- Joined

- Jun 20, 2002

- Posts

- 17,841

- Qantas

- LT Gold

- Virgin

- Platinum

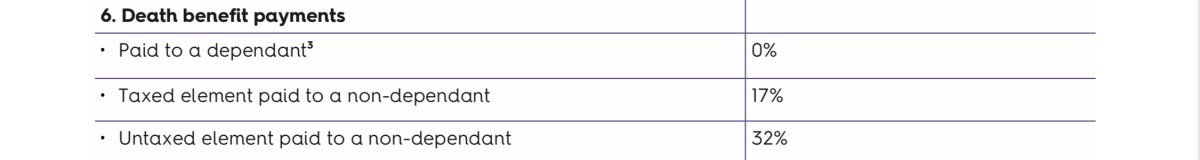

Correct @Pushka, you and MrP couldn't be (as I know you) in a Commonwealth Government non-funded superannuation fund (or similar) where the benefits are paid from consolidated revenue (and therefor have yet to be taxed). That's why they have 30% taxed on any lump sum withdrawals (or fully taxable if they are taken as a pension benefit).

Where your son is a resident is not relevant. The first and only question is whether he is a non-dependent, partial dependent or fully dependent. You can answer that one pretty easily

Plus remember the above commentary from the ATO website relates only to the taxable component of your super benefit. The tax free component is already (and will always be) tax free to anybody receiving the benefit.

Where your son is a resident is not relevant. The first and only question is whether he is a non-dependent, partial dependent or fully dependent. You can answer that one pretty easily

Plus remember the above commentary from the ATO website relates only to the taxable component of your super benefit. The tax free component is already (and will always be) tax free to anybody receiving the benefit.

Last edited: