You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Flights are more expensive than ever

- Thread starter wendlle

- Start date

- Status

- Not open for further replies.

henrus

Established Member

- Joined

- Jun 23, 2016

- Posts

- 3,985

- Qantas

- Platinum

- Virgin

- Platinum

I was quite shocked yesterday, I had some family who were due to fly out of Newcastle late yesterday evening. Obviously with Newcastle airport closed I suggested they get to Sydney quick smart which turned out to be a good idea, a last minute Virgin flight was ~$145 per person which in my opinion is very good for something booked hours before travel.

They were booked on Jetstar (best option that evening) but Jetstar at ~4pm yesterday didn't want to reroute via Sydney funnily enough at 7pm last night they changed their tune.

They were booked on Jetstar (best option that evening) but Jetstar at ~4pm yesterday didn't want to reroute via Sydney funnily enough at 7pm last night they changed their tune.

eastwest101

Established Member

- Joined

- Oct 26, 2010

- Posts

- 3,403

- Qantas

- Gold

- Virgin

- Gold

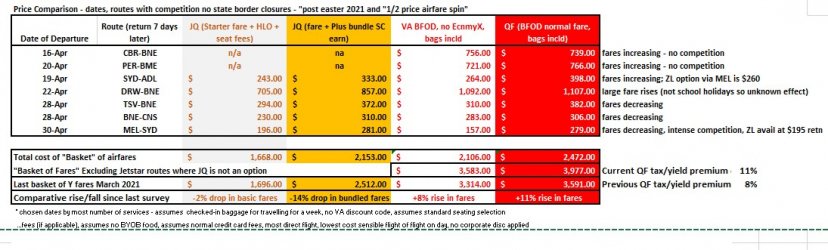

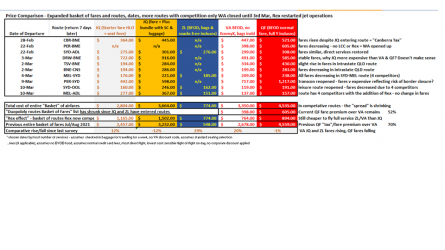

Updated and redid the numbers on the existing sample of airfares for the upcoming late April early May.

A few interesting things to note from this like-for-like rough comparison. Big picture story is that both VA and QF have been able to increase fares by careful addition of capacity to the market without flooding the domestic market with too many empty aircraft and seats but JQ has had a tougher time and has reduces its base fares and cost of bundles, note that the reason why I broke out JQ base fares and JQ fares with a Plus bundle is that the bundle gives you checked luggage and ability to earn QFF SC and points, Jetstar fares are not transparent with all sorts of hidden seat selection fees and credit card fees that all stay hidden until the final payment screen and its designed this way so as to appear that Jetstar appear"cheaper" in a simple Google flights or Webjet style aggregator comparison headline - whatever the case - it appears that JQ base fares have dipped slightly but the yield managers at JQ have had to trim the cost of some bundles for some reason.

The interesting thing to note is that it seems that in "Duopoly" markets with no third party competition price insensitive markets e.g. CBR-BNE and say BME-PER which are government and resource industry dominant, it seems that fares are increasing which makes sense as airline yield managers extract maximum cash out of these sources. Jetstars wide penetration of a lot of the domestic market might be moderating fares in some other markets. The statistical "outlier" seems to be the BNE-DRW route which actually has 3 airlines competing but has seen some outlandish rises in airfares that could be some sort of school holiday effect or maybe a reduction of capacity by all competitors. Looks like MEL-SYD is a yield bloodbath for all concerned so possibly due to a continued lack of higher yield business related travel as organisations continue to use zoom meetings and other IT solutions to avoid business related travel, addition of a 4th competitor in the form of Rex must have also contributed to this. The federal governments half price airfare scheme seems to have really affected the price of fares to OOL and also CNS but not elsewhere which is interesting.

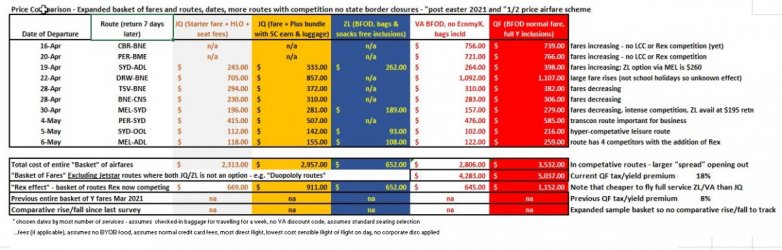

I realise this is a small sample size but tried to keep it consistent for historical comparison, but with the addition of Rex and realising that my small "basket" of airfares neglected a couple of important routes (like transcon PER to east coast) I thought I'd expand the basket a bit and allow for the entry of Rex onto routes to monitor its effect on different markets, I lose the ability to directly compare fares with the peak of the Covid-19 effect but the trade off is more transparency and a larger sample size to understand the trends a bit better. You can still think of it as a corporate travel arrangers "basket" of typical flights for a large government or corporation that would need to be booked and should show broad and some more localised trends in the prices of Y airfares. Transcon is important because its really a necessity due to the large distances involved/lack of any other options and reopening of the WA border. So the table below might be more useful and maybe a little more representative going forward. The addition of a "Rex effect" line will allow us to see if Rex and its competitors can sustain the low fares and the possible future effect of yield managers raising the white flag on routes such as SYD-MEL, SYD/MEL-OOL and MEL-ADL where we now have 4 competitors tripping over themselves in these markets.

