You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

HSBC Platinum Qantas Credit Card Changes: Ouchy

- Thread starter SOPOOR

- Start date

Franko Costa

Active Member

- Joined

- Aug 18, 2011

- Posts

- 770

It's funny - I read it and I thought this is positive so didn't understand.

However, the AF is goodgiven the cap is 10k p/m. This are other cards with 1:1 spend:

Qantas Premier Platinum $399 10k p/m

NAB Qantas Rewards Signature $395 15k p/m

BOQ Qantas Signature $400 10k p/m

ANZ Frequent Flyer Black $425 7.5k p/m

Better to cancel the card and churn one of the above with a nice bonus

However, the AF is goodgiven the cap is 10k p/m. This are other cards with 1:1 spend:

Qantas Premier Platinum $399 10k p/m

NAB Qantas Rewards Signature $395 15k p/m

BOQ Qantas Signature $400 10k p/m

ANZ Frequent Flyer Black $425 7.5k p/m

Better to cancel the card and churn one of the above with a nice bonus

Lost Redditor

Member

- Joined

- Mar 21, 2023

- Posts

- 372

We (churners) are to blameThe great devaluation of credit card points earning continues.

or perhaps it’s plain old greed on their end. I’m not sure how much they lose on our use

plus consider this.It's funny - I read it and I thought this is positive so didn't understand.

However, the AF is goodgiven the cap is 10k p/m. This are other cards with 1:1 spend:

Qantas Premier Platinum $399 10k p/m

NAB Qantas Rewards Signature $395 15k p/m

BOQ Qantas Signature $400 10k p/m

ANZ Frequent Flyer Black $425 7.5k p/m

Better to cancel the card and churn one of the above with a nice bonus

CBA Ultimate $0 10k pm. the points earn will probably be average 0.65 per dollar, and thats low, but without a $400 annual fee. If you are spending less than 10k pm you will be better off.

- Joined

- Aug 21, 2011

- Posts

- 15,661

- Qantas

- Platinum

- Virgin

- Platinum

- SkyTeam

- Elite Plus

- Star Alliance

- Gold

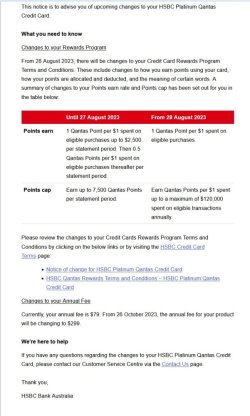

So, if I'm reading this right, the HSBC Platinum Qantas card annual fee will increase from $99 to $299. With that, the monthly points-earning cap will be replaced with an annual limit of 120,000 points. You still earn 1 Qantas point per dollar on everyday spend.

Meanwhile, the HSBC Premier World Mastercard (with Qantas Rewards) will go from $99/year to $0/year. This card also earns 1 Qantas point per dollar, up to 120,000 per year.

Why would anyone still use the HSBC Platinum Qantas card - am I missing something?

oz_mark

Enthusiast

- Joined

- Jun 30, 2002

- Posts

- 21,504

So, if I'm reading this right, the HSBC Platinum Qantas card annual fee will increase from $99 to $299. With that, the monthly points-earning cap will be replaced with an annual limit of 120,000 points. You still earn 1 Qantas point per dollar on everyday spend.

Meanwhile, the HSBC Premier World Mastercard (with Qantas Rewards) will go from $99/year to $0/year. This card also earns 1 Qantas point per dollar, up to 120,000 per year.

Why would anyone still use the HSBC Platinum Qantas card - am I missing something?

The main issue withe the HSBC Premier cards is that you need to be an HSBC Premier customer. So, your'e either depositing at least $9,000 per month, or have $150,000 balance in an acoount with them. If you can do that, it's obviously a better deal.

So, if I'm reading this right, the HSBC Platinum Qantas card annual fee will increase from $99 to $299. With that, the monthly points-earning cap will be replaced with an annual limit of 120,000 points. You still earn 1 Qantas point per dollar on everyday spend.

Meanwhile, the HSBC Premier World Mastercard (with Qantas Rewards) will go from $99/year to $0/year. This card also earns 1 Qantas point per dollar, up to 120,000 per year.

Why would anyone still use the HSBC Platinum Qantas card - am I missing something?

HSBC Premier World Mastercard

Get Qantas Points or HSBC Rewards points as you spend, airport lounge access, complimentary insurance and more with the HSBC Premier World Mastercard.

www.finder.com.au

www.finder.com.au

So assuming the link is correct, if youre redeeming to qff, the $99 is inevitible

- Joined

- Aug 21, 2011

- Posts

- 15,661

- Qantas

- Platinum

- Virgin

- Platinum

- SkyTeam

- Elite Plus

- Star Alliance

- Gold

Says there is a $99 hsbc qantas fee,

HSBC Premier World Mastercard

Get Qantas Points or HSBC Rewards points as you spend, airport lounge access, complimentary insurance and more with the HSBC Premier World Mastercard.www.finder.com.au

So assuming the link is correct, if youre redeeming to qff, the $99 is inevitible

Currently there is a $99 Qantas fee, yes, but that seems to be disappearing later this month according to the HSBC PDF that I linked above.

exceladdict

Established Member

- Joined

- Mar 26, 2014

- Posts

- 4,845

- Qantas

- Platinum

- Virgin

- Silver

Very interesting, reinforces the theory from other threads that Qantas has increased the cost to buy points / offer licensed products, probably with an annual and per-point component.The great devaluation of credit card points earning continues.

justinbrett

Senior Member

- Joined

- Mar 6, 2006

- Posts

- 9,748

- Qantas

- Platinum

- Oneworld

- Emerald

- Star Alliance

- Gold

I got the email and didn't see the increased annual fee until I saw it here.

I run most of my transactions through my QF AMEX, I only use this one for merchants that don't take AMEX.

Now I see I've been paying $199 annual fee even though the retail price was dropped to $99 5 years ago.

So definitely feel cheated by HSBC, will be ditching this account before the next annual fee is due.

I run most of my transactions through my QF AMEX, I only use this one for merchants that don't take AMEX.

Now I see I've been paying $199 annual fee even though the retail price was dropped to $99 5 years ago.

So definitely feel cheated by HSBC, will be ditching this account before the next annual fee is due.

exceladdict

Established Member

- Joined

- Mar 26, 2014

- Posts

- 4,845

- Qantas

- Platinum

- Virgin

- Silver

Oof that's savage, will you chase a refund?Now I see I've been paying $199 annual fee even though the retail price was dropped to $99 5 years ago.

justinbrett

Senior Member

- Joined

- Mar 6, 2006

- Posts

- 9,748

- Qantas

- Platinum

- Oneworld

- Emerald

- Star Alliance

- Gold

Oof that's savage, will you chase a refund?

I asked why, she said "you are on the legacy package so were charged the correct amount".

I then said "can I stay on the legacy package then? why are you increasing my annual fee?" to which she replied "because our third party costs have increased". To which I replied "oh, so you're happy to continue taking extra money from me when your costs go down, but not the reverse?

She wasn't apologetic at all and just recited the "benefits" the card gets me, to which I said "at $300 this is not very competitive, why on earth would I keep the account?"

By my calculations you need to run through about $16K per year to get your $300 value back in points. It's simply not worth it. I run most of my stuff through AMEX and these days it's getting rare not being able to use AMEX, and if so, it's low value transactions.

I might just look for a cheap no rewards visa with my bank.

As for the "legacy package", I think I was still getting the QF bonus points that stopped a few years ago, but that's about it.

Does anyone have any other alternatives like this? I'm not a high spender, so I doubt I'd clear the CBA $4K amount per month to waive their monthly fee.plus consider this.

CBA Ultimate $0 10k pm. the points earn will probably be average 0.65 per dollar, and thats low, but without a $400 annual fee. If you are spending less than 10k pm you will be better off.

Would love to find an alternative to my HSBC Platinum card after the price increase for the annual fee.

yeah Commbank has a new product Smart Awards, same as ultimate but only 2k spend a month to avoid a monthly fee. More info in the Commbank threadDoes anyone have any other alternatives like this? I'm not a high spender, so I doubt I'd clear the CBA $4K amount per month to waive their monthly fee.

Would love to find an alternative to my HSBC Platinum card after the price increase for the annual fee.

I just switched mine to it.

I currently have the HSBC Qantas Platinum but will be cancelling it within the next 2 weeks, before the annual fee is charged next month. After a lot of research I have gone with Qantas Premier. No big bonus points but ongoing I believe it offers a good deal when comparing annual fee against earn rate.Does anyone have any other alternatives like this? I'm not a high spender, so I doubt I'd clear the CBA $4K amount per month to waive their monthly fee.

Would love to find an alternative to my HSBC Platinum card after the price increase for the annual fee.

with HSBC premier, If I was to deposit salary into it 9k+ per month, can I still withdraw that cash and still be eligible for HSBC premier?

Really want the credit card.......

P.S. how is the rewards plus program vs Qantas rewards? I think I'm gaining enough from churning for Qantas points, so would the plus program be a better choice (give this card will just be a backup)

Really want the credit card.......

P.S. how is the rewards plus program vs Qantas rewards? I think I'm gaining enough from churning for Qantas points, so would the plus program be a better choice (give this card will just be a backup)

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Recent Posts

-

-

Choose your preferred membership card - there is no choice?

- Latest: JIMMYTHEJET

-

-

-

Currently Active Users

- RB001

- FredF

- watzy

- robbo135

- kaplan_thornhill

- cgichard

- Lukerayment

- Easy Tiger

- Doyvid

- poochio

- burmans

- areustillpretty

- lakeman

- Balad2005

- collcars

- mike0430

- Forg

- Mattao

- madrooster

- jc123

- Mrsfefe

- kamchatsky

- ChrisW.

- JIMMYTHEJET

- butters_1313

- BriarFlyer

- cgantonas

- Oubline

- mhen

- Daver6

- tgh

- Larko1

- StayGoldPonyboy

- MooTime

- ABC1

- Pbourkey

- JohnM

- Agenor

- I love to travel

- bluecoconut

- NamarrgonFlyer

- jastel

- Doug_Westcott

- jrfsp

- WrenchHammerMcTool

- fitzy6

- james1

- Human

- DejaBrew

- daft009

Total: 292 (members: 91, guests: 201)