- Joined

- Jan 26, 2011

- Posts

- 29,542

- Qantas

- Platinum

- Virgin

- Red

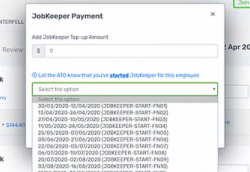

I'm thinking the Government thought FN would cover all bases and reconcile frequency through STP. I did hear monthly payments may prove problematic.Bare in mind that while Jobkeeper is fornightly that people are paid weekly, fortnightly, monthly and quarterly. So there needs to be some allowance for this.