A few interesting things to note from this like-for-like rough comparison. Big picture story is that both VA and QF have been able to increase fares by careful addition of capacity to the market without flooding the domestic market with too many empty aircraft and seats but JQ has had a tougher time and has reduces its base fares and cost of bundles, note that the reason why I broke out JQ base fares and JQ fares with a Plus bundle is that the bundle gives you checked luggage and ability to earn QFF SC and points, Jetstar fares are not transparent with all sorts of hidden seat selection fees and credit card fees that all stay hidden until the final payment screen and its designed this way so as to appear that Jetstar appear"cheaper" in a simple Google flights or Webjet style aggregator comparison headline - whatever the case - it appears that JQ base fares have dipped slightly but the yield managers at JQ have had to trim the cost of some bundles for some reason.

The interesting thing to note is that it seems that in "Duopoly" markets with no third party competition price insensitive markets e.g. CBR-BNE and say BME-PER which are government and resource industry dominant, it seems that fares are increasing which makes sense as airline yield managers extract maximum cash out of these sources. Jetstars wide penetration of a lot of the domestic market might be moderating fares in some other markets. The statistical "outlier" seems to be the BNE-DRW route which actually has 3 airlines competing but has seen some outlandish rises in airfares that could be some sort of school holiday effect or maybe a reduction of capacity by all competitors. Looks like MEL-SYD is a yield bloodbath for all concerned so possibly due to a continued lack of higher yield business related travel as organisations continue to use zoom meetings and other IT solutions to avoid business related travel, addition of a 4th competitor in the form of Rex must have also contributed to this. The federal governments half price airfare scheme seems to have really affected the price of fares to OOL and also CNS but not elsewhere which is interesting.

I realise this is a small sample size but tried to keep it consistent for historical comparison, but with the addition of Rex and realising that my small "basket" of airfares neglected a couple of important routes (like transcon PER to east coast) I thought I'd expand the basket a bit and allow for the entry of Rex onto routes to monitor its effect on different markets, I lose the ability to directly compare fares with the peak of the Covid-19 effect but the trade off is more transparency and a larger sample size to understand the trends a bit better. You can still think of it as a corporate travel arrangers "basket" of typical flights for a large government or corporation that would need to be booked and should show broad and some more localised trends in the prices of Y airfares. Transcon is important because its really a necessity due to the large distances involved/lack of any other options and reopening of the WA border. So the table below might be more useful and maybe a little more representative going forward. The addition of a "Rex effect" line will allow us to see if Rex and its competitors can sustain the low fares and the possible future effect of yield managers raising the white flag on routes such as SYD-MEL, SYD/MEL-OOL and MEL-ADL where we now have 4 competitors tripping over themselves in these markets.

Last edited:

AIRwin

Enthusiast

- Joined

- Apr 13, 2013

- Posts

- 12,046

- Qantas

- Platinum

- Virgin

- Gold

Ready. Set. Melbourne sale with up to 30% off flights:

specials.virginaustralia.com

specials.virginaustralia.com

Virgin Australia On Sale

Virgin Australia on sale. Check out the latest flight specials on offer. http://specials.virginaustralia.com/

specials.virginaustralia.com

specials.virginaustralia.com

Melbourne was never a half price destinationAnyone know why there are no longer any half-price tickets available to/from Melbourne? Were the rules changed? I can't find any news on Google....

It was a half price origin though...Melbourne was never a half price destination

True. There were a number of tickets to be released each month, so perhaps on 1 May more will be available, but certainly not TO Melbourne unless they change the guidelines

It was a half price origin though...

Ah ok great thanks didn't realise it was on a monthly allocationsTrue. There were a number of tickets to be released each month, so perhaps on 1 May more will be available, but certainly not TO Melbourne unless they change the guidelines

AIRwin

Enthusiast

- Joined

- Apr 13, 2013

- Posts

- 12,046

- Qantas

- Platinum

- Virgin

- Gold

CEO has commented that there would be a point where those extremely low fares ended, and fares costing $79, $99 or $115 became more prevalent:

www.afr.com

www.afr.com

Virgin CEO says financial pain of $39 airfares is worth it

Jayne Hrdlicka says lifting volumes is a big priority, and she’s heartened by a lack of cancellations after the Sydney COVID-19 cases.

