFlyer

Veteran Member

- Joined

- Nov 12, 2012

- Posts

- 31,458

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

Large items can be purchased retail and checked in whilst still claiming back tax, I have done this on luggage before.

You buy it retail, check it in your luggage, claim the GST back, lug the stuff all over wherever overseas then bring it back??? Rather than pre-order it at the departure airport and collect on return??? What would be the $ saving on, say a 1l bottle of gin (or choose your own medicine)?

Lynda2475

Suspended

- Joined

- May 1, 2009

- Posts

- 9,395

- Qantas

- Platinum

- Virgin

- Red

- Oneworld

- Emerald

You buy it retail, check it in your luggage, claim the GST back, lug the stuff all over wherever overseas then bring it back???

Well that's generally how luggage works, you take it with you to put your stuff in (the luggage was the large item i bought as clearly stated). I was able to claim tax back on my travel pack, packing cells, hiking poles and boots all bought at the same store, all checked in, all tax refunded. All stuff i needed to take with me to Patagonia, so no chore to lug and yes i brought it back as these are not single use items.

You clearly didn't bother to read what i wrote just tried to be funny about gin, not an item i mentioned nor would ever buy.

Last edited:

RooFlyer

Veteran Member

- Joined

- Nov 12, 2012

- Posts

- 31,458

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

Well that's generally how luggage works, you take it with you to put your stuff in (the luggage was the large item i bought as clearly stated). I was able to claim tax back on my travel pack, packing cells, hiking poles and boots all bought at the same store, all checked in, all tax refunded. All stuff i needed to take with me to Patagonia, so no chore to lug and yes i brought it back as these are not single use items.

You clearly didn't bother to read what i wrote just tried to be funny about gin, not an item i mentioned nor would ever buy.

We were talking about buying booze - you replied to and quoted a statement about booze. But yes, I see you changed the subject again. OK.

If some one writes " .... say, ..." its an example, an illustration. You know?

gaz0303

Active Member

- Joined

- May 22, 2011

- Posts

- 670

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

- Star Alliance

- Gold

How did the process go on return to Australia? I’m trying to figure if the hassle is worth saving max $90, if I understand the TRS and personal concession rules.Well that's generally how luggage works, you take it with you to put your stuff in (the luggage was the large item i bought as clearly stated). I was able to claim tax back on my travel pack, packing cells, hiking poles and boots all bought at the same store, all checked in, all tax refunded. All stuff i needed to take with me to Patagonia, so no chore to lug and yes i brought it back as these are not single use items.

You clearly didn't bother to read what i wrote just tried to be funny about gin, not an item i mentioned nor would ever buy.

Lynda2475

Suspended

- Joined

- May 1, 2009

- Posts

- 9,395

- Qantas

- Platinum

- Virgin

- Red

- Oneworld

- Emerald

We were talking about buying booze - you replied to and quoted a statement about booze. But yes, I see you changed the subject again. OK.

If some one writes " .... say, ..." its an example, an illustration. You know?

No someone said you cant claim large items, I provided evidence that you can. The title of this thread is not Duty Free Booze.

As i specified the item I was talking about, no example or illustration necessary.

Post automatically merged:

How did the process go on return to Australia? I’m trying to figure if the hassle is worth saving max $90, if I understand the TRS and personal concession rules.

Zero issues as the total value was under $900 (and being used clothing the boots were exempt from duty on return anyway).

Austman

Established Member

- Joined

- Sep 21, 2007

- Posts

- 4,504

- Qantas

- Platinum

Does Hong Kong do gate deliveries for Australian-bound flights

Unless the legislation has changed, HKG is not an exempt country so airside shops either will not sell alcohol at all or must deliver to the gate for a direct flight to Australia.

The last time I was flying to Australia, some years ago, the airside shops simply refused to sell it for those flights.

Forg

Established Member

- Joined

- Jan 25, 2017

- Posts

- 2,212

I’d be interested to know this too … what procedures are involved, how much difference does it make to the amount of time between that sweet release from The Hurtling Tube Of Pain and being land-side in <insert chosen form of transport>?How did the process go on return to Australia? I’m trying to figure if the hassle is worth saving max $90, if I understand the TRS and personal concession rules.

