bernardblack

Established Member

- Joined

- Sep 2, 2015

- Posts

- 1,226

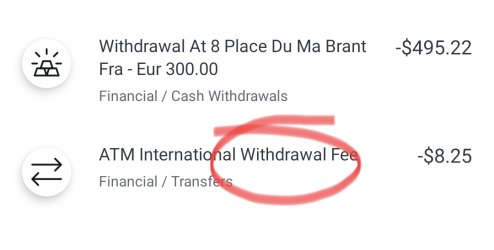

Is Citi Plus still the best option for overseas cash? Obviously I haven't done a lot of international travel since 2019.

If I have to open some other account it might be time to get started, since we depart in five weeks.

(I'm set for FX-fee-free purchases, with a US Amex Gold backed with a Coles Rewards Mastercard and a Bundll account which charges to my Dragon Visa.)

If I have to open some other account it might be time to get started, since we depart in five weeks.

(I'm set for FX-fee-free purchases, with a US Amex Gold backed with a Coles Rewards Mastercard and a Bundll account which charges to my Dragon Visa.)