eastwest101

Established Member

- Joined

- Oct 26, 2010

- Posts

- 3,403

- Qantas

- Gold

- Virgin

- Gold

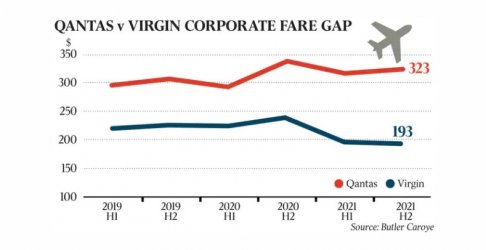

Haven't redone the numbers lately but this article in The Australian has some details: (will be paywalled so tiny bit extracted).

www.theaustralian.com.au

www.theaustralian.com.au

"The airfare difference between Australia’s major domestic airlines has doubled since Virgin Australia emerged from administration, with new analysis showing Qantas corporate travel fares are now 67 per cent higher than its rival. The report by independent travel procurement consultancy Butler Caroye shows Qantas domestic corporate airfares averaged $323 in the second quarter of 2021, compared to Virgin’s $193.

Butler Caroye managing director Tony O’Connor said corporate travel fares were those offered to clients willing to commit a certain percentage of their travel budget to a particular airline in return for discounts.......

The report examined whether simply choosing the “best fare of the day” was the better approach for travel buyers, and found that in most cases it was. “The price difference between the two airlines is now just too great to lock into one carrier, which for most companies has typically been Qantas,” Mr O’Connor said.

As a result of the changes, Qantas’s average domestic corporate fares were now about 9 per cent higher than pre-Covid times, and Virgin’s around 13 per cent lower."

NoCookies | The Australian

"The airfare difference between Australia’s major domestic airlines has doubled since Virgin Australia emerged from administration, with new analysis showing Qantas corporate travel fares are now 67 per cent higher than its rival. The report by independent travel procurement consultancy Butler Caroye shows Qantas domestic corporate airfares averaged $323 in the second quarter of 2021, compared to Virgin’s $193.

Butler Caroye managing director Tony O’Connor said corporate travel fares were those offered to clients willing to commit a certain percentage of their travel budget to a particular airline in return for discounts.......

The report examined whether simply choosing the “best fare of the day” was the better approach for travel buyers, and found that in most cases it was. “The price difference between the two airlines is now just too great to lock into one carrier, which for most companies has typically been Qantas,” Mr O’Connor said.

As a result of the changes, Qantas’s average domestic corporate fares were now about 9 per cent higher than pre-Covid times, and Virgin’s around 13 per cent lower."

I have to say, with QF selling MEL-SYD (I remain hopeful!) @ $200 for some future red-e-deals, and VA selling some business class at $271 (with advance purchase coupon code discount), it's a "no-brainer" for me. (Plus I can have a scotch onboard VA, even if it is Red Label in JHaven't redone the numbers lately but this article in The Australian has some details: (will be paywalled so tiny bit extracted).

...shows Qantas domestic corporate airfares averaged $323 in the second quarter of 2021, compared to Virgin’s $193.NoCookies | The Australian

www.theaustralian.com.au

The report examined whether simply choosing the “best fare of the day” was the better approach for travel buyers, and found that in most cases it was. “The price difference between the two airlines is now just too great to lock into one carrier, which for most companies has typically been Qantas,” Mr O’Connor said.

As a result of the changes, Qantas’s average domestic corporate fares were now about 9 per cent higher than pre-Covid times, and Virgin’s around 13 per cent lower."

jakeseven7

Enthusiast

- Joined

- Sep 9, 2005

- Posts

- 11,299

Haven't redone the numbers lately but this article in The Australian has some details: (will be paywalled so tiny bit extracted).

NoCookies | The Australian

www.theaustralian.com.au

"The airfare difference between Australia’s major domestic airlines has doubled since Virgin Australia emerged from administration, with new analysis showing Qantas corporate travel fares are now 67 per cent higher than its rival. The report by independent travel procurement consultancy Butler Caroye shows Qantas domestic corporate airfares averaged $323 in the second quarter of 2021, compared to Virgin’s $193.

Butler Caroye managing director Tony O’Connor said corporate travel fares were those offered to clients willing to commit a certain percentage of their travel budget to a particular airline in return for discounts.......

The report examined whether simply choosing the “best fare of the day” was the better approach for travel buyers, and found that in most cases it was. “The price difference between the two airlines is now just too great to lock into one carrier, which for most companies has typically been Qantas,” Mr O’Connor said.

As a result of the changes, Qantas’s average domestic corporate fares were now about 9 per cent higher than pre-Covid times, and Virgin’s around 13 per cent lower."

View attachment 254287

And now Bain has VA2 under its skirts we we have no idea how much they are losing!

Read our AFF credit card guides and start earning more points now.