I remember neighbours doing a 6-week trip around Europe carting a VHS VCR they’d bought in a Duty Free place before they left, and being surprised that someone would do that compared to the cost of a family-of-5 trip to Europe … stuff you’re using OS seems like a good idea (eg. digital cameras used to be quite expensive so buying duty-free to use OS and then claiming the GST back was something worth doing when you didn’t have lounge access on departure).

Last edited:

Austman

Established Member

- Joined

- Sep 21, 2007

- Posts

- 4,504

- Qantas

- Platinum

I’d be interested to know this too … what procedures are involved,

None of the item total is under $900.00.

If the items have been used, it’s their used value that counts. Many items lose value once used. Some by large amounts.

If in doubt you can ask customs and let them decide.

Eg I purchased an over $1,000 mobile, received the GST refund, but used it both before leaving Australia and while overseas. Customs, when I returned to Australia, said that they considered it now would be worth under $900.00.

Austman

Established Member

- Joined

- Sep 21, 2007

- Posts

- 4,504

- Qantas

- Platinum

Wine can be very expensive in many overseas countries, even at duty free prices.The 20% is good value when buying champagne.

Lotte duty free now runs Melbourne and Singapore.

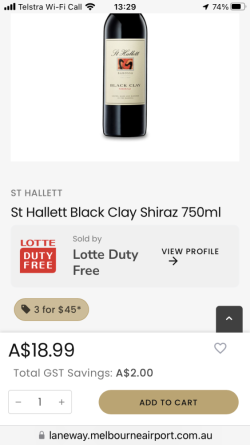

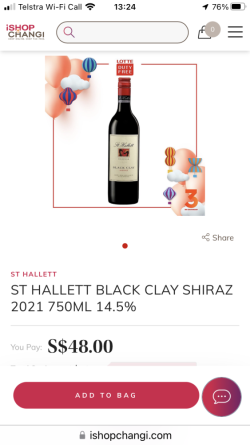

Look at the same product in Australia and Singapore.

Australia:

Singapore:

S$48 = A$53.

So you can buy 3 x bottles in Australia for less than 1 bottle in Singapore.

Both at duty free prices (haha).

Last edited:

Austman

Established Member

- Joined

- Sep 21, 2007

- Posts

- 4,504

- Qantas

- Platinum

Just to add to that, Australian wine is generally poor value at Oz DF at the best of times.

Agreed.

But, especially when on special, it can be reasonable value and quite handy to buy airside at the airport. That’s the only way if HLO of course.

And especially if going to a country like Singapore, were wine starts at around S$30 for a bottle of the cheapest (from anywhere). Maybe around S$25 in the big supermarkets. That’s still A$28!

It’s not always true to say that alcohol is cheaper overseas. Even at DF prices.

Last edited:

Forg

Established Member

- Joined

- Jan 25, 2017

- Posts

- 2,212

When last in a supermarket in Belgium, not known as the cheapest place in the entire world (OK not super expensive but not the 3rd world either), Australian wine was represented to me by the Wynns "black label" Cab Sauv being the equivalent of ~$20 when it was ~$40 here at the likes of Dan Murphys. Way cheaper there. However, the bad Oz stuff was barely any cheaper (and something that was a $10 bottle here was closer to $15 there ... "yellowtail" rings a bell, wine designed for soaking your car parts for cleaning).

Some countries are cheaper, some more expensive. Tax on booze isn't any lower in the UK for example; but the booze is cheaper in the first place, tax on a lower price is of course lower.

Some countries are cheaper, some more expensive. Tax on booze isn't any lower in the UK for example; but the booze is cheaper in the first place, tax on a lower price is of course lower.

- Status

- Not open for further replies.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- cmaviation

- Justinf

- agrias

- hydrabyss

- Tazza_0712

- vbroucek

- Scr77

- Scarlett

- logos 01

- Seat0B

- Aeryn

- Harrison_133

- Franky

- Rugby

- kpc

- Pete98765432

- grapes

- Rayesfeg

- Black Duck

- dh3mike

- SomeRando

- Wanderlust_tim

- aus_flyer

- Point Ventures

- kangarooflyer88

- fasola

- am0985

- RooFlyer

- Cottman

- zig

- SJF211

- Beer_budget

- moa999

- Zero

- fafnersbane

- SirCrumpet

- Hawk529

- Lat34

- Askance

- flyerboy

- tgh

- hwy

- http_x92

- im.daniel

- mccaffd

Total: 1,366 (members: 52, guests: 1,314)