Some may find it helpful to review this. I welcome critique for omissions or inaccuracies.

These are my understanding of the facts currently available, and my decision as a result;

- it's certain the current restrictions and climate make large pax driven commercial aviation impossible in Oz

- we don't know when the government will lift restrictions, or what will happen with aviation when they do

- there will (almost) certainly be commercial aviation in Australia in the future

- there is great uncertainty if Virgin Australia will an operator

- The government have so far refused to bail out Virgin, refusing their first request (edit: by bailout I mean any government financial intervention, which can take many different forms)

- They have said they are "committed to there being two operators in aviation" after all this is done, although it may not mean Virgin gets bailed out

- The government is more likely to take action consistent with a conservative government approach. Rather than directly intervene by bailing out a largely foreign owned Virgin Australia and provide direct assistance unfairly to a single private entity, they are more likely to "reduce the barriers to entry" for a new player in aviation. This would allow a new operator easier entry into an otherwise hugely regulated and difficult to enter market, at the same time they could cherry pick a defunct VA's assets and workforce

- The public statements made to date could be the govt using negotiation tactics to make VA's bail out request terms even more favorable (the govt is essentially directly threatening to let VA collapse and let a new operator pick up the pieces, as reported in the AFR and elsewhere)

- Ansett was allowed to collapse in 2001 despite a long history, huge workforce and perceived cultural significance. QF had a field day in the years after until VA re positioned itself to compete.

- Ansett's collapse was considered unlikely by 'experts' right up until the moment it happened. (Other parallels could be drawn about 'years of poor management leading up to the major external event and collapse' but they are not as relevant as they appear. Apples and oranges in different times and worlds.)

- VA could last until the restrictions are lifted and then resume operating (close to) normally and 'weather the storm'.

- VA would be reluctant to devalue points and sting the high yield frequent flyers, but may be forced to do so by a number of other internal or external factors and operating conditions

- Singapore Airlines could be allowed to step in, increase ownership and bail out VA, although this would require govt changing rules on foreign ownership

- All of these possible outcomes, and many others aside, could be totally consistent with these currently known facts

- it's impossible to know which facts will end up being relevant and which ones will not

- it's likely the most significant information which could be known right now is not listed above

- it's likely that the most significant information which could be known is not known by anyone (so no point looking to share price or another article for a clue into what the 'real experts' are thinking - not that there are any 'real experts')

* The last four points are born out of the paradigm explained and defended by Nassim Nicholas Taleb in The Black Swan, Fooled By Randomness and his other popular and technical works.

Other points collected from ABC news, AFR and other media.

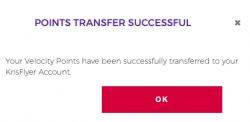

Although there's no certainties with SQ, I decided to convert all points across to KrisFlyer miles where I can still realise about $2,000 value per 100k points for long haul business class travel, compared with $500 per 100k for vouchers. The valuation is subjective, so that's as much personal consideration as everything else.