AFF Supporters can remove this and all advertisements

eastwest101

Established Member

- Joined

- Oct 26, 2010

- Posts

- 3,403

- Qantas

- Gold

- Virgin

- Gold

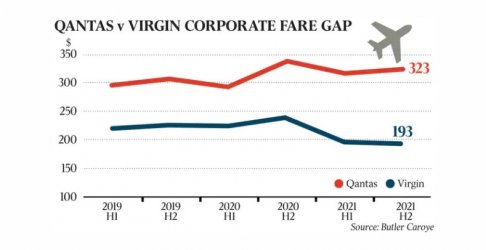

Updated and redid the numbers on the existing sample of airfares for the upcoming late April early May.

View attachment 245094

A few interesting things to note from this like-for-like rough comparison. Big picture story is that both VA and QF have been able to increase fares by careful addition of capacity to the market without flooding the domestic market with too many empty aircraft and seats but JQ has had a tougher time and has reduces its base fares and cost of bundles, note that the reason why I broke out JQ base fares and JQ fares with a Plus bundle is that the bundle gives you checked luggage and ability to earn QFF SC and points, Jetstar fares are not transparent with all sorts of hidden seat selection fees and credit card fees that all stay hidden until the final payment screen and its designed this way so as to appear that Jetstar appear"cheaper" in a simple Google flights or Webjet style aggregator comparison headline - whatever the case - it appears that JQ base fares have dipped slightly but the yield managers at JQ have had to trim the cost of some bundles for some reason.

The interesting thing to note is that it seems that in "Duopoly" markets with no third party competition price insensitive markets e.g. CBR-BNE and say BME-PER which are government and resource industry dominant, it seems that fares are increasing which makes sense as airline yield managers extract maximum cash out of these sources. Jetstars wide penetration of a lot of the domestic market might be moderating fares in some other markets. The statistical "outlier" seems to be the BNE-DRW route which actually has 3 airlines competing but has seen some outlandish rises in airfares that could be some sort of school holiday effect or maybe a reduction of capacity by all competitors. Looks like MEL-SYD is a yield bloodbath for all concerned so possibly due to a continued lack of higher yield business related travel as organisations continue to use zoom meetings and other IT solutions to avoid business related travel, addition of a 4th competitor in the form of Rex must have also contributed to this. The federal governments half price airfare scheme seems to have really affected the price of fares to OOL and also CNS but not elsewhere which is interesting.

I realise this is a small sample size but tried to keep it consistent for historical comparison, but with the addition of Rex and realising that my small "basket" of airfares neglected a couple of important routes (like transcon PER to east coast) I thought I'd expand the basket a bit and allow for the entry of Rex onto routes to monitor its effect on different markets, I lose the ability to directly compare fares with the peak of the Covid-19 effect but the trade off is more transparency and a larger sample size to understand the trends a bit better. You can still think of it as a corporate travel arrangers "basket" of typical flights for a large government or corporation that would need to be booked and should show broad and some more localised trends in the prices of Y airfares. Transcon is important because its really a necessity due to the large distances involved/lack of any other options and reopening of the WA border. So the table below might be more useful and maybe a little more representative going forward. The addition of a "Rex effect" line will allow us to see if Rex and its competitors can sustain the low fares and the possible future effect of yield managers raising the white flag on routes such as SYD-MEL, SYD/MEL-OOL and MEL-ADL where we now have 4 competitors tripping over themselves in these markets.

View attachment 245103

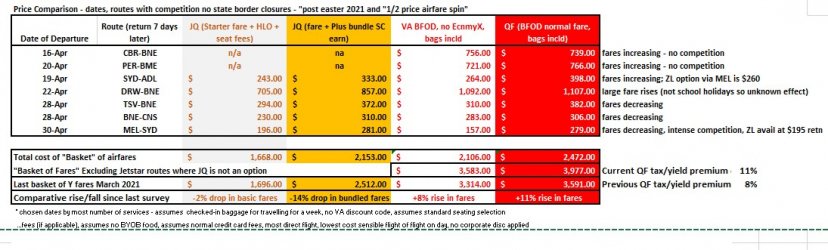

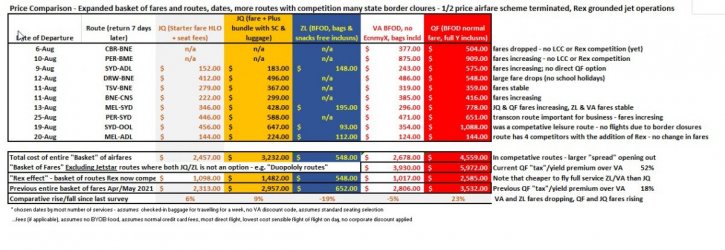

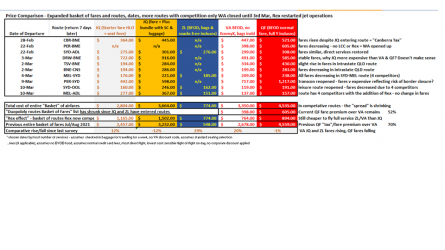

Just re-did the numbers with the expanded set of interstate and intrastate flights as per the last basket survey of airfares done for April 2021, if anything the state border closures have gotten worse again with many state borders now effectively closed, school holidays over, although the Federal Government half-priced airfares were supposed to close I was still seeing some local examples of very reduced fares, and the Covid-19 Delta strain having quite an effect on NSW which has previously been less affected than some other states. Anything in and out of SYD has been quite badly affected regarding availability due to state border closures and just this morning with the news that SE QLD will go into another lockdown won't help things.

The thing to note here is that the trend of increasing airfares and diverging fares and yields, unfortunately, these survey dates reflect the grounding of the Rex jet fleet, although they are still optimistically selling seats on some services. In general, we are seeing Rex fares drop, Virgin fares drop, Jetstar's bare-bones starter fares rise slightly, Jetstar's Plus bundle fares rise and Qantas mainline fares rise significantly.

Note that the Qantas Tax/Yield Premium has increased from 18% to 50+% although this is partly explained by Qantas mainline abandoning some trunk routes and only offering illogical and expensive one-stop fares, quite often taking the opportunity to leave Jetstar as the only direct option. We are seeing the continuation of the story that once all fees and extras are considered its usually cheaper to fly a "full service" airline like Virgin or Rex, rather than Jetstar, and I suspect the rise in all Qantas fares is also intended to separate out Qantas from Jetstar in the market and to try to increase yields for Jetstar and indeed for Qantas mainline.

In "competitive routes" with 3 or even 4 airlines competing the effect has been to lower airfares, no surprises there.

In the case of the "duopoly" routes where only Qantas and Virgin operate (and the Qantas group has made the conscious decision not to use Jetstar), and Rex isn't competing, we are seeing Virgin fares dropping and Qantas fares rising.

Obviously, non-essential travel demand is weak. We are seeing possibly people making bets about which flights will actually operate, and/or only making travel arrangements at the very last minute, which would distort yield curves and make forecasting of demand pretty difficult for all airlines. I think it would be fair to say that all domestic airlines except for resource charter operators would be losing money at the moment with almost as many aircraft and crew grounded now as what was in the winter of 2020.

As before - all fares are Y lowest BFOD and include checked baggage and allow for typical credit card fees and preference for normal flight times in the morning or afternoon with 5am OMG'oclock departures and overnight redeyes avoided where possible so these are fares that some corporates might see and some people who are still attempting to travel for their own work or leisure would be considering.

jakeseven7

Enthusiast

- Joined

- Sep 9, 2005

- Posts

- 11,299

Just re-did the numbers with the expanded set of interstate and intrastate flights as per the last basket survey of airfares done for April 2021, if anything the state border closures have gotten worse again with many state borders now effectively closed, school holidays over, although the Federal Government half-priced airfares were supposed to close I was still seeing some local examples of very reduced fares, and the Covid-19 Delta strain having quite an effect on NSW which has previously been less affected than some other states. Anything in and out of SYD has been quite badly affected regarding availability due to state border closures and just this morning with the news that SE QLD will go into another lockdown won't help things.

View attachment 254349

The thing to note here is that the trend of increasing airfares and diverging fares and yields, unfortunately, these survey dates reflect the grounding of the Rex jet fleet, although they are still optimistically selling seats on some services. In general, we are seeing Rex fares drop, Virgin fares drop, Jetstar's bare-bones starter fares rise slightly, Jetstar's Plus bundle fares rise and Qantas mainline fares rise significantly.

Note that the Qantas Tax/Yield Premium has increased from 18% to 50+% although this is partly explained by Qantas mainline abandoning some trunk routes and only offering illogical and expensive one-stop fares, quite often taking the opportunity to leave Jetstar as the only direct option. We are seeing the continuation of the story that once all fees and extras are considered its usually cheaper to fly a "full service" airline like Virgin or Rex, rather than Jetstar, and I suspect the rise in all Qantas fares is also intended to separate out Qantas from Jetstar in the market and to try to increase yields for Jetstar and indeed for Qantas mainline.

In "competitive routes" with 3 or even 4 airlines competing the effect has been to lower airfares, no surprises there.

In the case of the "duopoly" routes where only Qantas and Virgin operate (and the Qantas group has made the conscious decision not to use Jetstar), and Rex isn't competing, we are seeing Virgin fares dropping and Qantas fares rising.

Obviously, non-essential travel demand is weak. We are seeing possibly people making bets about which flights will actually operate, and/or only making travel arrangements at the very last minute, which would distort yield curves and make forecasting of demand pretty difficult for all airlines. I think it would be fair to say that all domestic airlines except for resource charter operators would be losing money at the moment with almost as many aircraft and crew grounded now as what was in the winter of 2020.

As before - all fares are Y lowest BFOD and include checked baggage and allow for typical credit card fees and preference for normal flight times in the morning or afternoon with 5am OMG'oclock departures and overnight redeyes avoided where possible so these are fares that some corporates might see and some people who are still attempting to travel for their own work or leisure would be considering.

You do realise some analysts did this and published their results yesterday?

From memory QF has increased their premium from 9 to 16 % over VA (don’t quote me just going off memory)

eastwest101

Established Member

- Joined

- Oct 26, 2010

- Posts

- 3,403

- Qantas

- Gold

- Virgin

- Gold

You do realise some analysts did this and published their results yesterday?

From memory QF has increased their premium from 9 to 16 % over VA (don’t quote me just going off memory)

Yes the Butler-Coroye stats in that article in the Australian seemed to indicate a fare premium of 60% over VA fares according to that graphic, I'm not sure how widespread their study was, and how large the sample group is etc etc but my own stats showed an increase from 18% to a 52% fare premium although I will admit that state border lockdowns will distort some pricing in my stats. All that I can see are fare premiums as we can't see inside QF and VA and see their actual costs, so the yields are difficult to measure.

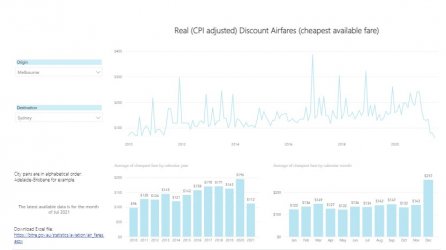

I found some interesting stuff on the ABS website but haven't gone into the weeds about their collection methodology, due to their timeframes their data has some good historical perspective, examples here:

This first one I set to the SYD-MEL pair and noting that its picking up discount fares such as Jetstar and Tiger at stupid times its still interesting to note that fares held up ok in 2020 which was surprising but fell off a cliff in 2021, not surprising?

This second one looks to be a basket of restricted economy airfares so presuming that their basket contains numerous domestic city pairs and is not just SYD-MEL fares.... the sudden fare jump in 2017 was a matter of Jetstar changing its refund and bundle policies which fell in or out of the definition of a restricted fare so we can see how the stats can be affected by fairly minor changes in fare rules and in the interpretation of the different definitions.

Notes

Indexes are constructed from BITRE's monthly survey of airline internet booking sites. Fares are recorded only when they are available on the nominated day of travel (the last Thursday of the month). The series is a price index of the lowest available fare in each fare class, weighted over selected routes. It does not measure real airline yields, or average fares paid by passengers. For more information on methodology use the link at the top of this page.Occasionally, the index may record an unusual result when the nominated day of travel falls on, or adjacent to, a public holiday:

- The travel date fell on a public holiday in December 2014, January 2017, April 2019 and December 2019.

- The travel date fell the day before a public holiday in December 2015, March 2018 and December 2020.

- The travel date fell the day after a public holiday in April 2018 and December 2018.

- The return travel date fell the day before a public holiday in March 2017.

April 2021 - Restricted Economy index: Virgin Australia Restricted Economy fares on some routes were noticeably lower this month. The Virgin Australia web site notes that complementary food would no longer be provided on Economy class fares as of 25 March 2021. It is not clear what part this change has played in the reductions to Virgin Australia's Restricted Economy fares.

Business class fares from April 2020: Fares collected may not include normal entitlements like meals and lounge access during the period impacted by COVID-19.

Index calculation for April 2020 to November 2020: There were significant reductions to airline services in April and May 2020 in particular due to the COVID-19 pandemic and valid fares were not available for many routes covered by the survey. The indexes for April to November 2020 are based on the available routes during those months compared to the same routes in the base period.

November 2017 change to Restricted Economy index: From November 2017, refunds of Jetstar's Restricted Economy products (Starter with Max) for cancellations are only available in the form of vouchers. Vouchers may only be redeemed for other Jetstar products and are therefore considered by BITRE to be closer to a transfer than a full refund. This change in Jetstar's product places it outside BITRE's definition of a restricted economy fare, which has resulted in a sharp increase in the restricted economy index for November 2017.

March 2015 - the Full Economy index is discontinued: From the middle of February 2015, Qantas Airways ceased offering Full Economy fares for domestic travel. It is no longer possible to produce an index for this fare category. In the future, if Full Economy fares are offered on sufficient routes, the index for this fare category could be reinstated.

December 2011 and January 2012 changes to Business and Full Economy indexes: Both the Business and Full Economy indexes were substantially affected by changes to fare offered. In December 2011 the Business index fell substantially mainly due to reductions in many of these fares by Qantas. This index again dropped significantly in January 2012 as Virgin Australia introduced Business class fares on many more of their routes. With the expansion of Virgin Australia's Business class fares they removed their Premium Economy class fare completely. The removal of these fares resulted in the Full Economy index rising substantially in January 2012.

June 2011 change to Restricted Economy index: In June 2011 both Virgin Australia and Jetstar introduced simplified fare structures. The new fare types used in constructing the indexes are shown on the Methodology page. The major impact of this change was to the Restricted Economy index. The new Virgin Australia fares used for this category (Flexi) were substantially lower than the previously used Virgin fares (Flexible). In a competitive response Qantas also reduced its Flexi Saver fares on competing routes. These changes produced a sharp drop in the Restricted Economy index.

February 2008 change to Full Economy index: Prior to February 2008 the Full Economy Fare category was based solely on the Qantas Fully Flexible Fare. From February 2008 on the category was expanded to include Virgin Blue's Corporate Plus Fare, leading to a drop in the index at the point of changeover.

Consumer price index Source: Australian Bureau of Statistics, Catalogue No 6401.0

Look at all the explanatory notes for that Index graph. Quite the tricky one for statisticians to keep on top of.

Someone could design a web crawler or even a dummy booker to go through a large sample of fares and deal with the Jetstar fares bundles and drip pricing to give a more accurate result on the price movement in airfares.

To summarize - anywhere that still has competitive forces in working order has seen only negligible to modest rises in airfares, but routes that have limited competition, and/or state base border disruptions, tend to send fares through the roof in 2020 and 2021.

Last edited:

henrus

Established Member

- Joined

- Jun 23, 2016

- Posts

- 3,985

- Qantas

- Platinum

- Virgin

- Platinum

After watching this thread for a while, 99% of my travel of leisure (we're talking one business trip every 2-3 years) and despite holding VA status (mix of plat/gold) for years I think this year may be the first time I don't renew. I don't blame it on flight prices but more on flight times. QF/JQ has had better times (not necessarily prices) and that's what determined my last 12 months of domestic travel.

After watching this thread for a while, 99% of my travel of leisure (we're talking one business trip every 2-3 years) and despite holding VA status (mix of plat/gold) for years I think this year may be the first time I don't renew. I don't blame it on flight prices but more on flight times. QF/JQ has had better times (not necessarily prices) and that's what determined my last 12 months of domestic travel.

As somebody who flies 50/50 business/leisure I agree flight times are number 1, even for leisure flights, but I wonder if you might be making a subconscious choice to choose QF/JQ because you value QF status over VA? I am the in the same boat (plane?) but opposite to you in that I have been flying QF/JQ more but feel that I will try to retain VA status over QF for much the same reasons - VA has better/direct flight times (or is that just what I am telling myself!)

eastwest101

Established Member

- Joined

- Oct 26, 2010

- Posts

- 3,403

- Qantas

- Gold

- Virgin

- Gold

As somebody who flies 50/50 business/leisure I agree flight times are number 1, even for leisure flights, but I wonder if you might be making a subconscious choice to choose QF/JQ because you value QF status over VA? I am the in the same boat (plane?) but opposite to you in that I have been flying QF/JQ more but feel that I will try to retain VA status over QF for much the same reasons - VA has better/direct flight times (or is that just what I am telling myself!)

I expect it will also be a case of people booking direct flights where possible - avoiding any transit in any city - because as some recent threads have demonstrated, the pre-covid mindset of airlines automatically rerouting pax through new/different airports can then potentially turn into an overnight transit with further cancellations, which might then becomes an enforced unintended expensive 14-day quarantine because of state border closures.

Almost no ones going to risk that, hence almost no one is making bookings into the future, and the few that are booking (because they really do want/need to travel) are booking at the last minute to avoid being ambushed by state premiers, which results in fewer flight frequencies and fewer seats ... so quite the vicious cycle for airline yield managers.

eastwest101

Established Member

- Joined

- Oct 26, 2010

- Posts

- 3,403

- Qantas

- Gold

- Virgin

- Gold

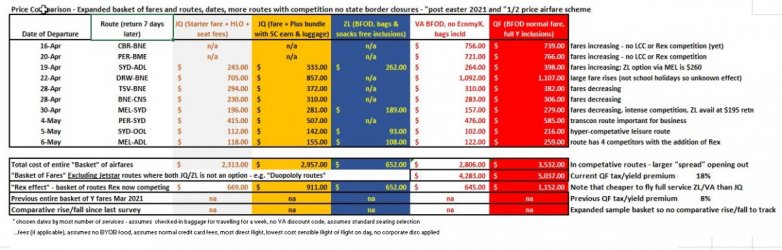

Been a while since some discussion on here but redid the numbers for Feb/Mar 2022 (not looked at them since July 2020), obviously nearly all the interstate borders are effectively open, and Rex have restored their jet services to what was closed down due to Covid. The only other major change has been the entry of Jetstar onto the BNE-CBR route, so that now goes from being a "duopoly route" to a a three way competitive proposition although the fares so far suggest that the market can bear high yields.

Overall the trend seems to have been the Jetstar basic "no-frills" fares have risen, and the Plus bundles prices have fallen so thats a little bit interesting as its the opposite of the mid year 2021 trend that we were seeing. Looks like Rex have actually been able to raise their fares a little despite Jetstar and Virgin trying to undercut them so despite all appearances it looks like owners Bain and Qantas aren't going to slit their own throats to put Rex out of business, for Qantas and Virgin some rises and falls in different markets, but the divergence that we were seeing with Qantas able to exctact a premium yield over Virgin seems to have reversed with Virgin able to raise fares modestly and Qantas trimming its fares in places, so that the gap between it and Virgin for full service fares is not so noticeable. This aligns with the perceprion that Virgin are trying to get right in the middle of the market and anecdotal evidence from others has surprised me that they have been able to fill their planes despite all the previous uncertainty of the airlines finances behind it and the smaller operational footprint compared to the pre-Bain operation. Everyones prices seem to be gravitating towards the middle of the market and maybe that suggests yield managers experimenting with demand elasticity and testing the market to see what peoples travel spend is looking like going forward?

I guess the status extensions have rendered "loyalty" a bit of a moot point up to now, but presumably the premium that Qantas is able to extract over Virgin fares would be the better frequency and inter-connectivity of its domestic route network with quite a few trips in Australia now unable to be done in one day on Virgin, whereas on Qantas you can still do it. Once the WA borders reopen it will be interesting to see how the transcon Perth or east coast fares shape up. People certainly seem a little more comfortable crossing state borders, and probably are able to make plans in the future with some level of confidence (WA excepted). I have been flying throughout the last few years but domestic airports seem a little busier, but still a bit "listless" compared to 2019 and before. I'm not doing the golden triangle slog every week or more so maybe some other people who are still doing that have some additional comments they can make?

The last two major pieces of the puzzle to fall into place are obviously the reopening of the WA border, and the return of (some) international tourism both into and out of Australia, along with jet fuel prices. I suspect a lot of Australia and will be looking at overseas and obviously not many Chinese tourists coming into Australia so could be a pretty tough environment for the domestic carriers for a while yet.

Overall the trend seems to have been the Jetstar basic "no-frills" fares have risen, and the Plus bundles prices have fallen so thats a little bit interesting as its the opposite of the mid year 2021 trend that we were seeing. Looks like Rex have actually been able to raise their fares a little despite Jetstar and Virgin trying to undercut them so despite all appearances it looks like owners Bain and Qantas aren't going to slit their own throats to put Rex out of business, for Qantas and Virgin some rises and falls in different markets, but the divergence that we were seeing with Qantas able to exctact a premium yield over Virgin seems to have reversed with Virgin able to raise fares modestly and Qantas trimming its fares in places, so that the gap between it and Virgin for full service fares is not so noticeable. This aligns with the perceprion that Virgin are trying to get right in the middle of the market and anecdotal evidence from others has surprised me that they have been able to fill their planes despite all the previous uncertainty of the airlines finances behind it and the smaller operational footprint compared to the pre-Bain operation. Everyones prices seem to be gravitating towards the middle of the market and maybe that suggests yield managers experimenting with demand elasticity and testing the market to see what peoples travel spend is looking like going forward?

I guess the status extensions have rendered "loyalty" a bit of a moot point up to now, but presumably the premium that Qantas is able to extract over Virgin fares would be the better frequency and inter-connectivity of its domestic route network with quite a few trips in Australia now unable to be done in one day on Virgin, whereas on Qantas you can still do it. Once the WA borders reopen it will be interesting to see how the transcon Perth or east coast fares shape up. People certainly seem a little more comfortable crossing state borders, and probably are able to make plans in the future with some level of confidence (WA excepted). I have been flying throughout the last few years but domestic airports seem a little busier, but still a bit "listless" compared to 2019 and before. I'm not doing the golden triangle slog every week or more so maybe some other people who are still doing that have some additional comments they can make?

The last two major pieces of the puzzle to fall into place are obviously the reopening of the WA border, and the return of (some) international tourism both into and out of Australia, along with jet fuel prices. I suspect a lot of Australia and will be looking at overseas and obviously not many Chinese tourists coming into Australia so could be a pretty tough environment for the domestic carriers for a while yet.

- Status

- Not open for further replies.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- ozstamps

- Larko1

- jamestranm

- accompanimince

- Aeryn

- MEL_Traveller

- CASETRAV

- Happy Dude

- CMA222

- jrfsp

- bablong

- odysseus

- pjm99au

- jc123

- Rich

- billmurray

- cove

- Lolalou

- Peter78

- scaredeycat

- AndersK

- Monya Meow Meow

- DeanCorp

- NamarrgonFlyer

- Rebus

- b3LKMZAYN9

- jswong

- kpc

- n7of9

- bPeteb

- REM

- Steady

- Basaka

- N0mad

- LiamR

- Vipers

- otis

- Hunter4vr

- newmarket

- Zinger

- snabbu

- dairyfloss

- B A

- skflyer

- Arkana

- jeza

- Colin 2905

- Triben

- darktiger

- Rayesfeg

Total: 675 (members: 74, guests: 601)